This week... I call this week the “The Holiday Blues” week. As the name suggests, we're a little down this Holiday season.

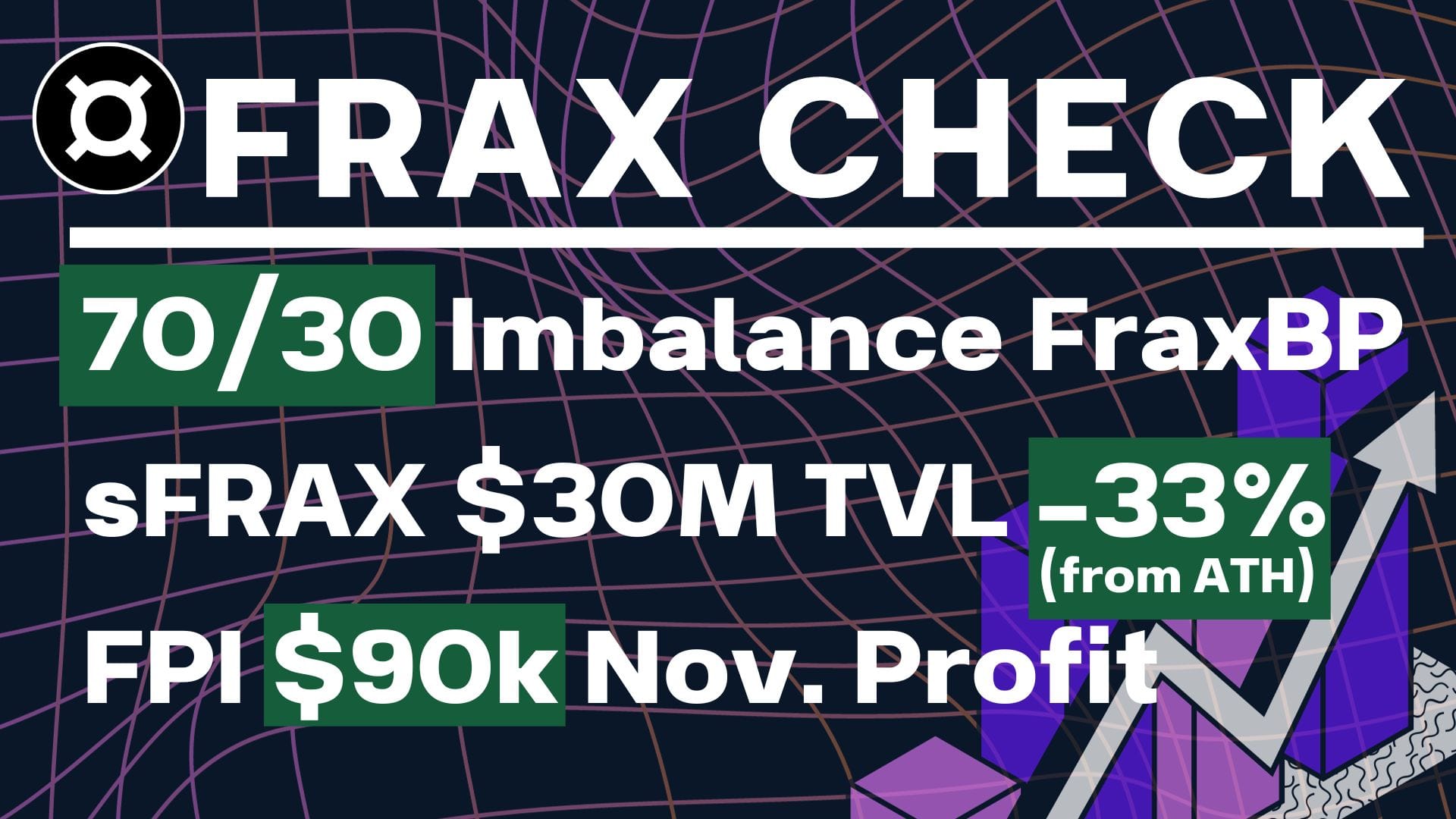

TOP 3 TL;DR

- FraxBP // 70/30 FRAX-USDC Imbalance (again)

- sFRAX // $30M TVL (Down 33% from ATH)

- FPI // $90k Profit for November

Frax Supply & Peg

FRAX supply dipped down (-0.3%) to $669M for the first time in 2 months – maybe this is just for the meme. Nothing else to report here, moving on the peg.

We saw the peg got as high as 1.000 and as low as 0.999. In the market, we saw an exchange rate of $0.994 when swapping up to 80M of FRAX for USDC. We're having to reduce the total size of our swap from 100M FRAX to 80M FRAX since the FraxBP is getting imbalanced again.

Small drop on the assets side of the balance sheet, minus $4.8M, for this Frax Check. Our Liabilities decreased by $2.1M, so our equity also decreased by $2.7M. We currently have $814M in Total Assets, $740M in Liabilities, and $74M in Balance Equity.

Collateralization Ratios

The Collateralization Percentage dropped by 10 basis points up to 93.8%. We got this number by taking the Total Assets ($814M) subtracting the Locked Liquidity ($120M) then dividing that by the Total Frax Supply (740M).

FraxBP

As aforementioned, FraxBP's balance is edging towards the wrong side. We might see another rebalance thus reducing the FraxBP TVL again. Recall that earlier we had to remove like $300M in liquidity.

When we add up all the FraxBP, Frax3CRV, and FraxPP, we receive a total of $208M, which is 1.06x of the 3Pool. We're holding above 1.00x again!

sFRAX

sFRAX been live for nine weeks and we're down 33% of ATH of $45M. The current TVL is $30M.

But the real yield is still here so come get real-world yields via sFRAX now.

The APY at the time of writing is 5.4%. There are 186 sFRAX holders, which is holding steady for the month. But we suppose it's normal to see a decrease in TVL as the market becomes more risk-seeking.

FrxETH supply and distribution

Now onto the crowd favorite, le frxETH. We rocking strong here with 295,029 frxETH supply, a 0.1% increase from the last Frax Check (lol, at least it's not a decrease).

frxETH's monetary premium remains at 6%! This means that 6% of the supply of frxETH holders are happily holding or utilizing frxETH outside of the Frax native ecosystem.

FrxETH peg

Reminder, frxETH is still a stablecoin, just a stablecoin pegged to ETH instead of the dollar. In the markets, we swapped 3.5k frxETH for ETH via Curve and received an exchange rate of 0.997.

Total frxETH liquidity on Curve is at $156M across 3 pools. The blended balance across these pools is 71% frxETH and 29% ETH, wETH, and stETH.

Competitive landscape

Speaking of landscape, let’s look at the LSD market.

We held onto 2.5% of the market. For the last 30 days, we've grown 4.9% but our competitors such as rETH and stETH, grew by 4.7% and 5.0%, respectively.

In the yield department, frxETH leads the pack with 4.0%. The competitors are closely behind though so there is no resting!

FPI

The final stablecoin: FPI. The Annual Inflation Index dropped by 0.5% and is now at 3.2%. Good thing that the FPI is still above Peg by 4 basis points. The treasury consists of $92.8M with an excess equity of $4.2M.

As inflation decreases and the treasury continuing to earn high yields, the excess equity will continued to be built up in FPI's treasury.

Fraxlend

FraxLend's stable. We've found a good level at around 250M-ish TVL with $67M borrowed. An 85% utilization rate is healthy. I like to see utilization in this range – it keeps the interest rate high enough for suppliers while still providing ample liquidity for borrowers.

Fraxswap

Lastly, we have the final leg of the DeFi Trinity with FraxSwap. We like to call this the Dex that no one talks or knows about. There are only $63.7M TVL across all the pools. For October, this DEX turned over 73% of its TVL. But in November, it facilitated 125%.

Profitability

Revenue, Expenses, Profit

Show me the money! Well, here it is.

Let's look at the FraxLend AMO as that's one of the key revenue drivers with $171k so far in November. FRAX Lent decreased to $58M from the $62.5-$65M range that we were in for quite some time.

Another revenue stream from FraxLend is liquidation fees. For November we had one micro liquidation for $600. Good work to almost everyone for staying safe.

FPI finally resumed a green profit month in November with $90k in earnings. Fortunately, this contributed to the treasury's equity balance of $4.2M.

Lastly, if we do some rough math we could estimate the run rate of frxETH at $1.6M for the year. The math goes as such: 26.5 frxETH rewards per day* 365 days * 8.0% fee rate * Price of ETH. Then divide that by 12 to get the monthly figure of $135k per month or 64.5 ETH.

ACCESS TO SLIDES: Here

Not financial or tax advice. This article is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This post is not tax advice. Talk to your accountant. Do your own research.