On Monday, February 20, the Eigenlayer team dropped their long awaited whitepaper which describes what we discussed with Sreeram in episode #39.

Sreeram told us in the interview that Eigenlayer will unlock “radical innovation” by allowing anyone to borrow the security guarantees of Ethereum. Referring to what we wrote in our previous article:

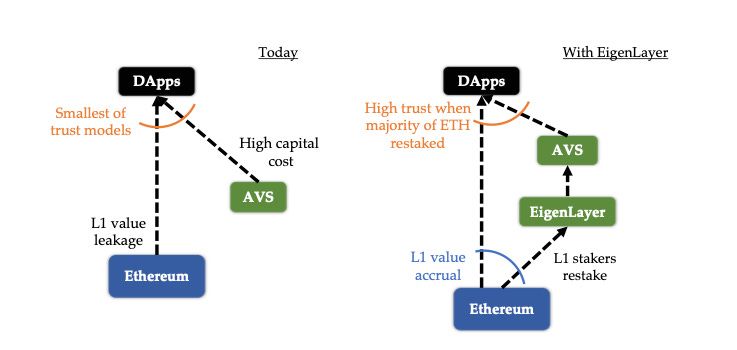

Eigenlayer is a way by which Ethereum stakers can provide other services like oracles, data storage networks, new consensus protocols, and multi-party computation. Today, to secure these systems, you have to spin up a new set of validators or a new trust network, and it is very expensive to bootstrap this.

The limitations of these systems, which EigenLayer calls actively validated services (“AVS”), are “are either secured by their own native token, or are permissioned in nature.” Four negative consequences stem from the current AVS regime:

- Bootstrapping problem for a new AVS: Innovators need to create a new trust network for security.

- Value leakage: Users have to pay fees to different trust pools, resulting in value leakage from Ethereum.

- Burden of capital cost: Validators who stake to secure a new AVS must bear a high opportunity cost and price risk, which can dominate any operational cost.

- Lower trust model for DApps: Current AVS ecosystem results in a lower trust model, where an application's dependencies may be vulnerable to attack, and economic security guarantees provided by Ethereum may not be sufficient.

Solving these issues, EigenLayer introduces two “novel” ideas pooled security via restaking and free-market governance.

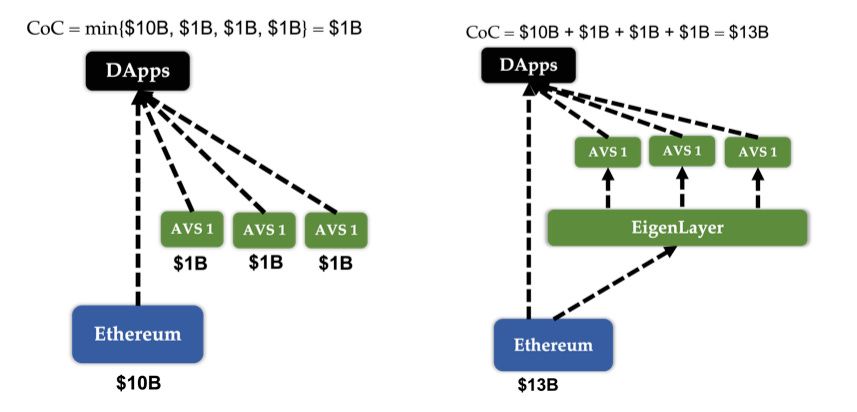

Pooled security via restaking enables modules to be secured by restaked ETH rather than their own tokens. Ethereum validators can opt into new modules built on EigenLayer, and in return, they gain additional revenue from providing security and validation services to their chosen modules. Restaking expands the space of blockchain applications over which security can be pooled and enables EigenLayer to expand open innovation beyond smart contract-based DApps. Any AVS with an on-chain slashing contract can be secured by EigenLayer.

Free-market governance gives validators the agency to determine their own risk/reward trade-offs by opting in or out of each module built on EigenLayer. This allows validators to play a key role in bootstrapping applications and accelerating open innovation of blockchain applications while increasing profit from contributing to the growth of pooled security. The opt-in dynamics of EigenLayer provide stable and conservative governance of the core blockchain while complementing it with a fast and efficient, free-market governance structure for launching new auxiliary capabilities.

Ultimately with EigenLayer solves the issues plagued by the current AVS setup with the following solutions:

- Solves bootstrapping problem for a new AVS by leveraging the large validator set of Ethereum.

- The capital cost of restaking ETH on EigenLayer is minimal, which helps to amortize the cost of staking capital.

- Improves trust aggregation by restaking a larger pool of capital and massively increasing the cost of corruption.

- Provides additional revenue streams to ETH stakers and consolidates the ecosystem's network effects due to the presence of a highly secure AVS ecosystem.

How does restaking work?

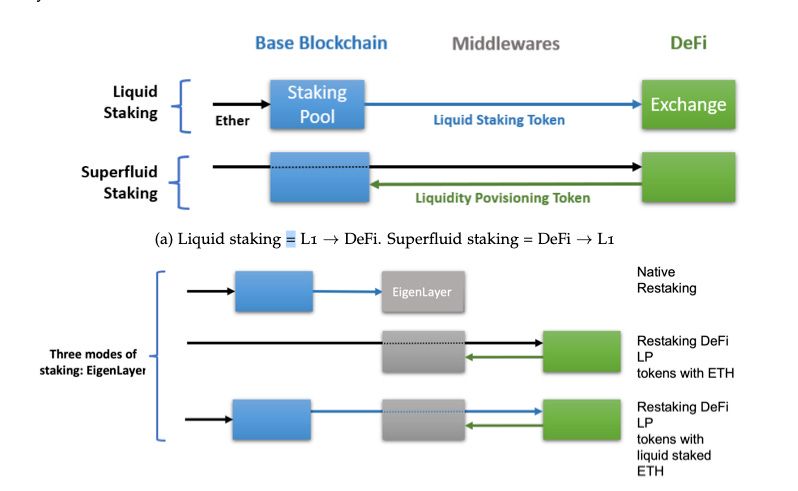

With Eigenlayer, there will be several forms of staking. In the interview we primarily discussed restaking of staked ETH either directly from self-managed validators or, alternatively, LSDs like FrxETH or stETH. But this will not be the only way to stake into Eigenlayer. Another type called Superfluid Staking allows for LP tokens to be used as “collateral,” meaning that in theory any asset paired with ETH or FrxETH could be used.

This opens up a ton of possibilities (and potentially gauges) that could be added in the future. If any FrxETH based pair can be used as staking collateral in EigenLayer, it could open up a vast new set of yield opportunities outside of just DeFi.

Where does Frax fit in with EigenLayer??

Previously Dave wrote a great proposal for Frax titled EigenLayer and Frax: The Next Generation of Cryptoeconomic Security.

In the article he proposed the following:

- Create new ERC-4262 vaults (for example, esFrxETH) for those who want to participate in EigenLayer validators. More research needs to be done in how to safely and effectively manage this part of the stack but this will offer stakers optionality that would not exist with any other LSD.

- Develop a governance process in deciding which EigenLayer clients to support. Since it is an open market of networks to choose from, the Frax community can decide which ones to secure. This can be similar to how gauges are decided.

- Since every network is different, FrxETH can develop a methodology of tranches for each network that is supported, allowing stakers to optimize for yield and risk management.

This proposal was written before our interview and also the publication of this whitepaper. Given this additional information, we can make a few changes to Dave’s ideas.

First, Frax should pursue a role as a primary operator of EigenLayer, allowing for sFrxETH to be restaked through the main website with a new UI. Frax should conduct an analysis of the fee market once EigenLayer is launched and determine what costs and fees.

Second, Frax could potentially create new gauges or use some of its CVX/CRV voting power to swap for incentives provided by the new AVS’s. Recent proposals set the stage in what this would look like. New protocols or services would bribe the Frax DAO with a portion of their earnings or tokens in return for liquidity incentivization and opt-in security.

Third, the Frax DAO could vote to opt-in their entire sFrxETH holdings to validate new AVS instead of using a new ERC-4262 vault. If this was the case, individual voting could be assumed by veFXS on a week to week basis.

Fourth, Liquidity provision through EigenLayer could be integrated with the gauge system, where liquidity could be both locked and earn both Frax, Convex, Curve, and EigenLayer incentives all at once. A true expansion of the flywheel.

There are a ton of possibilities the Frax DAO can explore over the next few quarters as EigenLayer is launched and the initial AVS’s come online. Frax is well suited to lend its security and also enable new income streams from new EigenLayer services. This really could be the next gold rush for Ethereum.