Update: After a long debate, the rate has been set at 2.5 FPIS to 1. This comes after feedback from multiple parties about the merge and how it should be conducted. It's been one of the most heated discussions of Frax in its history and with the general approval by major parties and the community, now we can continue to focus on building.

Yesterday, after a long week of waiting, Sam Kazemian posted Frax Singularity Roadmap Part 1 in the governance forums. The post came after his first proposal to merge FPIS at a 1:1 ratio, which would have valued the sister protocol to Frax at 800% its current market cap. The proposal was extremely contentious and was heavily argued in the Telegram chat.

The problem is that all of the rage is misguided. Merging FPI back into Frax will increase revenues, offsetting any future dilution.

In the new proposal Kazemian wrote the following:

There is a tremendous amount of mental overhead that goes into having a separate token and alternate governance process. For all of Frax’s existence, FXS had been that token until FPIS was released in 2022. To unlock FPI’s growth potential, simplify Frax’s structure and reduce developer and community overhead, we propose that FPIS be absorbed into Frax. Additionally, this brings onto the Frax balance sheet $4.5m of additional profits/assets to bolster the treasury. The important outcome is that the entire Frax community is singularly aligned behind FXS and the success of Fraxtal. Thus, to simplify this resolution, we propose lowering the FPIS to veFXS conversion by 67% to the new 1 FPIS→1.33 veFXS for a 4 year lock. This dramatically lowers the governance & utility power of FPIS while still merging it into a single FXS token distribution. veFPIS also qualifies for the April 3rd FXTL points snapshot at the 1.33 rate.

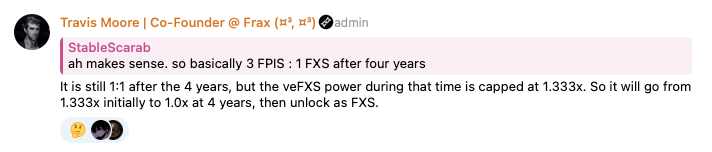

The proposal stated that FPIS would convert to veFXS at a 1.33 rate, but it was unclear about the actual ratio of FPIS to FXS.

Travis clarified that the ratio was still 1:1, but the FPIS would just have reduced governance power during its lockup period.

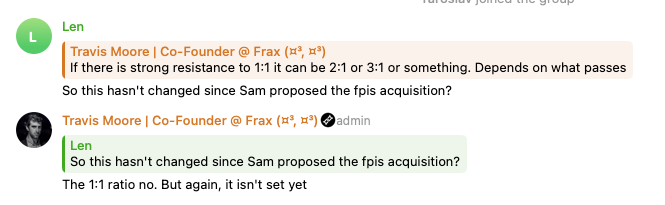

After Travis confirmed the 1:1 ratio was still being proposed, the TG chat exploded with many people complaining that it was a bad deal and needed to be changed. The blowback from proposing what previously was extremely contentious showed strong community rejection of the 1:1 ratio.

After some back and forth, C2tP dropped into the chat and said that a 3:1 ratio was fine, and that we should just pass a proposal at this rate and move on. There was broad support for this and the chat quieted down in its wake.

FPIS History/Summary

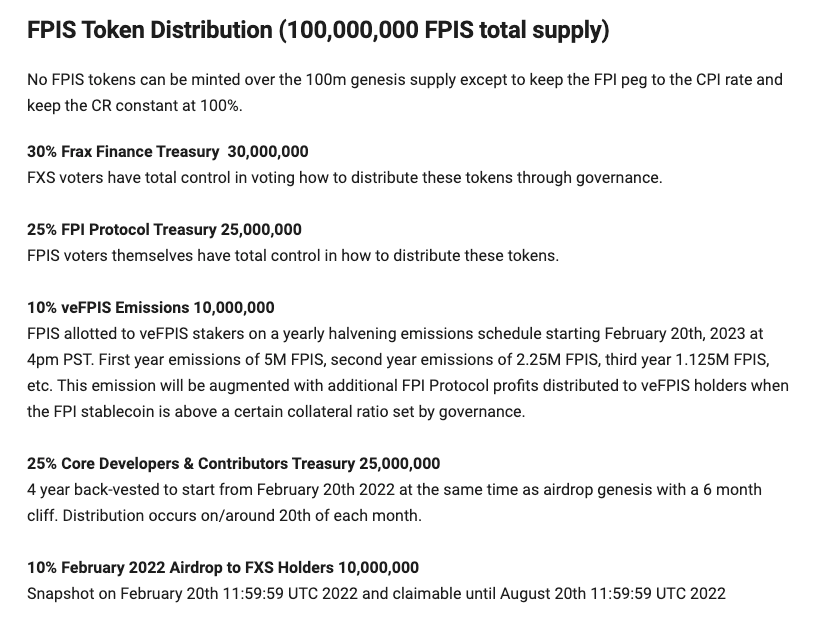

FPI/FPIS was launched two years ago in February 2022 with the following token distribution:

At the time, the team wanted a separate governance token to limit risk to the main Frax protocol. Inflation was high and there was a worry that if it remained at high levels for an extended period of time, it could negatively affect the health of Frax, which at the time was at 92% collateralization. FPIS was meant to serve as a junior tranche to FPI, meaning it would reap the profits when interest rates were above inflation CPI, but also bear the risk of being wiped out to maintain the peg if inflation ever picked up again.

These risks also were the reason that the FPI has yet to be raised above $100m since its launch. In a small manageable state, losses to FPI if inflation spiked would be minimal.

And so FPI has languished in a state of non-growth, with no clear path for its future. The merge was specifically proposed to bring FPI back into the Frax ecosystem and shift its backing from a single token with a single revenue source with high convexity to FXS, which boasts several revenue lines that could bolster FPI during an inflationary spike.

FPIS Valuation

The crisis at hand with the merge is what valuation FPIS should be acquired for. Currently there are 100m tokens in the supply, with 28m of those circulating.

The circulating tokens originated from the following sources:

- 10m were initially airdropped to veFXS holder in Feb 2022.

- 12.5m were distributed to Core Developers and Contributors after a 6 month vesting period.

- 7m were distributed as rewards to veFPIS lockers.

In the previous 18 months, FPIS has traded in a range between $0.88 and $2.84, with an average price of $1.59 for the past year.

A 1:1 ratio swap to FXS would have valued FPIS at the same price FXS is trading, $7.50, which is well above its trading range, and a valuation of $210m. At the currently proposed 3:1 ratio, the implied price is $2.50 with a valuation of $75m.

The merge would convert all FPIS into FXS at a certain ratio, and would be locked for 4 years. At the end of the four years it could be unlocked and removed.

However... the acquisition of FPI will greatly benefit Frax and the new income generated from lifting the FPI cap will outweigh any dilution.

sFRAX Ceiling Cap Raise and Ethena

Two key details in the proposals will be responsible for millions of dollars of new revenue for Frax.

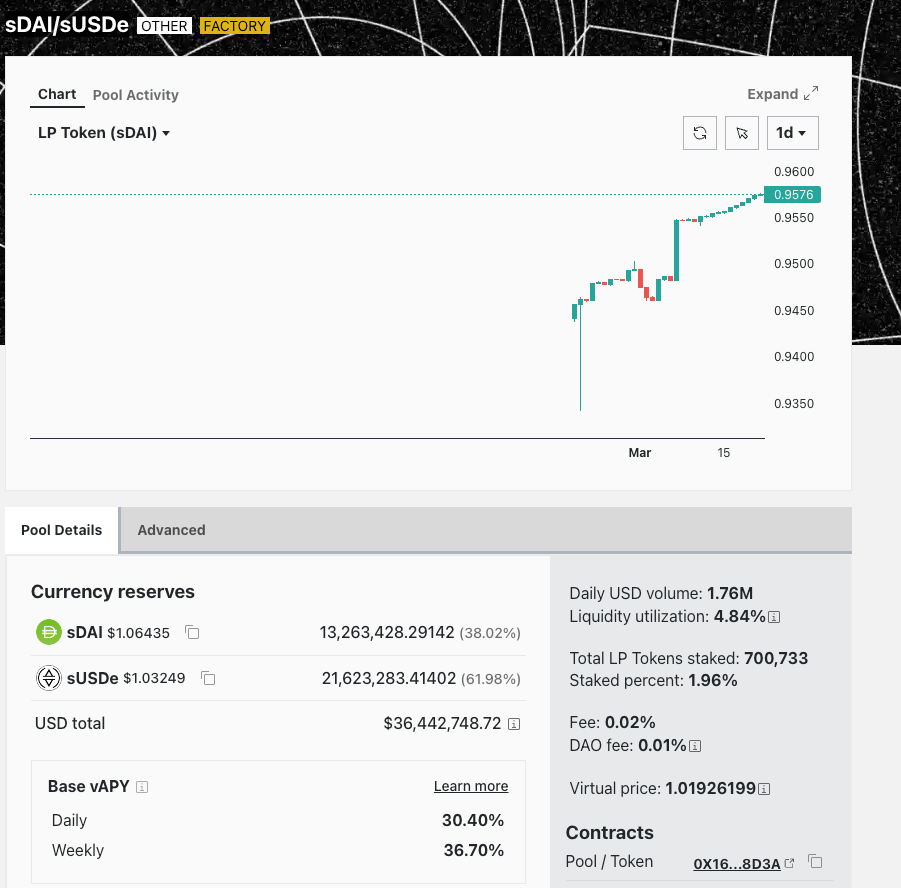

First, Frax will add sUSDeFRAX POL through the Curve AMO. sUSDe is a delta neutral stablecoin issued by Ethena. It earns yield from passive liquidity provision into perpetual futures markets on and off-chain. Currently, it's paying a 50% yield on deposits.

Second, the sFRAX interest rate ceiling is being raise to 50% with an IORB floor rate. This means that Frax will be able to shift sFRAX deposits from treasuries into other yield sources like Ethena based on yields. As Ethena is providing 50% APR currently, revenue earned from Curve LP deposits would be passed back to sFRAX.

There is currently an sDAI/sUSDe LP on Curve that has a realized yield of 66% (6% from sDAI, 30% from sUSDe, 30% from trading fees). With Frax creating a new sUSDeFRAX LP and funding it with POL, it most likely will be able to match these rates and pass them back on to sFRAX.

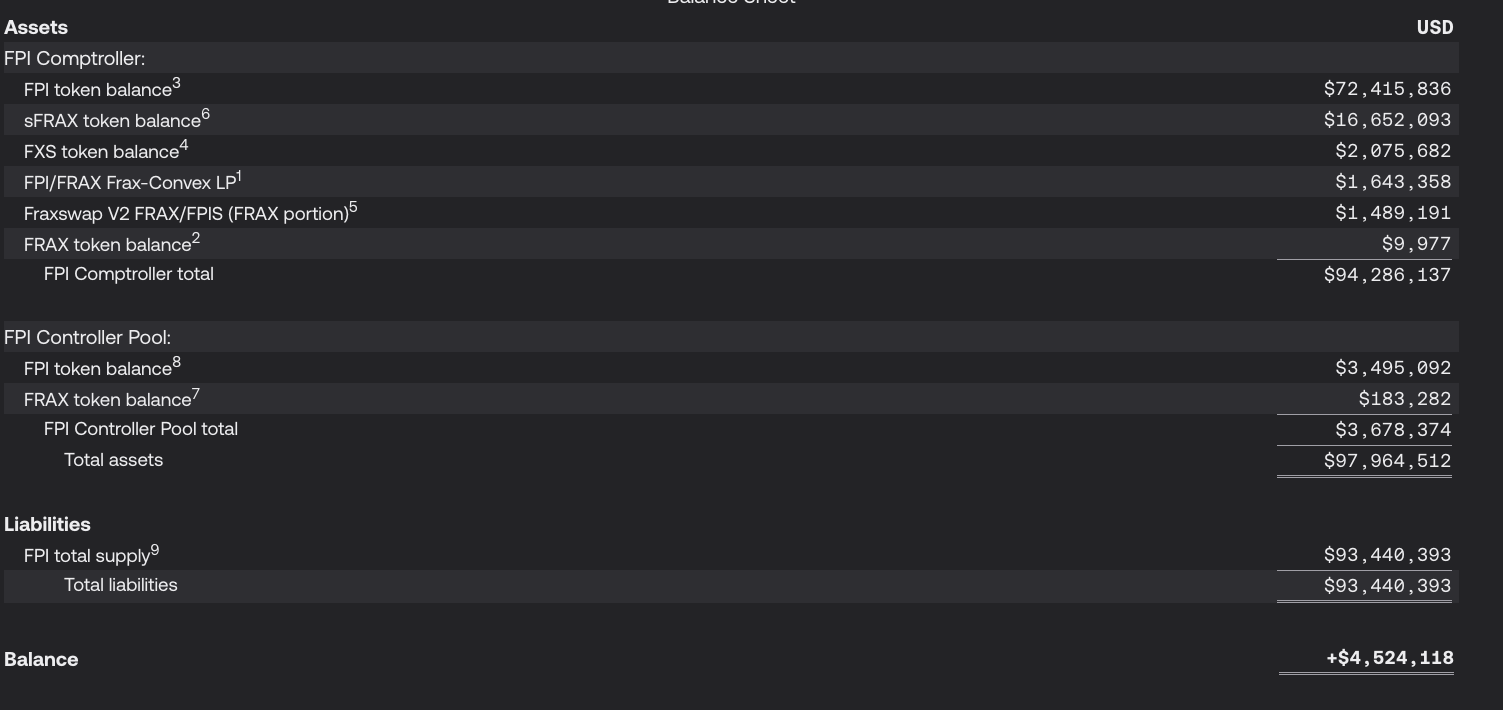

With the passing of [FPIIP - 12] Whitelisting sFRAX and FXBs as FPI Collateral back in Oct 2023, collateral held in the FPI treasury can be used to deposit in sFRAX. This means that once the Singularity proposal is passed, up to $100m worth of FRAX can be deposited into sFRAX to earn these high yields.

As of today, $16m worth of FRAX is deposited into sFRAX from the FPI treasury, however, there is another 72m FRAX available for deposit.

If the entire $88m was deposited earning a 50% APR, the treasury would earn over $3.5m a month. If rates dropped to 15%, this figure would be $1.1 monthly.

In the current structure of FPI, veFXS holders are entitled to 20% of those revenues. Without the merge, between 200k-700k of revenue would be transferred back to veFXS. The remaining funds would go towards FPIS buybacks for distribution to veFPIS lockers. veFPIS lockers would receive the same amount.

After the merge, all of those revenues will be distributed to veFXS. Sam Kazemian has stated that currently Frax earns roughly $4-5m monthly, thus the merge would effectively double revenues. With the CR gap now essentially closed and the Singularity proposal turning back on yield, veFXS most likely would receive double digit yields as a result of the merge if Ethena's high yields persist. Ethena's high rates won't last forever, they might even turn negative at some point and the 50% APR would collapse.

Lifting the Cap

The real opportunity of merging FPI is the ability to raise the supply cap. Frax can again begin to grow FPI in a rapid way. With every additional cap raise, more revenues can flow back into Frax.

A future supply of $1bn worth of FPI could potentially generate hundreds of millions of dollars of new revenue for the protocol that could be distributed to veFXS.

Without the merge, FPI can never grow. A merge must occur.

And this is what everyone is getting wrong about the merge. A $2.50 implied price for FPIS in FXS is not a detriment to the protocol. It's the cost of adding billions of future revenue for the protocol.