Bitcoin is the “most pristine” crypto collateral on the planet…. But it’s terrible for anything else. DeFi, NFTs, etc, it’s just not made for “utility.” It’s digital native money.

Due to Bitcoin’s hardened and non-expressive code, it can’t communicate with other networks like newer L1s can. What this means is that any bridge/custody solution is going to have to rely on M-sigs at some level. Different projects use different strategies to protect the M-sigs, like with MPCs or simply a high number of signers, but ultimately, it’s a security flaw. This is probably why WBTC is so prolific and stands without competition from other decentralized options. It’s simply easier to trust a regulated private custodian, than placing trust in your code not to be hacked.

So what’s the best solution then? Well BadgerDAO thinks its to ditch this custody question altogether and instead rely on good ole staked ETH!

Their newest product is eBTC, a synthetic Bitcoin product built with LSDs like Frax in mind. Badger describes eBTC as:

eBTC is a collateralized crypto asset soft pegged to the price of Bitcoin and built on the Ethereum network. It is backed exclusively by Liquid Staked ETH (LSD) and powered by immutable smart contracts with no counterparty reliance. It’s designed to be the most decentralized synthetic BTC in DeFi and offers the ability for anyone in the world to borrow BTC at no cost.

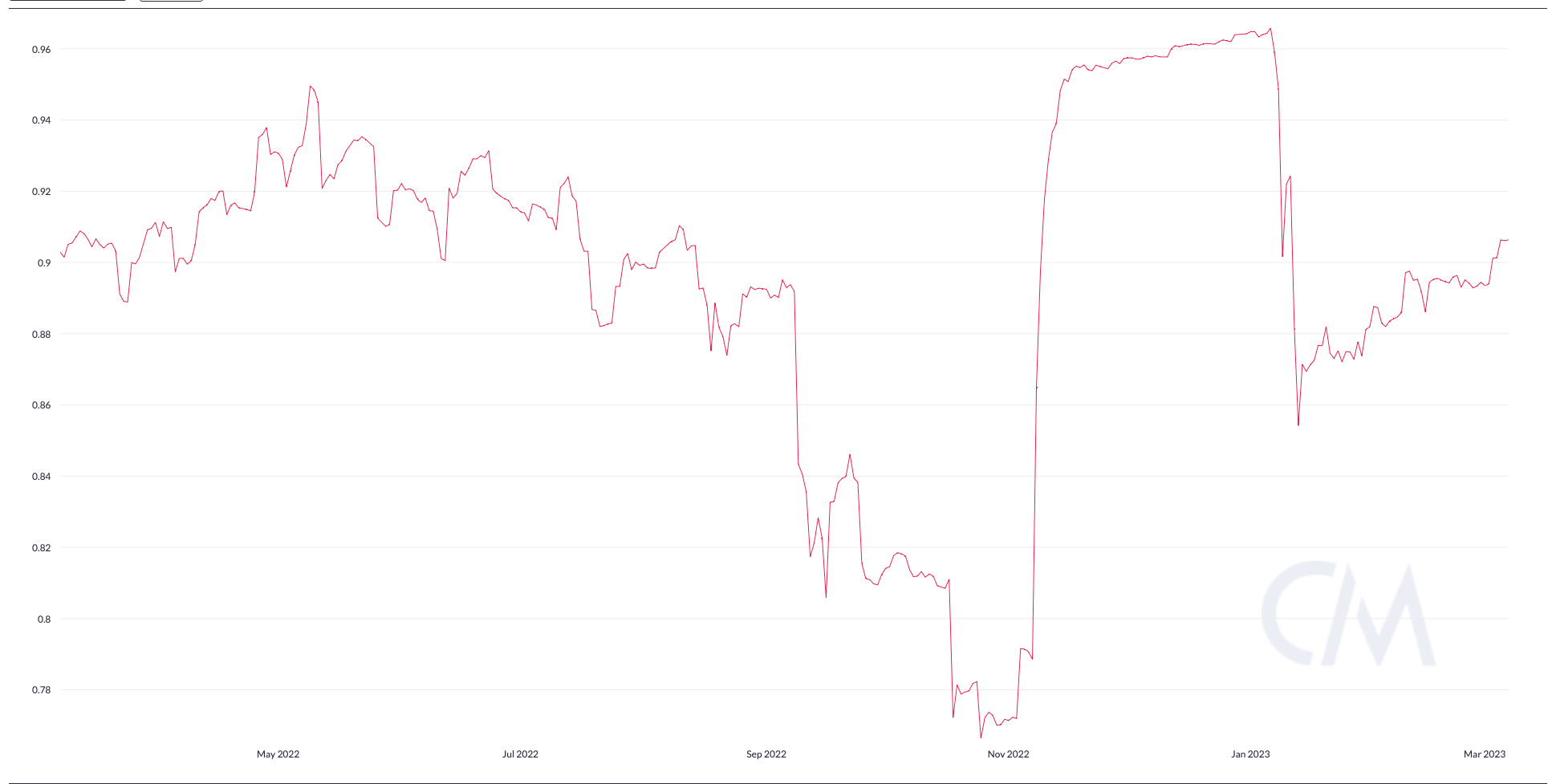

Fun is the first word that I think of after reading this. eBTC is a collateralized synthetic BTC, where the collateral, staked ETH, is highly correlated. Correlation can be between -1, 0 and 1. Over the last year, ETH/BTC has typically fallen in the .9 range for long periods of time, meaning that the two assets trade in near perfect movements to each other.

When borrowing assets, how correlated the two are directly affects the future probability of liquidation. The higher the correlation, the lower the risk of getting rekt, and vice versa. As a result of ETHBTCs super high correlation, the protocol can offer a much higher LTV ratio than other pairs like ETH-USDC. Maximum leverage will be much higher as a result.

Another cool aspect is that when you use ETH collateral to borrow eBTC, you now are short Bitcoin. This is such a cool prospect for those who believe in the Flippening, where the market cap of ETH becomes larger than BTC.

eBTC will be collateralized by LSDs (FrxETH) and have no borrow, minting or closing debt fees. A percentage of the ETH yield will be repurposed to drive eBTC asset demand and incentives. Most likely they will use part of the yield to pay LPs. The BadgerDAO team has not released any specific info on this yet.

Watch the full interview with Chris (Spadaboom) to get all the alpha.

P.S. no post game this week as we had some recording issues.