"New Year New Coin" - FraxCheck #60

This week... I call this week the “New Year New Coin” week. As the name suggests, we got a new coin that I'm quite excited about and I'm going to tell you about it.

TOP 3 TL;DR

- FraxPYUSD // $110M TVL

- FraxBP // -18.8% at $84M TVL

- sFRAX // 25M TVL (+25%)

Frax Supply & Peg

We kick the year off pretty much exactly where we left off at $649M $FRAX supply. Nothing else to report here, moving on the peg.

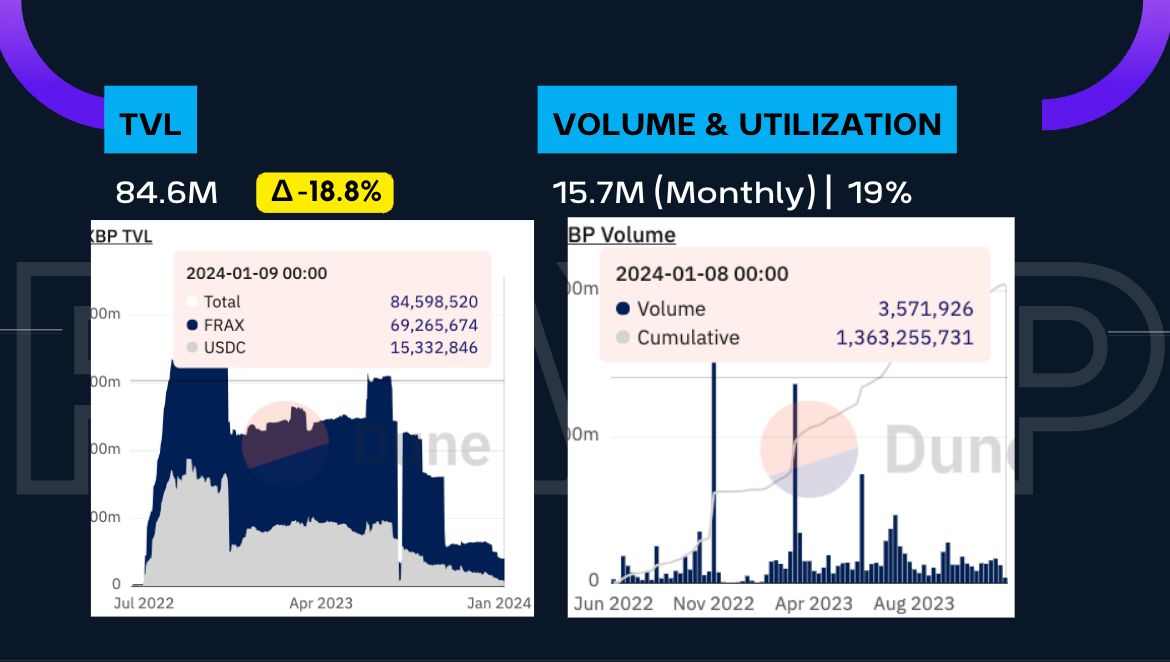

We saw the peg got as high as 1.000 and as low as 0.998. In the market, we saw an exchange rate of $0.994 when swapping up to 40M of FRAX for USDC. We're having to reduce the total size of our swap from 100M FRAX to 40M FRAX since the FraxBP went from a high of 600M to 84M TVL. But also because we have a new FRAX/PYUSD pool. Yes that's right, a FRAX/PYUSD, not FRAXBP/PYUSD.

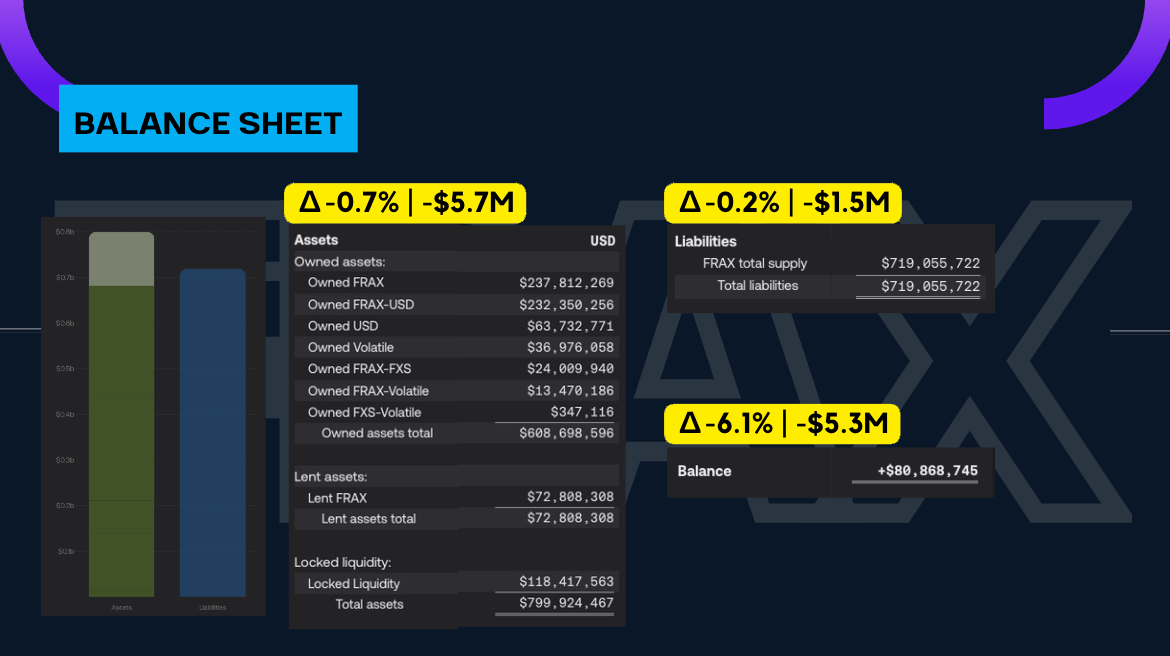

Some fluctuations on the balance sheet, but nothing too major. Our equity balance dropped by $5M (-6%) for this Frax Check. Though, our liabilities decreased by $1.5M. We currently have $800M in Total Assets, $719M in Liabilities, and $81M in Balance Equity.

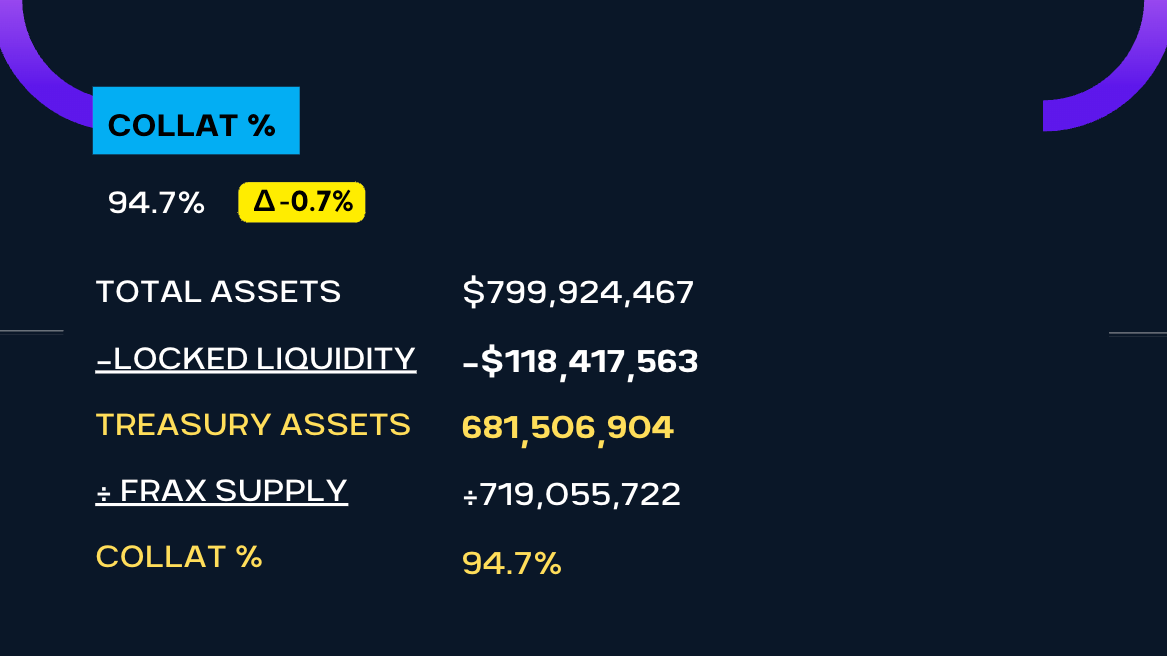

Collateralization Ratios

The Collateralization Percentage decreased by 70 basis points down to 94.7%. We got this number by taking the Total Assets ($799M) subtracting the Locked Liquidity ($118M) then dividing that by the Total Frax Supply (719M).

FraxBP

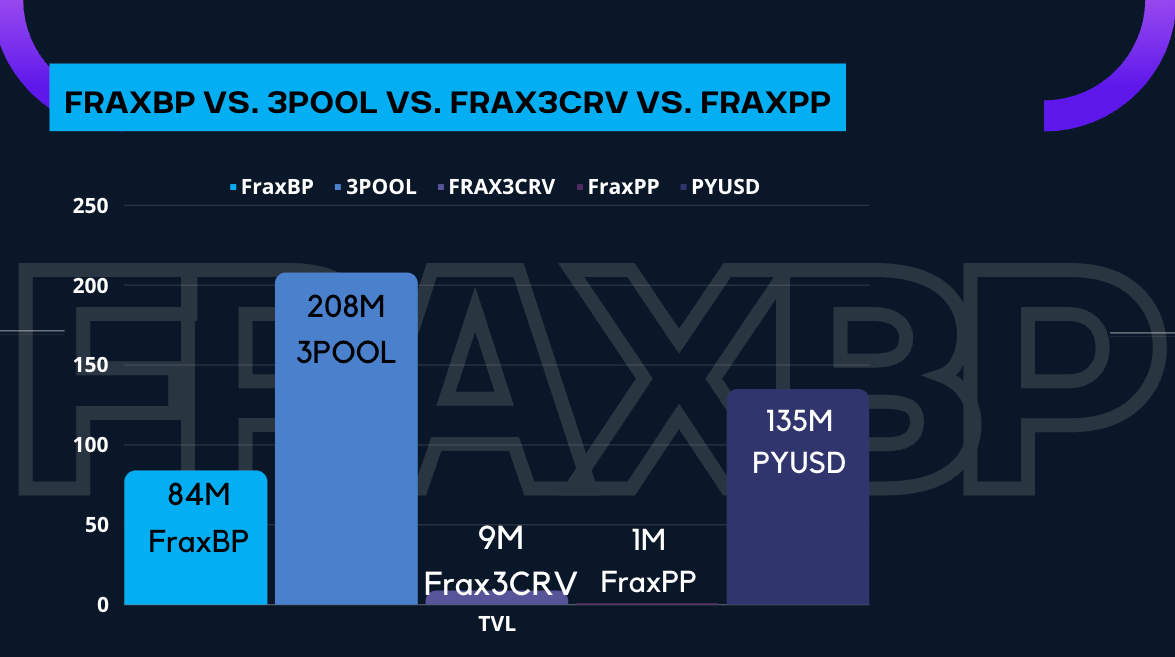

As aforementioned, FraxBP's balance remains on the wrong side with an 80/20 imbalance between $FRAX and $USDC. There was another TVL reduction to balance down nearly 19%, from $104 to $84M. Though the decrease in TVL here is offset by the massive increase in TVL for the FRAX/PYUSD pool of $110M TVL plus $25M of PYUSD.

When we add up all the FraxBP, Frax3CRV, FraxPP, and Frax/PYUSD we receive a total of $229M, which is 1.1x of the 3Pool. There was one point in time when Frax-related pools were 3.0x of the 3Pool.

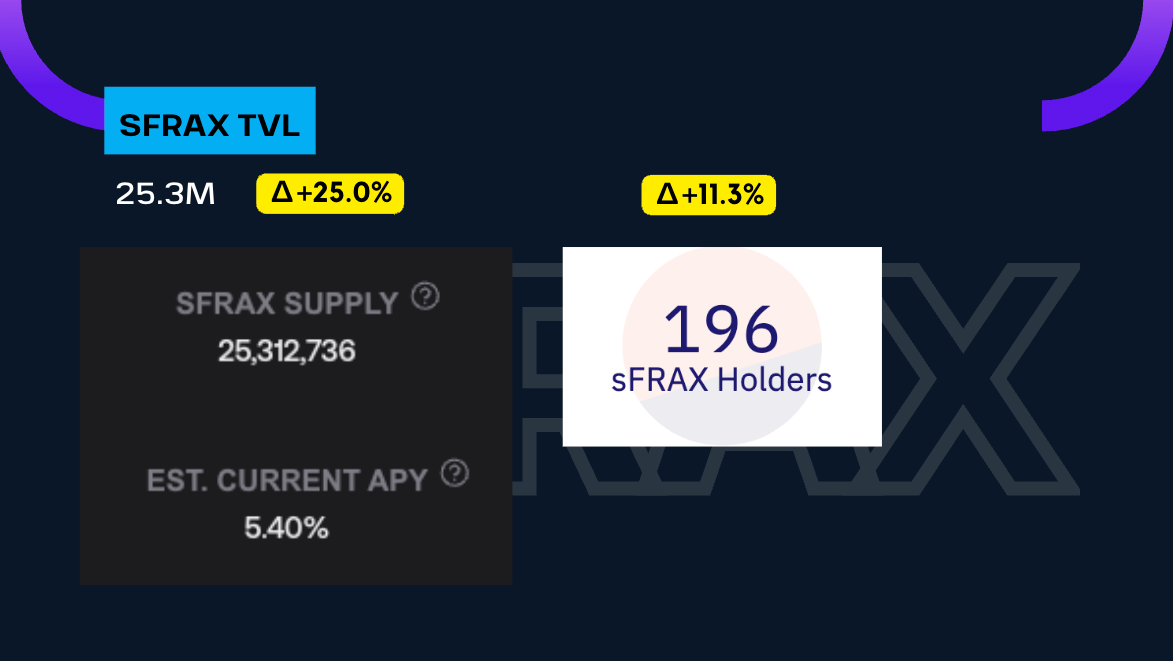

sFRAX

sFRAX been live for about four months and we finally experienced a bounce in the TVL from the lows of $20M to $25.3M but this is down 55% from ATH of $45M.

But the real yield is still here so come get real-world yields via sFRAX now.

The APY at the time of writing is 5.4%. There are 196 sFRAX holders, which is an 11% bump from the last Frax Check.

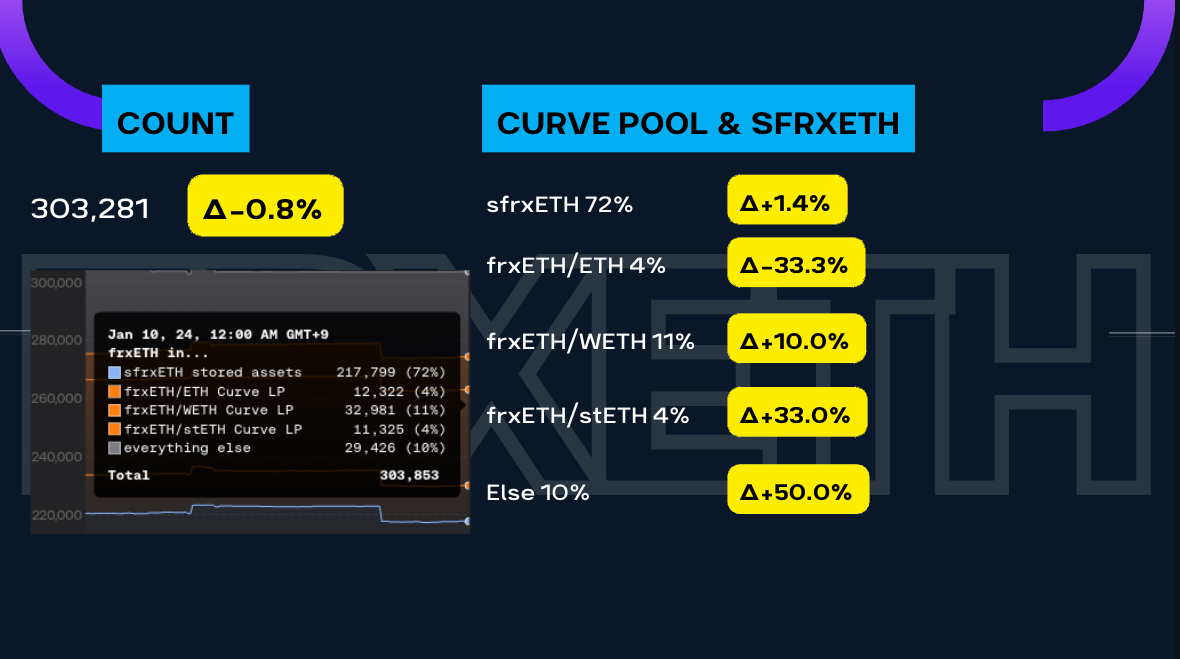

FrxETH supply and distribution

Now onto the crowd favorite, le frxETH. We believe this is the second time that frxETH's growth is negative.

Not much movement in the frxETH supply, aside from liquidity moving from one pool to another. frxETH's monetary premium jumps to 10%! This means that 10% of the supply of frxETH holders are happily holding or utilizing frxETH outside of the Frax native ecosystem.

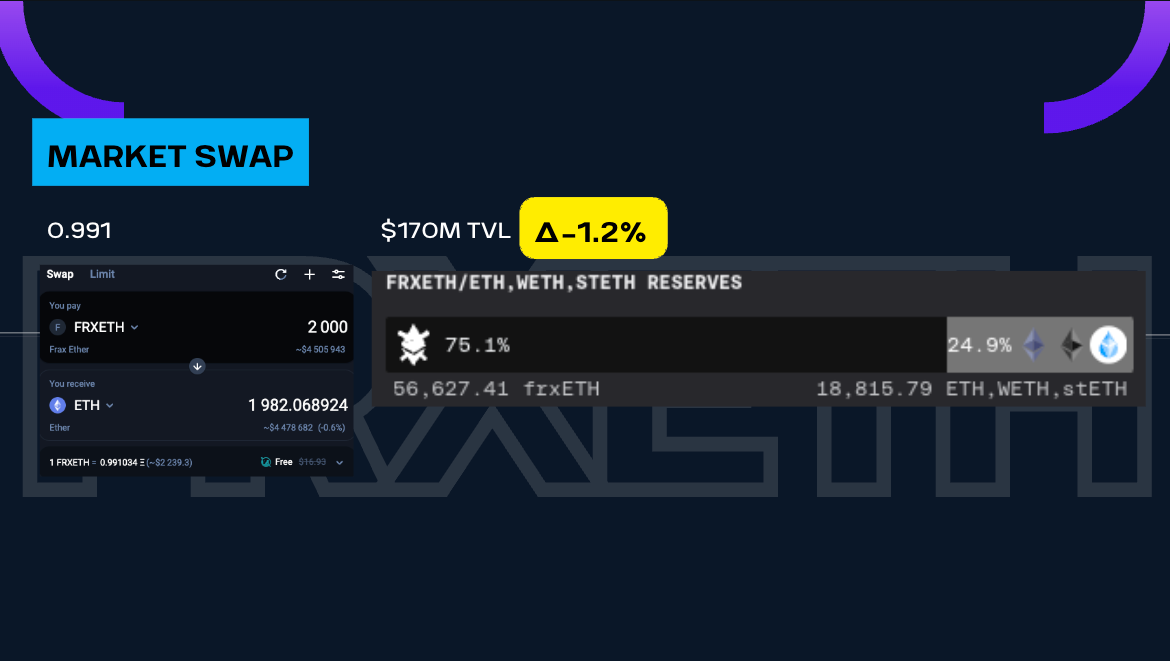

FrxETH peg

Reminder, frxETH is still a stablecoin, just a stablecoin pegged to ETH instead of the dollar. In the markets, we swapped 2.0k frxETH for ETH via Curve and received an exchange rate of 0.991. We had to reduce our normal swap rate of 3.5k frxETH.

Total frxETH liquidity on Curve is at $170M across 3 pools. The blended balance across these pools is 75% frxETH and 25% ETH, wETH, and stETH. There weren't any changes to the liquidity so unsure why we couldn't swap our usual 3.5k frxETH.

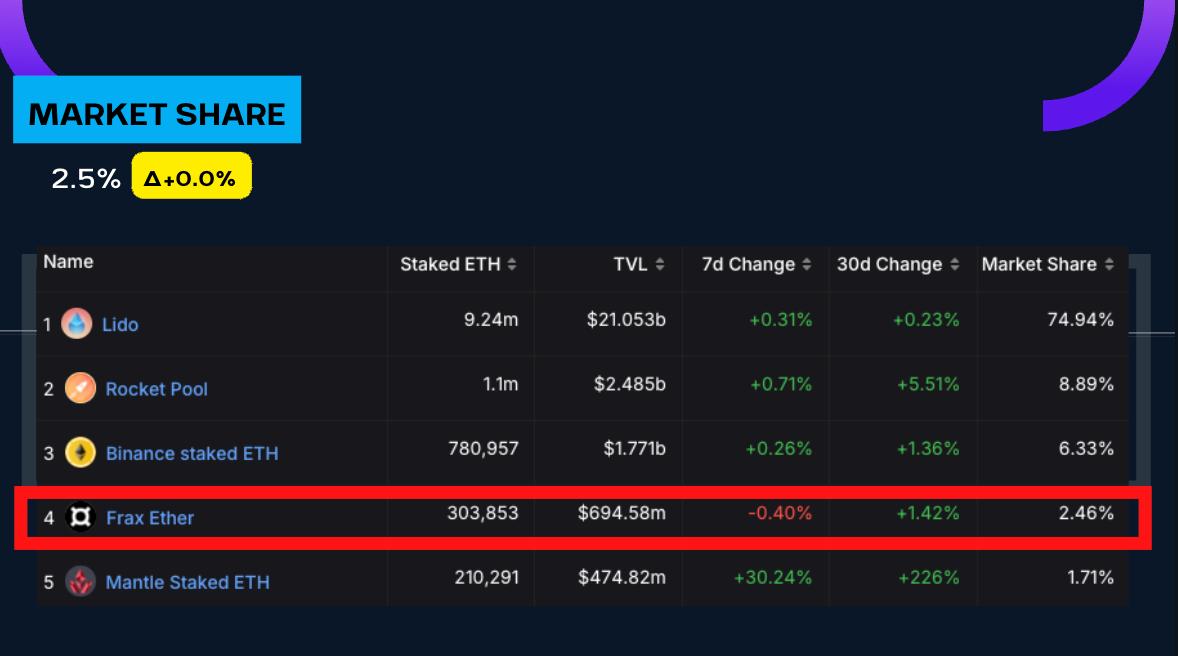

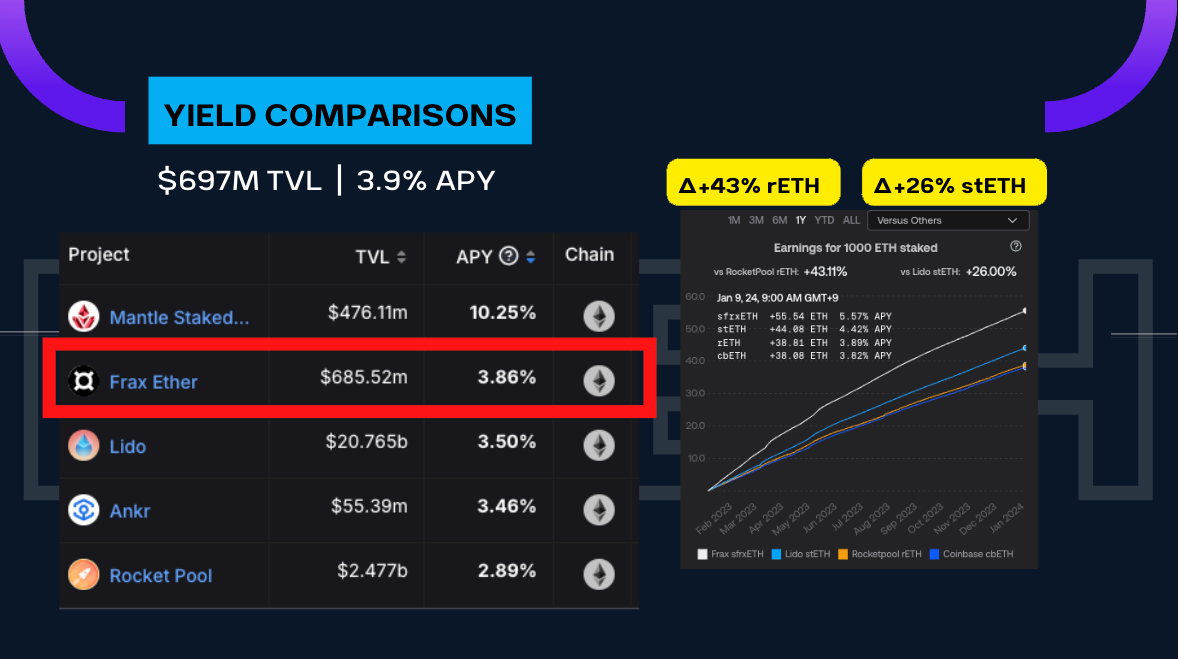

Competitive landscape

Speaking of landscape, let’s look at the LSD market.

We held onto 2.5% of the market. For the last 60 days, we've grown 1.4% but our competitors such as rETH grew by 5.5%. And we have a new contender Mantle Staked ETH growing at 228% over the last 30 days and they're right behind us with 210k staked ETH.

In the yield department, frxETH is completely dominated by Mantle Staked ETH's 10% APY. Even though frxETH is ahead of all our other competitors with a 3.9% APR. The competitors are closely behind though so there is no resting!

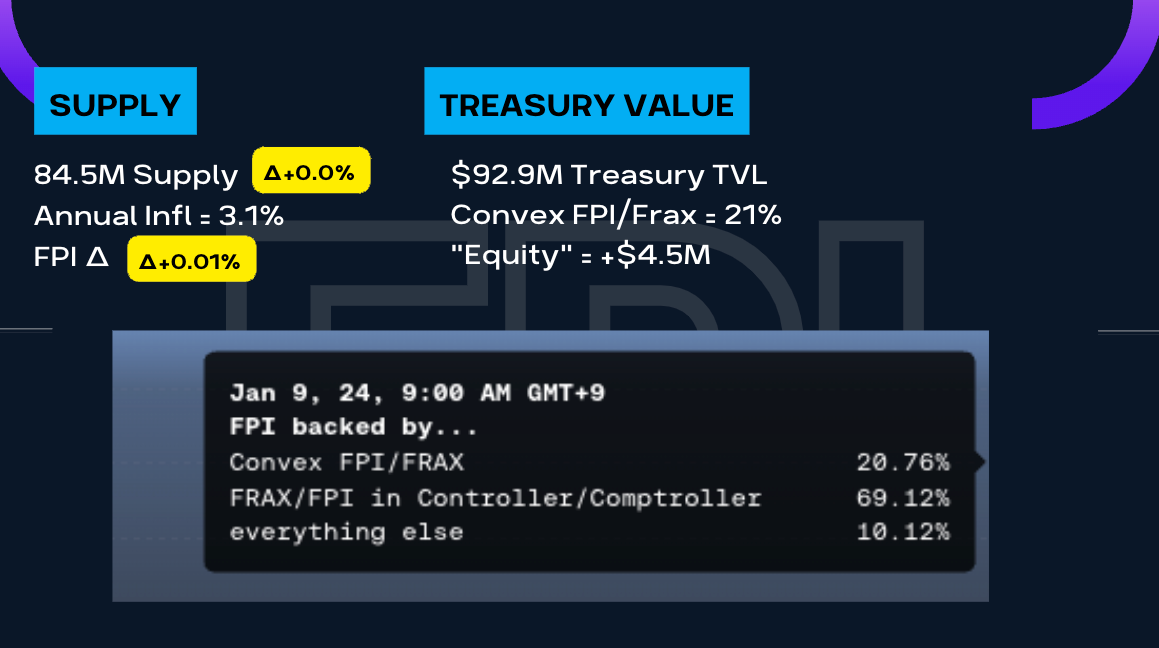

FPI

The final stablecoin: FPI. The Annual Inflation Index is now at 3.1%. Good thing that the FPI is still above Peg by 1 basis point. The treasury consists of $92.9M with an excess equity of $4.5M.

As inflation decreases and the treasury continues to earn high yields, the excess equity will continue to be built up in FPI's treasury, which would perhaps be converted to Frax's (FXS's) treasury.

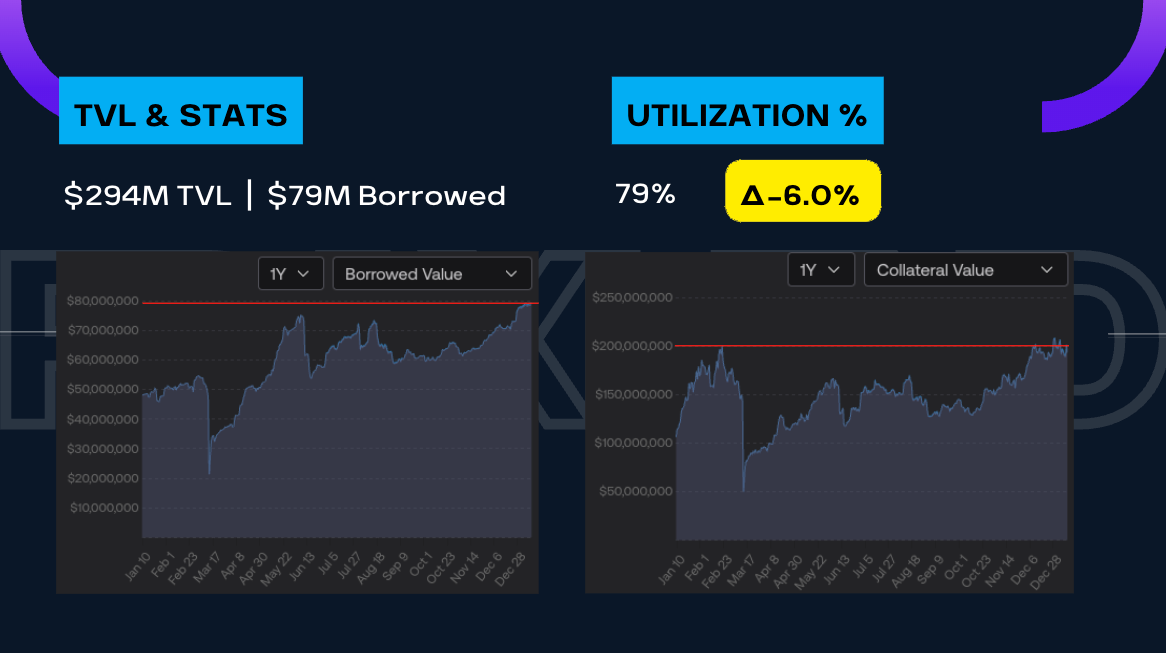

Fraxlend

FraxLend's operating at peak performance. This is a new ATH at $294M TVL as well as an ATH in borrowed amount of nearly $80M. A 79% utilization rate is healthy. I like to see utilization in this range – it keeps the interest rate high enough for suppliers while still providing ample liquidity for borrowers. FraxLend AMO was also able to lend out an additional $6M to meet the borrowers' demands.

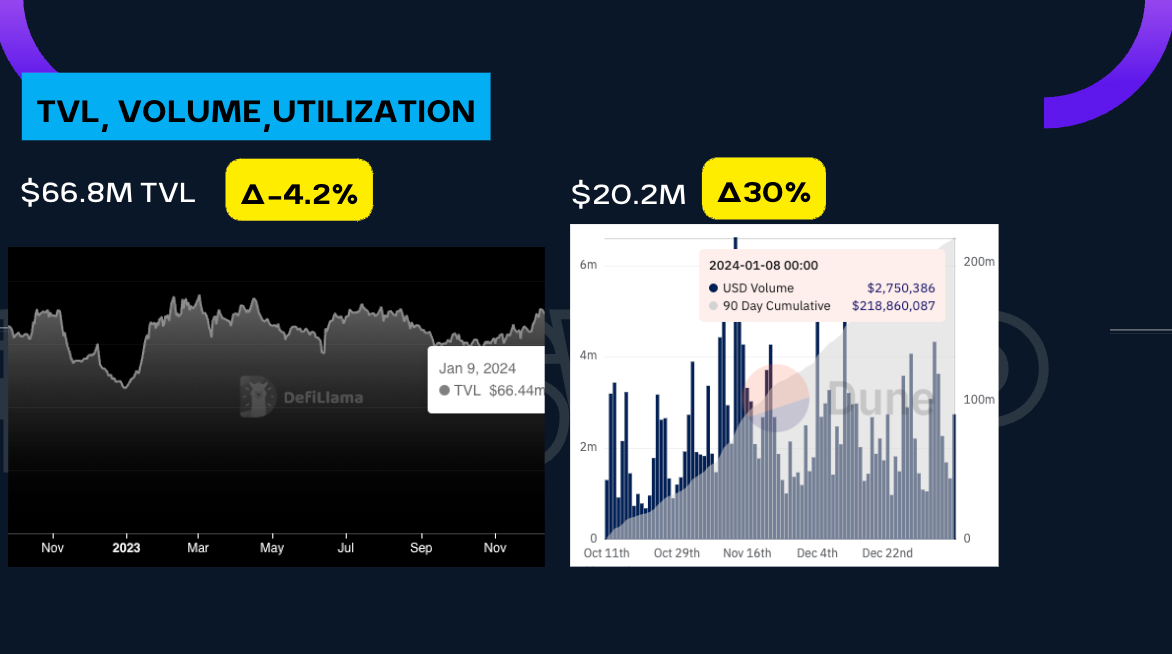

Fraxswap

Lastly, we have the final leg of the DeFi Trinity with FraxSwap. We like to call this the Dex that no one talks or knows about. There are only $66.8M TVL across all the pools. For January, this DEX turned over 30% of its TVL.

Profitability

Revenue, Expenses, Profit

Show me the money! Well, here it is.

Let's look at the FraxLend AMO as that's one of the key revenue drivers with $124 so far in January.

Another revenue stream from FraxLend is liquidation fees. For January we generated $8.4k – glad we're staying safe out there.

FPI continues with a green profit month in January with $45k in earnings. Fortunately, this contributed to the treasury's equity balance of $4.5M. And this treasury may soon be combined with that of FXS'.

Lastly, if we do some rough math we could estimate the run rate of frxETH at $1.62M for the year. The math goes as such: 24.6 frxETH rewards per day* 365 days * 8.0% fee rate * Price of ETH. Then divide that by 12 to get the monthly figure of $135k per month or 60 ETH.

ACCESS TO SLIDES: Here

Not financial or tax advice. This article is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This post is not tax advice. Talk to your accountant. Do your own research.