THE FIRST WORD IN LSD IS LIQUID - Sam Mc randomly on a podcast

What is Liquid Staking?

Liquid staking allows users to earn rewards from Ethereum Proof of Stake (PoS) consensus without the hassle of operating a node. With traditional staking, users lock up 32 ETH in a contract, becoming validators and participating in the network's consensus mechanism to help secure the network and process transactions. In return, these stakers receive rewards in the form of new ETH issuance. However, once ETH is staked in this way, it is locked and cannot be used until its fully withdrawn from the staking process.

Liquid staking, on the other hand, allows users to keep their assets “liquid” by receiving a tokenized representation of their staked ETH, in the case of Frax: frxETH and sfrxETH. This token can be traded, used in DeFi applications, or otherwise utilized while the underlying ETH continues to be staked and earn rewards

What is frxETH and sfrxETH?

FrxETH and sfrxETH are the two tokens comprising Frax’s liquid staking system.

Frax Ether (frxETH) is an ETH-pegged stablecoin. It receives no rewards from staking and it always should remain highly correlated with ETH. As a comparison, it is most similar to Wrapped Ether (WETH).

sfrxETH is frxETH that is staked in a ERC-4626 vault. sfrxETH receives all of the staking rewards earned by validators. sfrxETH is non-rebasing and its price goes up slowly over time as rewards are earned.

Why two tokens?

The first question most people ask about Frax’s model is “Why is frxETH necessary if it earns no reward yield?”

Every frxETH that exists outside of the sfrxETH vault earns no yield and increases the yield for others.

However, there is a good reason why DeFi needs an ETH-based stablecoin.

Every Ethereum-based LSD has two components: principle and yield. The principle is the ether is deposited into a validator, and the yield is the rewards earned from successfully providing validation services.

Other protocols like Lido and Rocketpool designed their token architecture to primarily capture and distribute yield. Pooled staking is the core functionality and external integrations and use cases are left to the open market.

There are two main token designs: number go up, re-basing, two token system.

NUMBER GO UP - in this model, when you swap your ETH to the LSD, you are given a fixed supply of tokens. These tokens do not change in amount, but their value goes up steadily as rewards accrue. Rocketpool’s rETH use this model.

REBASING - Rebasing is an onchain operation that increases or decreases the number of tokens in a user's wallet based on staking rewards or slashing penalties on the Beacon chain, and execution layer rewards. A rebase happens when oracles, which is a third-party service used by blockchain networks to provide external data, report beacon stats.

The problem with rebasing tokens is that they break DeFi. Most, if not all dAPPs assume that token balances remain constant relative to deposits. As rebasing adjusts this number up and down, it screws with the internal math, causing critical potentiality for critical exploits. This is why the wrapped version of stETH is the only asset used in DeFi, while vanilla stETH is not.

In both cases, Number-go-up and Rebasing, neither LSD model is a substitute for ETH or WETH. Lido, Rocketpool, and Stakewise all implement token models that focus on the yield aggregation primarily. However, they fail to adequately incorporate the characteristics of the underlying principle. This is important, as both assets are an enormous part of the Ethereum DeFi ecosystem and are the most typical asset paired against on DEX’s.

While there are benefits to these systems, they neglect the “liquid” in LSD. The entire point of LSDs is the ability to swap, borrow, or lend your assets. Rebasing is suboptimal for DeFi and rETH’s yield is often the lowest against its peers.

LSD + Curve = Win

The beauty of crypto is that builders have a lot of design space to try out new ideas. We saw this in the lead up to Frax’s launch as a plethora of algorithmic stablecoins with various peg stability models, all which failed spectacularly. Frax nailed the right idea and has been the only algo stable to survive this long, and it’s learned a lot along the way.

If you read our first Frax 101 on the FRAX stablecoin, you’ll have learned that Curve/Convex became an integral part of all design choices following deployment of V2 and AMO’s. Curve combines liquidity with a novel incentive layer to encourage liquidity provision. By staking your LP, you can earn CRV. By locking CRV as veCRV, you can multiply the rewards. With this knowledge Frax used its liquidity magic to acquire nearly 10% of CVX’s supply and build dynamic products leveraging its power.

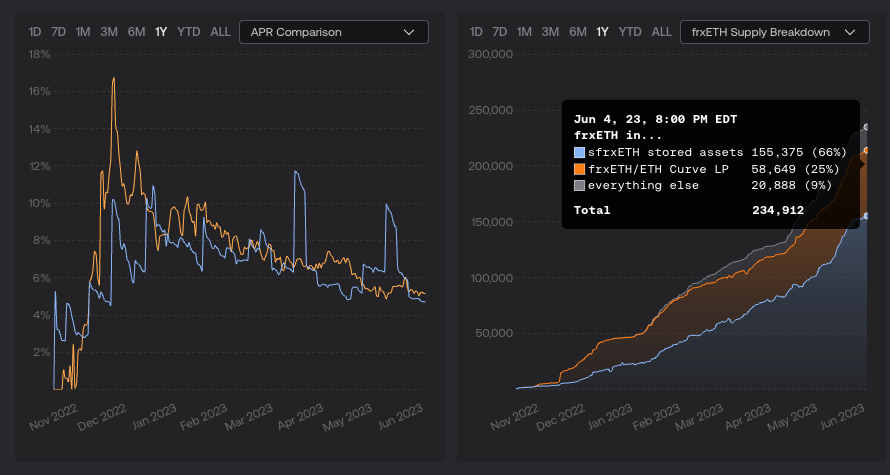

We’ve talked about the two tokens (frxETH & sfrxETH), now Curve adds a third component, liquidity pools. Once you mint frxETH, you have an immediate choice to make, stake in the vault or provide liquidity. Vault rewards are paid in ETH, Curve LP rewards are CRV,CVX, and FXS. This choose your own adventure game is how frxETH finds any demand, but more importantly, how Frax maintains exit liquidity.

Frax does not provide a public way to execute a full withdrawal of an ETH validator. The only way to exit frxETH is to sell into the Curve frxETH/ETH LP. If the pool ever has a large imbalance, the protocol can unstake their ETH nodes and wait to rebalance the pool.

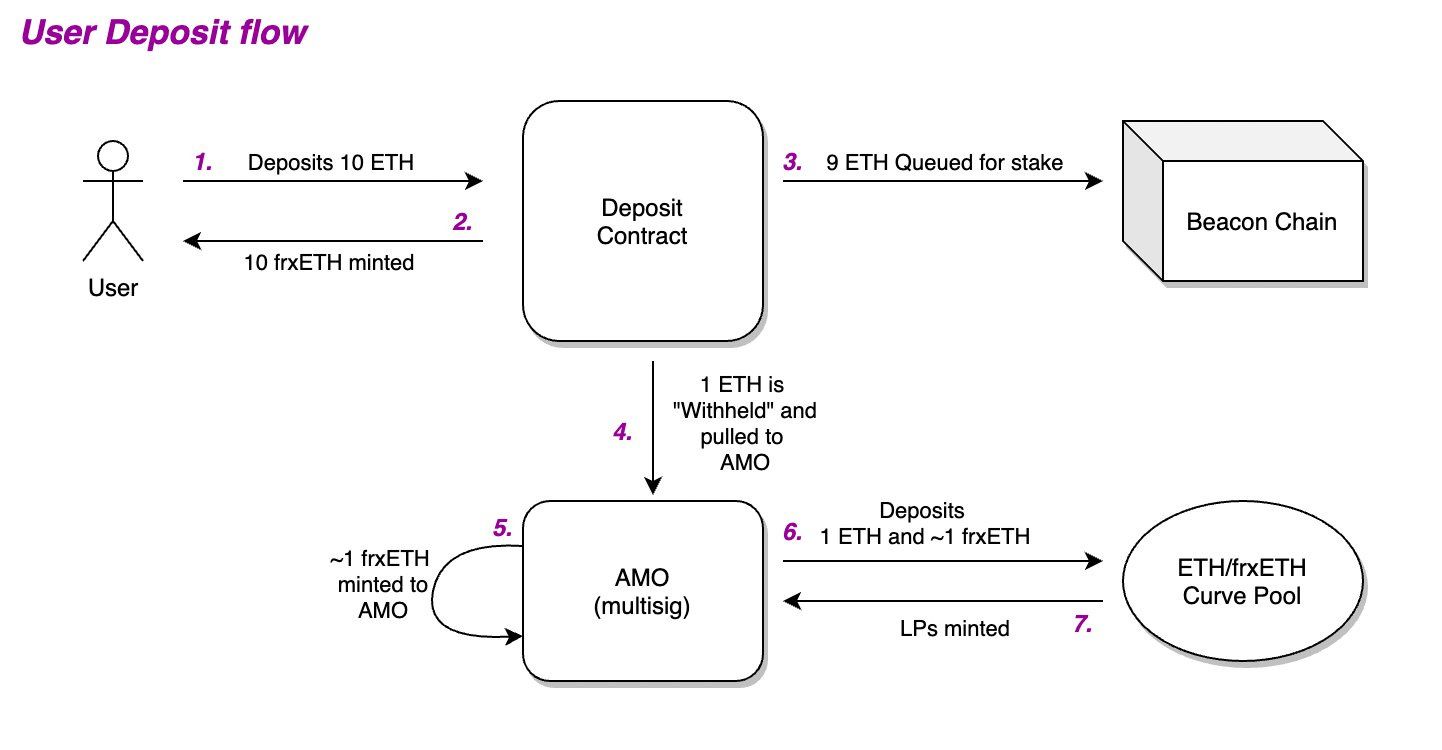

Additionally, Frax sets aside 10% of ETH swapped for staking to pair against frxETH in Curve. For every 10 ETH staked, 1 ETH is held by the AMO, it pairs it with newly minted frxETH and then deposits both into the ETH/frxETH Curve LP.

And while it might seem strange that Frax is create new frxETH for the Curve LP, it can only ever enter circulation when people buy or sell into it. If someone buys frxETH, it only enters circulation right then and there. If sold, the AMO can burn excess frxETH until the proportions become healthy again. If too much frxETH is sold and the peg breaks, the protocol can either buy frxETH at a discount and wait until the ETH validator exits, arbing the difference in price between the two.

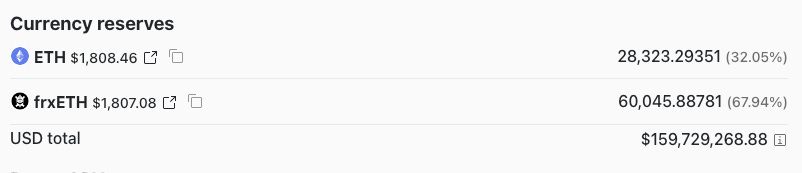

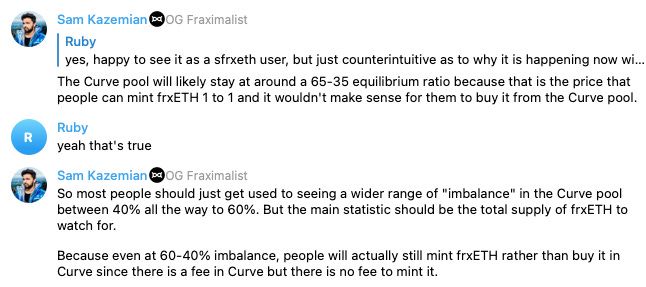

For everyday operations, the Curve LP typically is imbalanced 60:40 frxETH/ETH. This allows the protocol to increase its TVL, while still maintaining the peg, and increasing its farming yields from Curve.

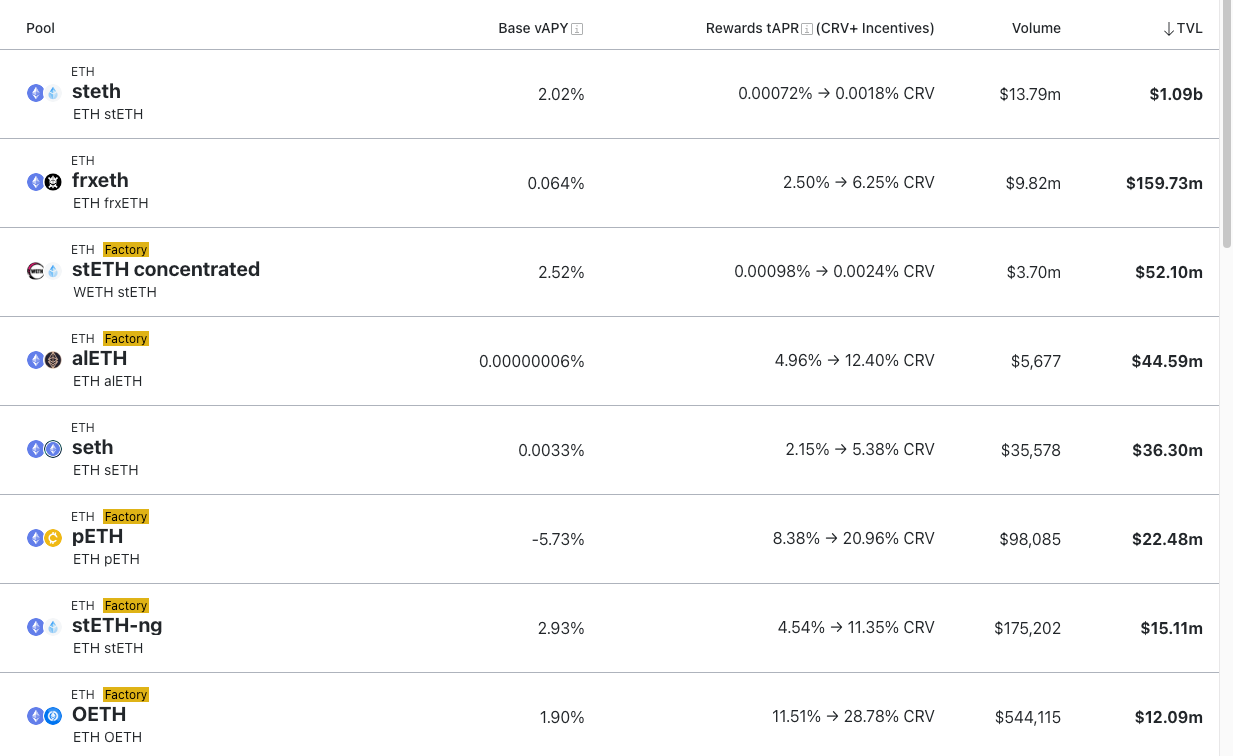

Based on how frxETH was designed, its liquidity will always be unmatched comparatively. On Curve, it is able to retain a much higher depth versus its market cap, with TVL of 160m versus a total TVL of 426m.

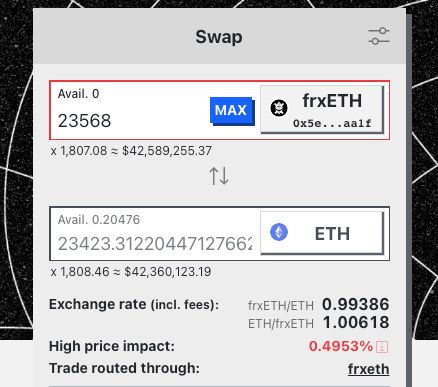

Traders benefit as they can swap larger amounts with lesser slippage. Even if 10% of the frxETH supply is swapped to ETH in 1 transaction, the trader would only lose .5% to slippage.

Monetary Premiums

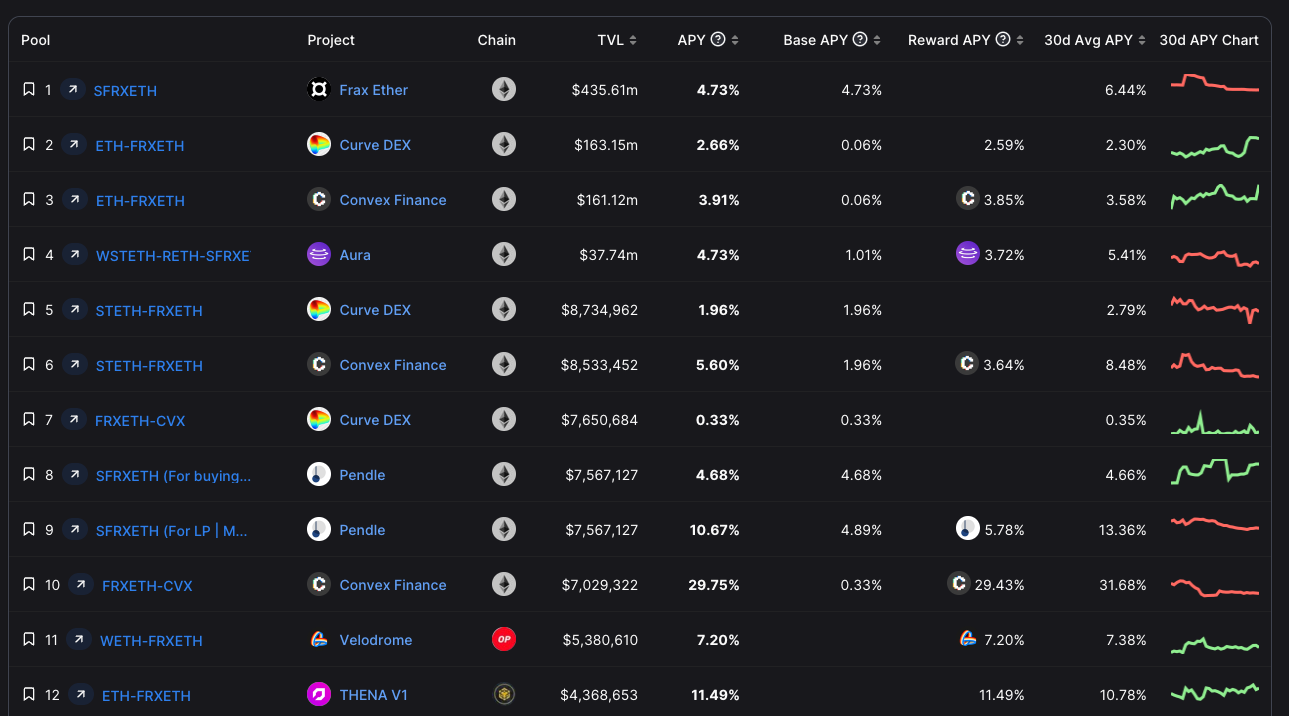

The beauty of frxETH’s design is that it forces holders to choose between earning yield from 3 options: sfrxETH, the frxETH/ETH Curve LP and third party dApps and exchanges.

As sfrxETH provides a baseline yield that is the risk-free rate, yields opportunities must be higher to incentivize deposits. If the yield ever goes below the sfrxETH rate, liquidity will naturally be drawn back to the core staking product.

But for every ETH not in the sfrxETH contract, it means a higher base yield. This ever changing dynamic yield chase is clearly seen in the charts. sfrxETH and frxETH Curve yields track each other tightly. Additionally, as frxETH is used is more dApps, its monetary premium has also risen. As of writing more than 20k frxETH is used outside of Curve and sfrxETH, nearly 10% of the supply.

Conclusion and what’s to come with frxETH v2

Since launch the Frax model has successfully achieved a total market share of 2.5% and is growing faster than any other competitor. However, there are centralization risks in frxETH which will be remedied soon.

As we wrote in Frax 101: Governance 2.0 - What is frxGov?

The Core Team also possesses complete control over the Frax’s assets. Currently, a 3 of 5 multisig, consisting of Sam Kazemian, Travis Moore, Jason Huan, and Justin Moore, and veFXS holders manages approximately $690 million of Frax assets. Drake Evans is planned to be added to the multi-sig once the new Gov module is launched. This multisig, along with a timelock contract, also holds administrative rights over other Frax contracts, including a wallet holding $524 million of Frax assets on Curve. In total, over $ billion is managed by the core team.

The Core Team is public and well known, which reduces the potential for collusion and theft. Currently, Sam, Travis, Drake and Justin are US citizens and residents, raising additional risks.

In its current model the Frax Core Team completely controls all validator nodes using a 3/5 multi-sig. While this has been necessary for initial growth and launch, now at a more mature state this control is dangerous and threatens the health of the entire Frax protocol.

Last week, Kazemian announced in a Dorahacks presentation as well as a Twitter thread the coming of frxETH v2 which essentially creates a dynamic lending market for validators to run “frxETH nodes”. This peer-to-pool model is similar to how Aave and Compound operate as lending markets, allowing for market forces to determine the interest rate for lenders and borrowers.

In frxETH v2, interest from borrowing validators is paid directly to sfrxETH holders while node operators keep the rest. It is likely that the LTV (Loan-to-Value) ratio will be 75% to start with governance being able to adjust when needed as well as decide on collateral. Liquidations occur when node operators are slashed and ultimately ejected from the system. The frxETH v2 model is designed to reward the most competent node operators deploying sophisticated strategies to earn levered yield.

Full article and podcast episode about frxETH v2 coming soon!