Big News of the Week - Flywheel Grant Proposal

This weekend, DeFi Dave proposed the largest grant in Frax governance history to fund Flywheel’s efforts of supporting the Frax ecosystem. Totaling $214.2k (half to be paid in FRAX and the other half in FXS), the grant would cover initiatives across different mediums reaching both retail and institutional audiences of all experience levels. Flywheel has played a vital role in shaping the narrative around Frax for over half a year and stepped about to be the de facto media arm of the Frax ecosystem. The efforts have not gone unnoticed, Flywheel has received praise from across the DeFi ecosystem and has been frequently cited in major publications such as The Defiant and The Block. The proposal is currently being discussed in the forum and we are hopeful that the community will continue supporting the fruitful relationship between Frax and Flywheel.

Other Happenings

Eigenlayer x Frax

DeFi Dave also published what could be a seminal partnership in the making and yet another cog in the growing Frax flywheel. Eigenlayer leverages Ethereum network security through restocking, a process that lends it to other growing networks so they don’t have to rely on bootstrapping their security.

We think its important because it could generate extra yield for sFrxETH stakers, and it could eventually make Frax one of the core layers on which protocol build for the future. Lots to explore here and we are excited to see where this potential partnership could go.

Dollars Rule Everything Around Me (D.R.E.A.M)

When it comes to liquidity, there is no second best. Despite there being approximately 180 national currencies in use today around the globe, new data shows that 90% of all BTC trades are conducted using a stablecoin. Euros, Pounds, Pesos are nowhere to be found and for good reason, USD stablecoin liquidity is incredibly deep and non-USD stables have yet to proliferate.

Crypto markets are mostly free, open, and without capital controls. The US dollars ability to retain value across time and its near infinite liquidity makes it the singular choice for crypto trading. Increased dollar dominance only further strengthens my personal belief that most people prefer the best money (USD) and in an open and free environment they will use no substitutes.

veFPIS Docs Update

Last week, a sneaky sleuth found out that the core team had stealth updated the veFPIS doc. The most important piece of Information was that the new ve-contract had “DeFi whitelist” capabilities to add “modular functionality to the staking system.”

What this means is that decentralized apps will be able to interact with the veFPIS contract and enable new features like borrowing and leverage. In the event of liquidation, the veFPIS lock will remain active, and the rights to the tokens will be transferred to the protocol or different users.

This functionality is missing from the original veCRV/FXS contracts and is the core reason why Convex exists in the first place. Unfortunately, this improvement is not available for veFXS holders as the contract is not upgradable.

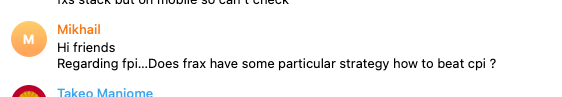

Another reason for the whitelisting ability is to enable “slashing,” or penalties against one’s stake for malicious voting. veFPIS holders will vote on CPI gauge weights as their primary function to control the growth of FPI. If a voter is providing malicious votes, their stake can be slashed.

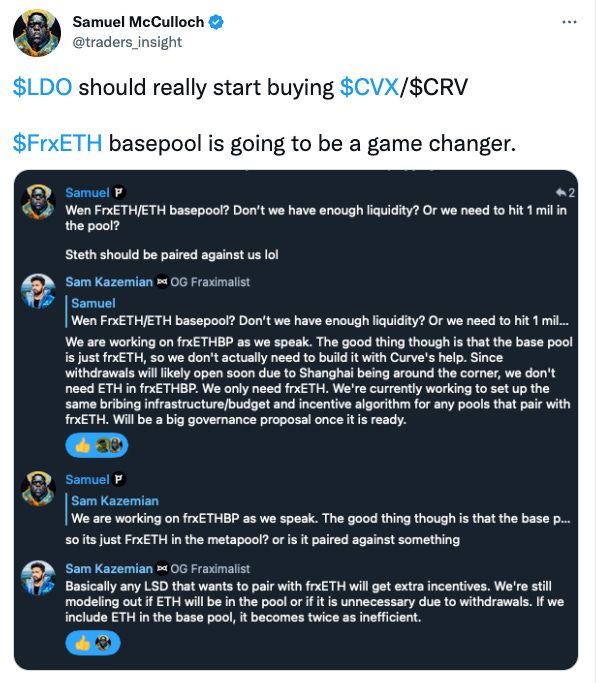

FrxETH basepool

There’s so much alpha in the Frax TG, all you have to do is ask. On Sunday, January 15, I asked a simple question of Sam, “Wen FrxETH base pool.” Alpha ensued.

Sam K explained that a “FrxETH” base pool was already in the works and that they didn’t need Curve’s help to create it. The biggest revelation was that FrxETH would most likely stand alone and would not be paired against ETH. The incentive system would work similar to how FraxBP currently works. Frax will set aside a portion of its CRV voting power and use to to vote on FrxETH paired LPs relative to the total distribution across all pools. So if the stETH/FrxETH pool is 50% of all FrxETH liquidity on Curve, Frax will use 50% of its voting power to incentivize that pool.

While not specifically a “base pool” this incentive system would serve the purpose of creating new FrxETH pair liquidity and further splitting sFrxETH/FrxETH un the form of new use cases. Once Shanghai opens up there won’t be a need for regular ETH anymore. FrxETH will hopefully serve as the base layer asset for all ETH, it's all part of Frax’s plan for global domination as the base liquidity layer for all of crypto.

Watch it again

Sam K Quotes

An intrepid follower asked Sam about beating CPI

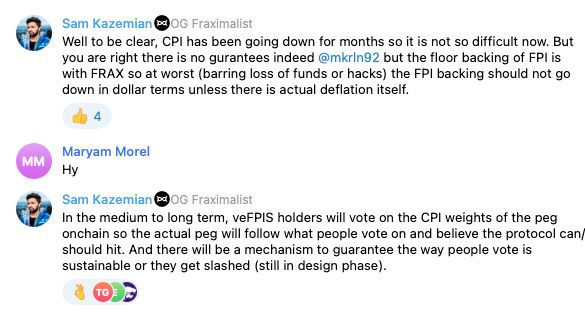

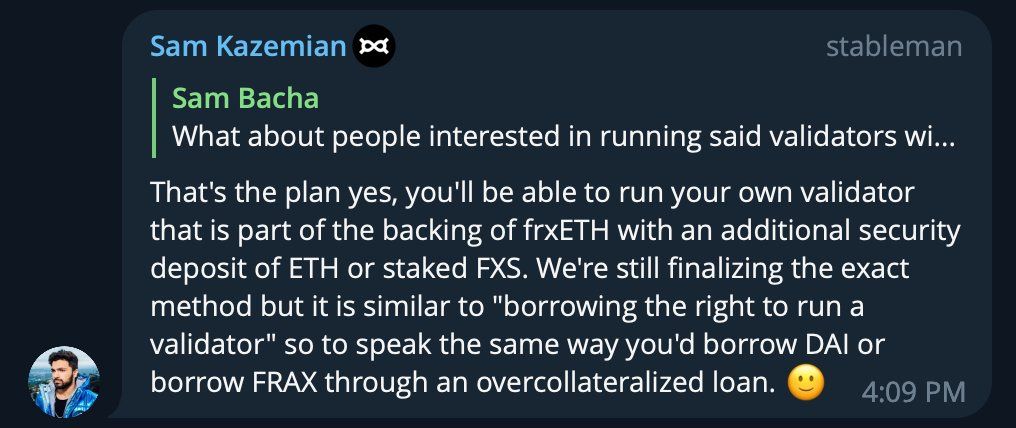

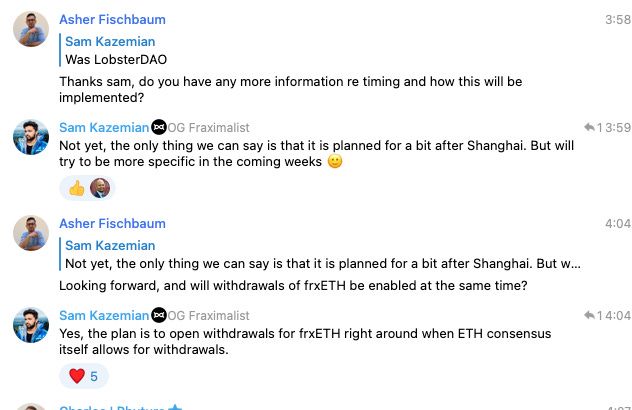

Sam dropped some alpha around FrxETH decentralization in LobsterDao

Aura wars up ahead?

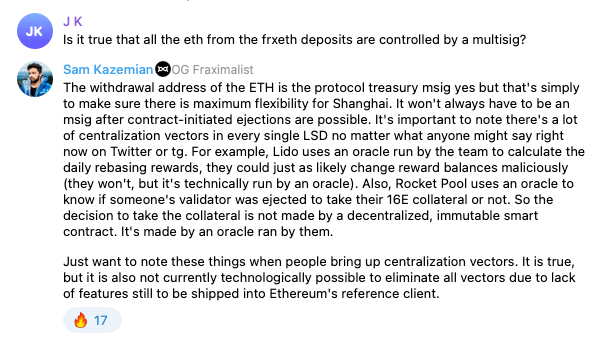

Don’t fret the multi-sig

Frax in the Media

Flywheel Team

Legacy

https://thedefiant.io/frax-triples-in-value