Partnership Spotlight: RAMSES

This week we had on North from RAMSES. North joined the show to talk about Frax liquidity pools and the current Arbitrum STIP grants.

FRAX nation making friends and growing rapidly on @arbitrum $frax $frxETH $dola $grai $alUSD@AlchemixFi @InverseFinance @gravitaprotocol pic.twitter.com/kzRTpaS3O6

— RAMSES (@RamsesExchange) October 5, 2023

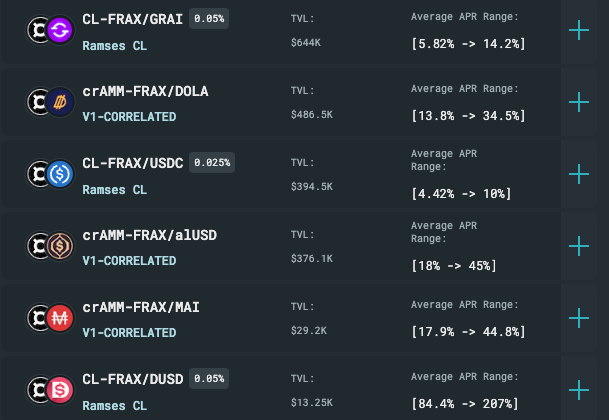

RAMSES is a ve(3,3) DEX inspired by Andre Cronje's Solidly concept on Arbitrum, that focuses on community engagement, decentralization, and advanced functionality. There are several pools available for staking Frax assets currently.

FRAX V3!FRAX V3!FRAX V3!FRAX V3!

BREAKING!!!! Frax v3 launch today!! $FXS pic.twitter.com/vsW2JiB6q1

— Cryptovestor (@Cryptovestor77) October 4, 2023

It's finally arrived. Frax v3 is here. Yesterday the team dropped updated docs for Frax v3 in the main chat and we learned a lot about "The Final Stablecoin." Let's dig in to the newly released docs.

But first.... a beautiful chicken.

Frax v3 adds several new features to the FRAX stablecoin:

100% Collateralization: FRAX aims to maintain a collateralization ratio (CR) of at least 100% for all its stablecoins. This is achieved using AMO smart contracts and real-world assets from approved partners like FinresPBC. The CR is determined by the value of external collateral on FRAX's balance sheet, which helps stabilize the FRAX stablecoin's market price. As FRAX is below CR, it is using its protocol profits to close the gap.

USD Pegging: Once FRAX achieves 100% CR, it will be pegged to the USD. This peg is maintained using Chainlink oracles and approved reference rates. If the CR falls, measures will be taken to restore it and ensure the FRAX price remains at $1, irrespective of other assets like USDC, USDT, or DAI. This is a response to the USDC depeg and questions around USDT which have occured in the last year.

IORB Oracle Integration: FRAX v3 uses the Federal Reserve's Interest on Reserve Balances (IORB) rate for specific functions, such as sFRAX staking yield. Depending on the IORB rate, the protocol will adjust its collateralization strategy. If the IORB is rising, it will gain more exposure to assets like Treasury Bills or USD deposits at Federal Reserve Banks. If the IORB rate drops, the strategy shifts towards on-chain assets and overcollateralized loans.

Rates in DeFi suck because they're getting crushed by the IORB rate. No one's lending on Aave, no one's lending on Compound, or if they are, it's not great risk adjusted because it just sucks. Everyone's just crowded into Treasury bills or some way to access the IORB rate, right? The Fed's risk free rate.

If you think of a dollar peg stable coin design, right, you basically need it to function extremely well in a high rate environment and function really well in a low rate environment, right? - Sam Kazemian

The protocol specifically uses RWAs that closely match the IORB rate while minimizing duration risk. Currently, the accepted assets include: Short-term U.S. treasury bills, Federal Reserve Overnight Repurchase Agreements, USD in Federal Reserve Bank master accounts, and selected money market mutual fund shares.

FRAX v3's partner custodians focus mainly on these assets. These RWA partners are required to provide monthly reports detailing their custody, broker, banking, and trust arrangements for holding these assets. FinresPBC has been recognized as the inaugural RWA partner for FRAX v3, emphasizing low-risk "cash equivalent" RWAs that yield close to the IORB rate, especially for the sFRAX staking vault. The addition of more RWA partners is possible through governance voting.

Trust Assumptions Removed: FRAX v3 operates entirely on-chain using the frxGov module, eliminating the need for multi-signature trust assumptions.

As for the off-chain balances, Frax will setup a public API to track collateral with Plaid.

Non-redeemability: FRAX stablecoins can't be redeemed like traditional fiat currencies. Owning a FRAX doesn't guarantee the right to exchange it for any specific asset. However, FRAX should always be redeemable for approximately 1 USDC or USDP.

Ok, so there's a bit to unpack here. The big feature that's being added is Finres PBC, which will serve the Frax DAO to find and return yield. Sam Kazemian described the flow of funds to an from Finres:

Sure, here's a clearer version that stays close to the original text:

When individuals stake FRAX into the staking vault that tracks the IORB rate, we can withdraw USDC. This is either through Curve or from the collateral we have on our balance sheet. We then convert these USDC funds into fiat. After conversion, they're managed through our partnership with FinresBBC and other brokerage relationships we maintain.

This process allows us to earn yield on those assets. Conversely, when individuals decide to unstake their sFRAX to obtain FRAX stablecoins, it's essential to ensure there's ample liquidity, either from collateral or a redemption mechanism, to keep the FRAX price stable.

In such cases, the fiat is converted back to USDC through FinresBBC. In the future, this might also involve other currencies like Paxos or PayPal USD. Once back in digital form, these funds are used to provide liquidity for FRAX on Curve and are integrated into our AMO strategy.

So as sFRAX is capitalized, the funds are moved off-chain and then into a variety of yielding instruments. If the yield is high, these will be T-Bills or Repo's and if the yield is low, Frax will lend it out on-chain through the AMOs or other avenues it deems acceptable.

sFRAX Explainer

sFRAX is an ERC4626 staking vault associated with the Frax Protocol. It distributes a portion of the protocol's yield to stakers in FRAX stablecoins every week. The sFRAX token is a depositor's share in the vault and can always be exchanged for FRAX stablecoins.

The vault's APY aims to align with the Interest on Reserve Balances (IORB) rate provided by Chainlink. While the vault strives to match this rate, it's not guaranteed. The APY is determined by a utilization function, starting at a maximum of 10% APY and potentially trending towards 0. As more FRAX is staked, the protocol tries to invest it in sources yielding close to the IORB rate as possible.

Every Wednesday, new FRAX are added to the sFRAX vault, representing the protocol's earnings from the past week. The governance module oversees the vault's investment strategy, with yields primarily coming from strategies used by partner custodians like FinresPBC.

Ondo Partnership with FinresPBC

Some alpha that Sam dropped in our interview was that Ondo has signed a partnership agreement with FinresPBC, which now has the ability to hold OUSG, their short dated U. S. Government T-Bill token. Frax would send USDC to Ondo and it would be converted into a yield bearing token.

Sam Kazemian stated that FRAX's future objective is to simplify the transition of transfers both on and off the blockchain using FRAX stable coins directly. Frax's ultimate success would be acquring a Federal Reserve master account and direct fiat deposits, eliminating the need for brokers. He envisions FRAX as a decentralized dollar-pegged stablecoin that offers direct redemption into fiat from a Fed Master Account.

Fraxchain Blockspace Alpha

The most alpha we found out in our interview with Sam Kazemian was when we asked about Fraxchain. He told us that they are working on a new system that will propose a novel approach to the blockspace market. Traditionally, this market has been dominated by gas prices, with little to no significant advancements.

Fraxchain will change the status quo by focusing on supply and demand. The supply side is represented by developers and their smart contracts. On the other hand, the demand side consists of users who are actively seeking valuable activities on the blockchain.

The two sides will be balanced with reward incentives. Unlike traditional models where only users bear the brunt of gas fees, with Fraxchain both users, who engage with and pay for smart contracts, and the smart contracts themselves, based on their block space usage, potentially will receive rewards.

The core problem is managing their distribution and not giving "$2 liquid rewards for every $1 of gas they spend." Sam K didn't give any more information on how that would be managed.

Long duration FXBs

I’m still just waiting for my onchain 30ys or onchain TLT man.

— Adam Cochran (adamscochran.eth) (@adamscochran) October 3, 2023

Trying to buy the dip is lame when I’ve got to transfer to banks to lock long yields.

After this tweet was posted in the main chat, Sam K. said that its entirely possible to have 30y FXB's, however it would have to go to a governance vote. What a crazy outcome to think of if we ever add this.

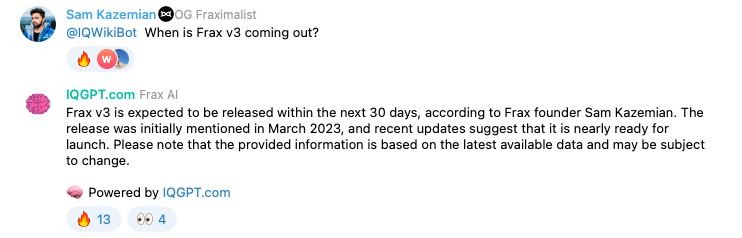

IQWikiBot Makes its debut

Sam Kazemian Joins Manifold as Advisor

SEBA Bank Writeup on Frax

🔎Exploring the world of @fraxfinance

— SEBA Bank AG (@WeAreSEBA) October 3, 2023

Today’s thread covers one of the most popular DeFi protocols – @fraxfinance.

What products does the ecosystem offer? How are Frax markets run? How is Frax Ether different?

Let's #SEBADeepDive in🧵 pic.twitter.com/XBotDSt3Yu

MakerDAO offboarding rETH to Spark

Should Frax offer rETH in Fraxlend? Let's here your comments on Twitter or Telegram.

This is an important notice to all RETH-A users.

— Maker (@MakerDAO) October 3, 2023

The RETH-A vault type is being offboarded from the Maker Protocol.

The first step in this offboarding process is set for the Executive Vote on October 11th.

Learn more and stay updated:

The offboarding parameters for the… pic.twitter.com/uL6DZJyIi1

Liquis APR's Continue to Flow

gm to our @fraxfinance frens! 🌊

— Liquis (@Liquisfi) October 2, 2023

Enjoy the APRs ❤️ pic.twitter.com/3f4qYbrPCJ

Lodestar APR Update

⏳Epoch 6 is in! Let's do a rate recap as this week, it appears that the $GMX and $plvGLP folks have taken over the $LODE gauge from the $MAGIC peeps 👀

— Lodestar Finance | Backup Account (@backuplodestar) October 2, 2023

🏛️ On the Supply side: pic.twitter.com/0meoPtxYXr