This week... I call this week the "LOOK MA' WE MADE IT" week. As the name suggests, we have made it and we are about to evolve into the next form.

TOP 3 TL;DR

- FRAX // 99.3% CR

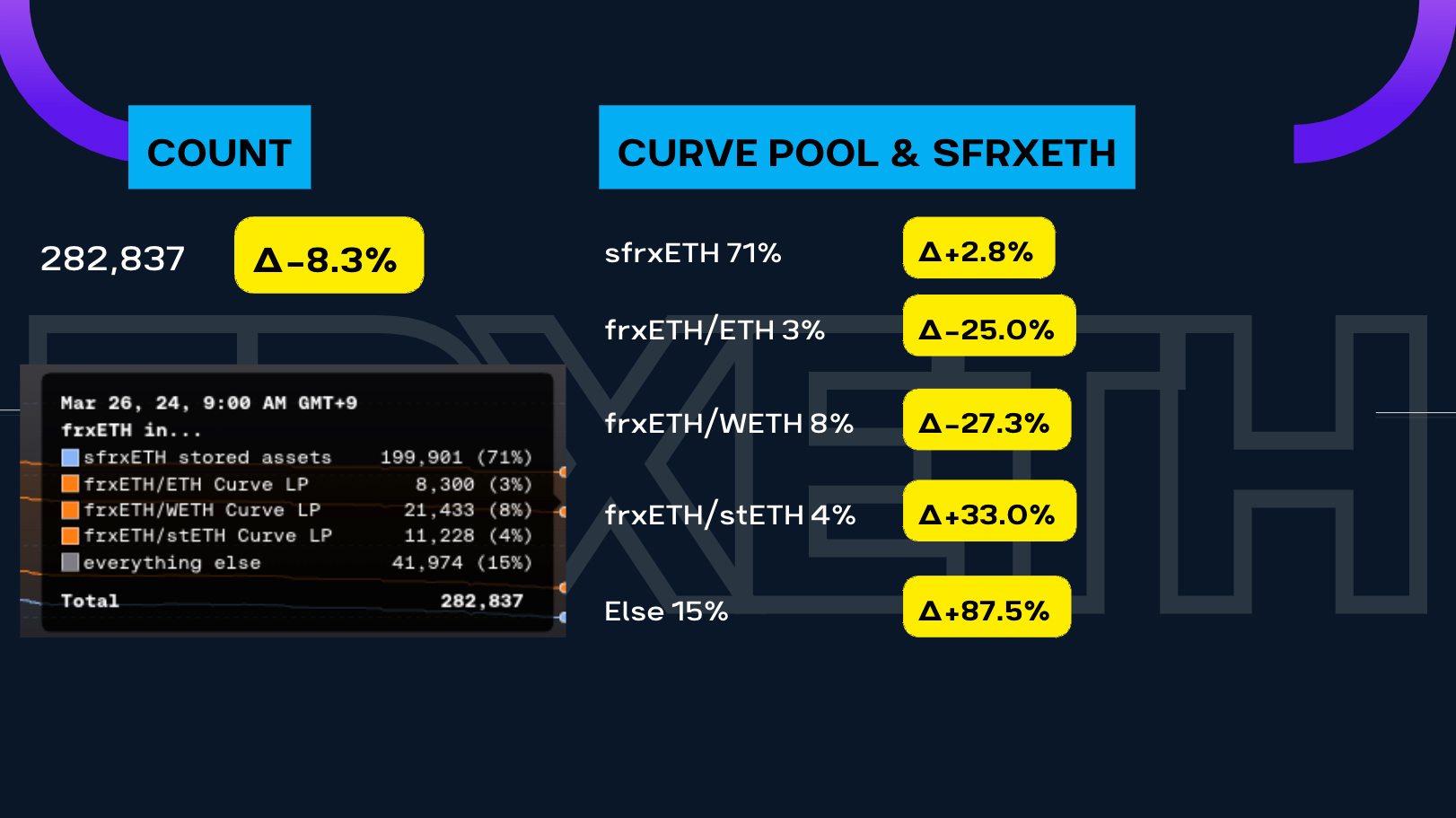

- frxETH // Dropped 8% (below 300k ETH)

- FraxLend // ~$1M in AMO + Liq Rev

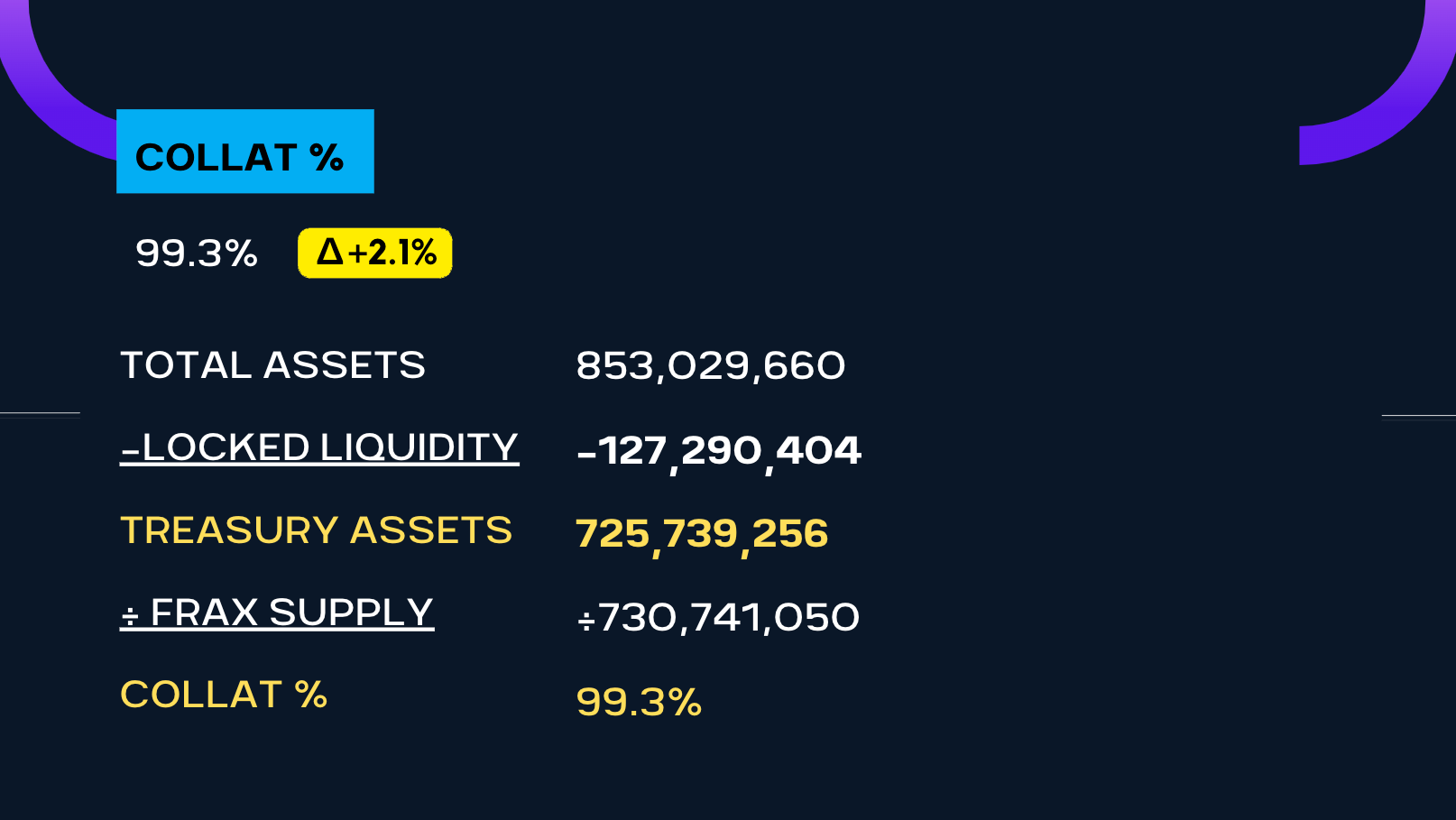

1. FRAX // 99.3% CR

What a journey to arrive at this point. We have arrived as near as 100% CR as we could get. Frax had to generate $45M in profits to achieve this.

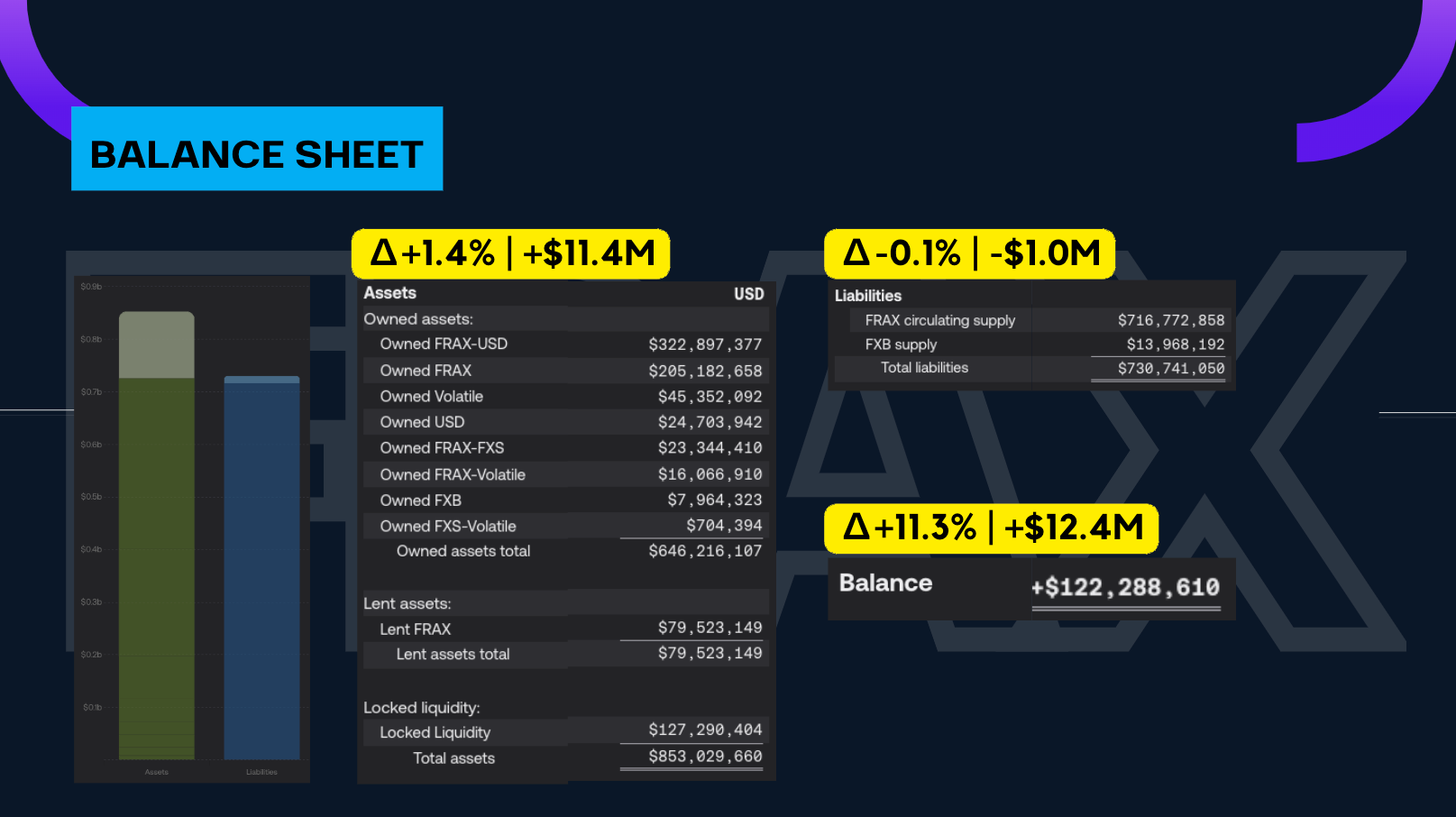

For the last four months, the FRAX supply remained flat at $650M but what changed is our Assets.

Assets bumped up by $11.4M (+1.4%), while Liabilities decreased by $1.0M so that means the Equity Balance saw a very healthy step-up of $12.4M (+11%). This contributed to our CR going all the way to 99.3%.

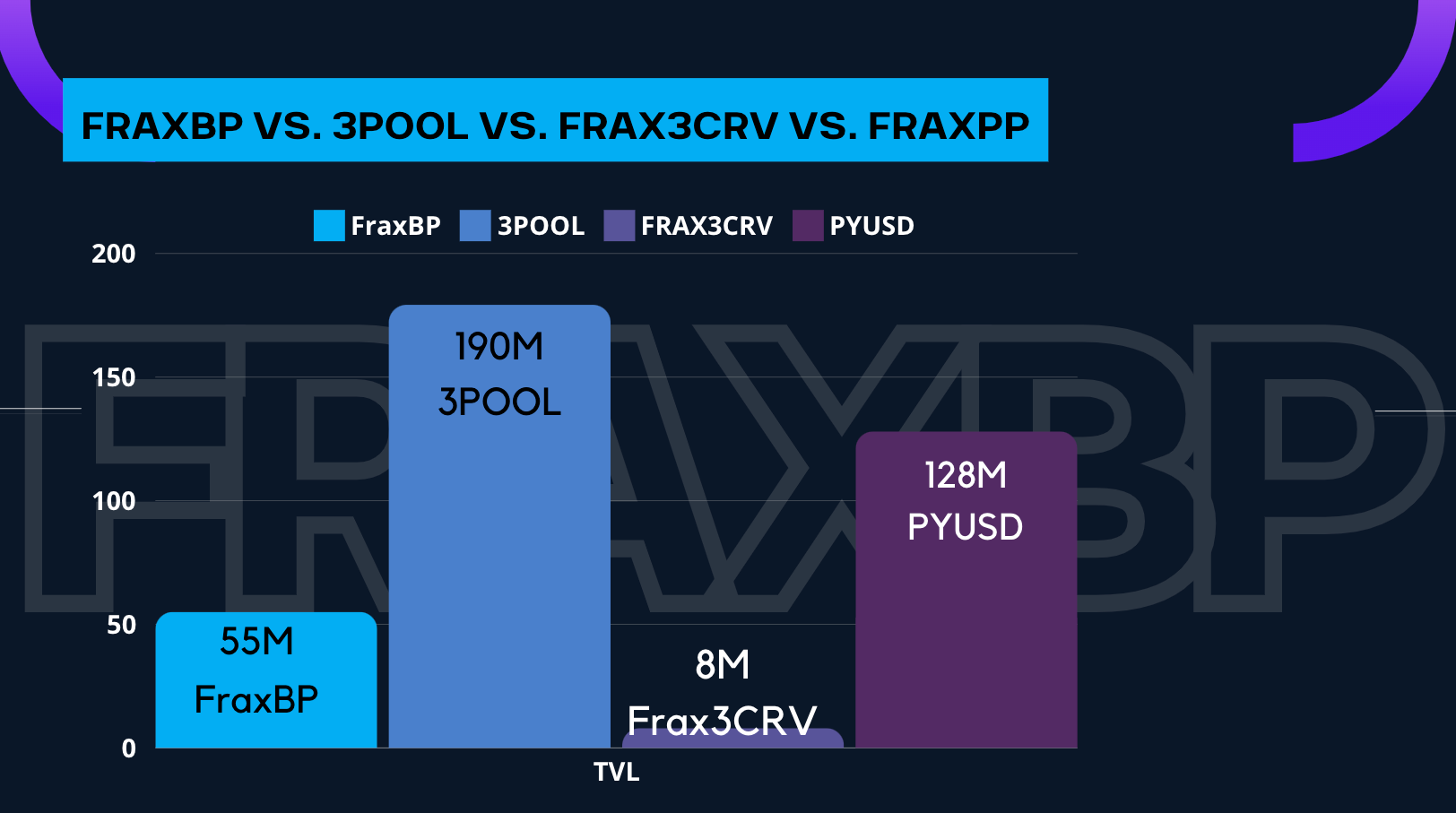

In terms of liquidity, though now we have two options (USDC and PYUSD), we are still quite short from the large multi-9-figure TVL that we had last year. At one point, the amount of Frax-related liquidity pools on Curve versus the native 3Pool was 3-to-1. Now, it's 1:1 as seen in the graph below.

2. frxETH // Dropped 8% (below 300k ETH)

We can't have all good things. Unfortunately, we're experiencing a downtrend for the crowd's favorite product: frxETH.

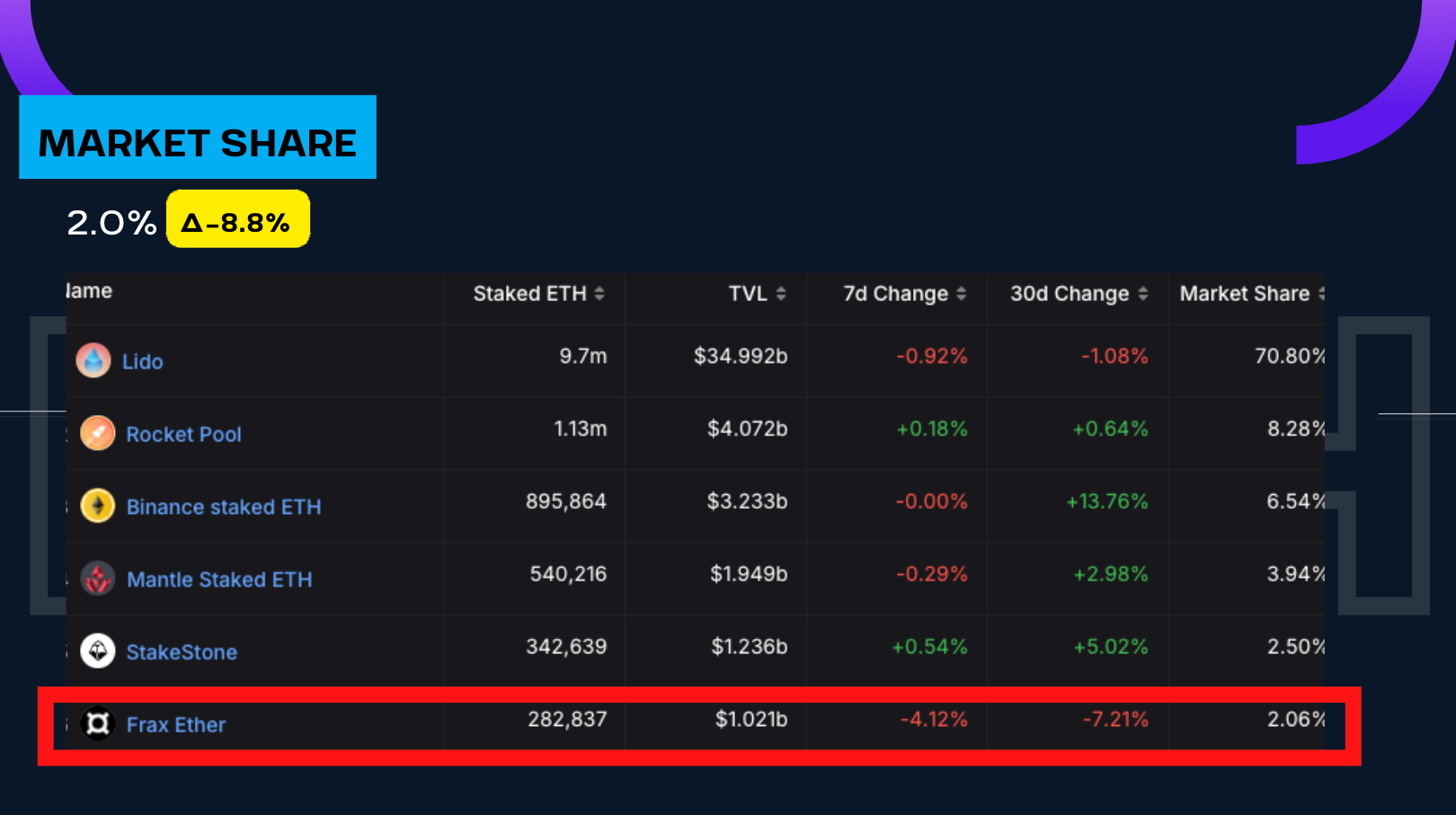

We dropped below the 300k ETH mark, representing an 8% decrease from February's figures. Moreover, this led to us ceding 9% of our market share to competitors. Not to mention, another contender is following closely behind (Swell).

Previously, we were in the top 3. stETH was number one then there was rETH and frxETH in third. Binance's staked ETH came and blew right past us but that was expected (duh, it's Nance). But when Mantle's mETH and Manta's Stone entered the scene, we got smoked dropping us out of the 5th place.

Though there is one shining light is the 15% monetary premium right now on frxETH. That means there are approximately 42,000 frxETH being used outside of the Curve-Frax system – pretty great to see the adoption of Frax's LST in the wild.

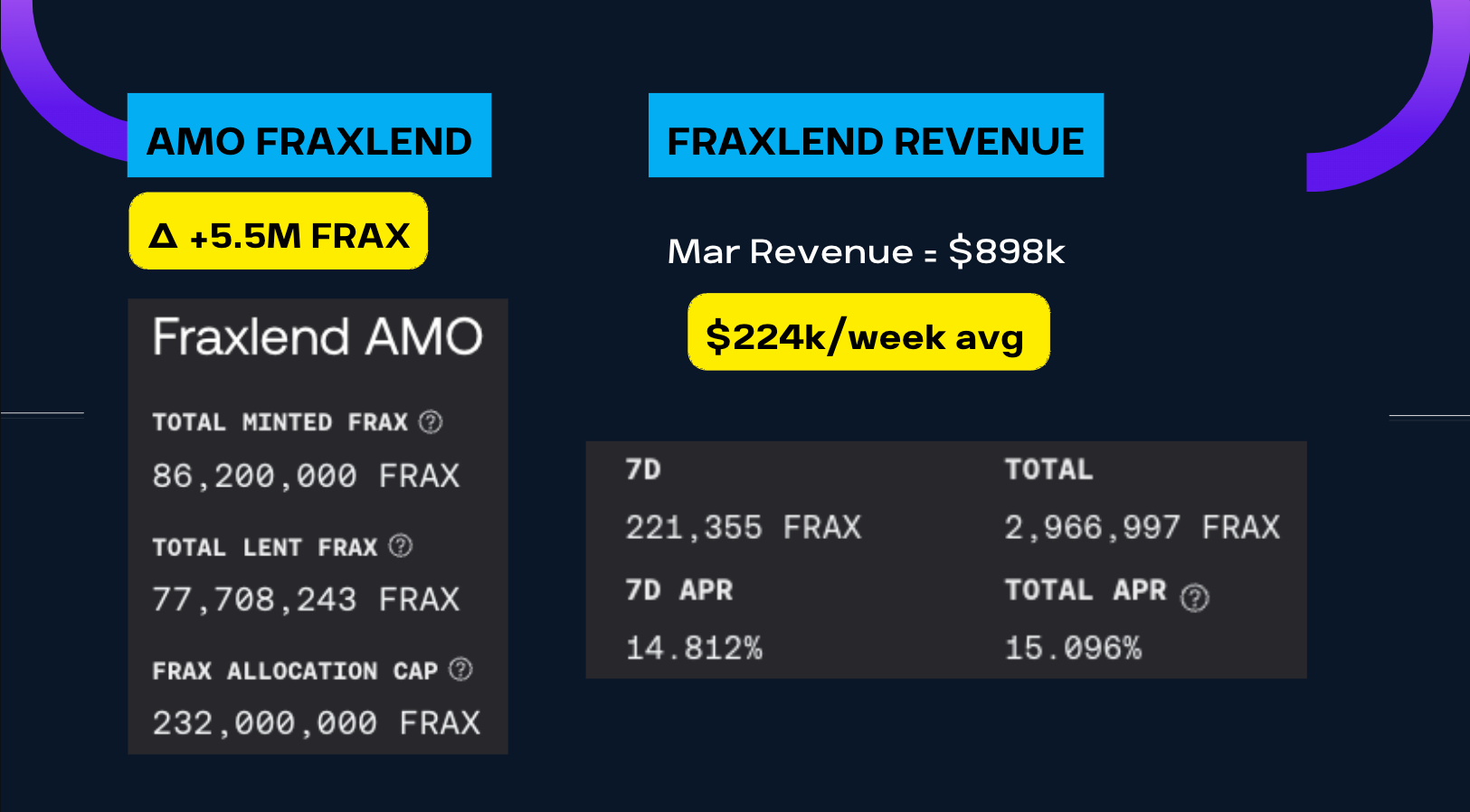

3.FraxLend // ~$1M in AMO + Liq Rev

FraxLend is making big bucks. The revenue run rate nearly 3.5x'd since the beginning of the year. Previously, we were doing $62k/week but now the number is $220k/week.

We also increased the amount of Frax lent by $5M and the AMO is still pulling this level of revenue. Truly incredible. Users are hungry for that leverage and Frax Finance is here to deliver.

The lending APY for the top pools are 30%, 24%, and 23% for the CRV, WETH, and FXS pairs, respectively. These are bull market tings.

The huge FraxLend revenue numbers give us an estimated monthly revenue of nearly $1M and an annual run rate of $12M. And this is before factoring in the Liquidation profits.

For March, 17 positions were liquidated, which amounted to $93k in fees for the protocol. This puts the total annual run-rate of FraxLend into the $13M ballpark. What a revenue-generating machine.

PS. Pour one out for the liquidated homies.

ACCESS TO SLIDES: Here

Not financial or tax advice. This article is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This post is not tax advice. Talk to your accountant. Do your own research.