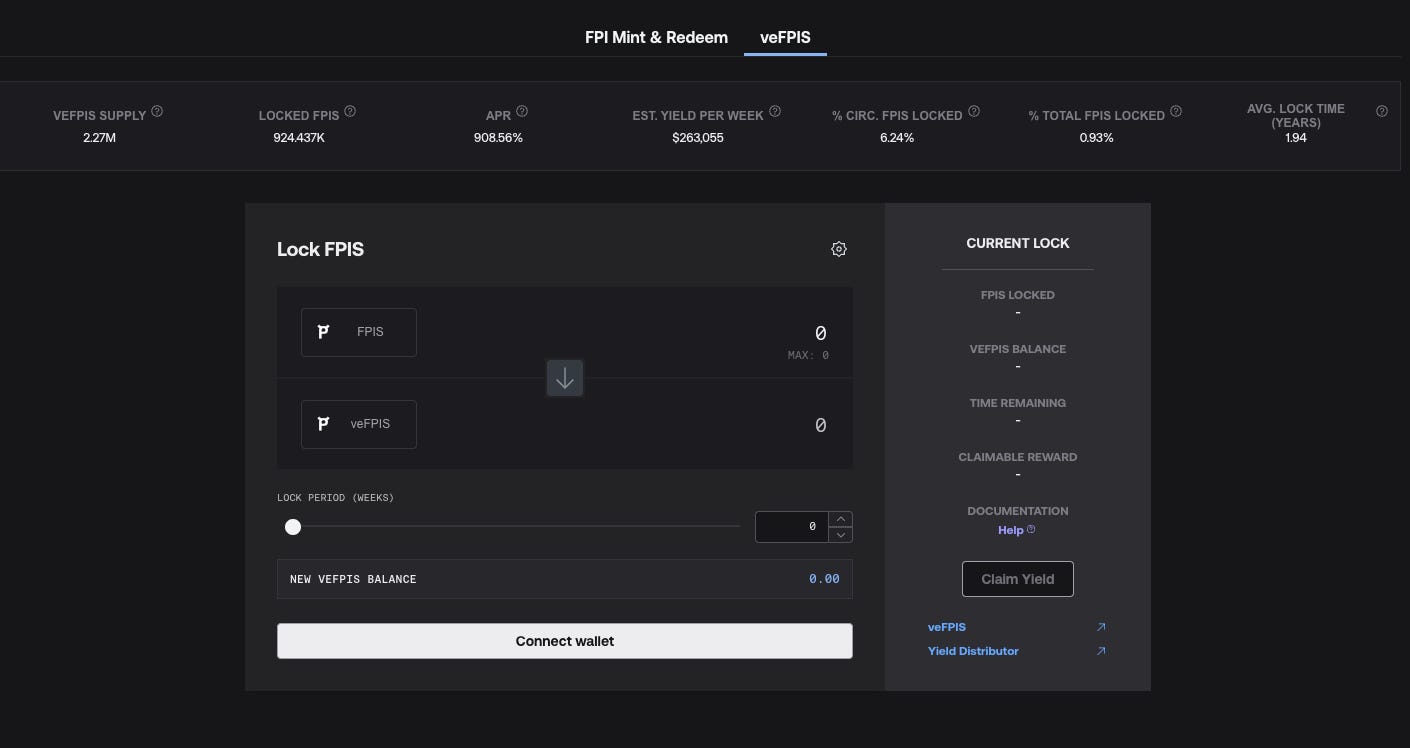

Today marks the launch of veFPIS, the newest product in the Frax ecosystem. With over $250k in rewards distributed each week, the yields for locking for 4 years are in the triple digits as of publishing. With a maximum of 10% of the supply available to stake, this could be one of the hottest Frax products for the next several months.

This is the culmination of a year-long process over which the Frax core dev team released a brand new type of inflation pegged stablecoin. From just an idea, to now a fully decentralized product, FPI is one of the three flagship stablecoins created and maintained by Frax.

The price of everything is too damn high. Eggs, silicon chips, beef, cars, oil, gas; you can find inflation in the price of goods across the entire economy. Over the past year, inflation peaked at 8.5% and has now started to cool down to 6.5%, with expectations for it to reach 3-4% in the next year or two. What this means for your pocketbook is that the money in your savings and checking account is losing a lot of its purchasing power to inflation. Normally this number is around 2%, which is manageable for most people, but when it creeps higher, maintaining a proper budget can be hard.

Most people escape inflation by investing in assets like stocks, bonds, real estate and crypto. The idea is that cash is always a losing game, so it's better to invest into productive investment assets which can either match or outpace inflation. The problem with money though is that once it gets minted, someone has to hold it until it's retired out of circulation. So you are always going to have cash on hand and need to spend it before it loses value.

What is inflation and the Consumer Price Index?

Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, the purchasing power of currency is falling. Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. CPI is used as a benchmark to assess the overall inflation rate of an economy. The CPI includes a wide range of products such as food, housing, transportation, and medical care, and is calculated by measuring price changes for a particular basket of goods and services over a period of time.

Escaping the effects of inflation is important because it can erode the value of savings and investments over time. Inflation reduces the purchasing power of money, so the same amount of money can buy fewer goods and services as time passes. This can make it harder for people to meet their financial goals, such as saving for retirement or paying for education. By escaping the effects of inflation, people can help preserve the value of their savings and investments and maintain their ability to meet their financial goals over time.

What is Frax Price Index (FPI)?

Frax Price Index is an inflation pegged or inflation resistant stablecoin pegged to a basket of real-world consumer items as defined by the Consumer Price Index (CPI). The goal of FPI is to maintain its price to the CPI, and therefore its purchasing power, using on-chain stability mechanics and market operations. So instead of keeping your cash in a savings account, you could alternatively keep it in FPI with the understanding that the inflation protection comes with a different set of risks.

We mention risks here, as unlike a highly regulated bank account with FDIC insurance, there are different backstops for FPI and the Frax protocol. In more technical terms, FPI is a wrapper for FRAX, so that when you swap the former for the latter, you are entrusting the Frax protocol to earn an equal or higher rate of return than current inflation metrics. As long as more yield is earned than inflation, FPI remains solvent and safe. Frax thus becomes similar to Yearn, where different strategies are employed to earn yield for the protocol, except for FPI, there is a fixed price by which the stablecoin should trade at. If Frax cannot earn enough yield to maintain the solvency of FPI, for example during a period of high inflation, then it would have to resort to selling FPIS.

What is Frax Price Index Shares (FPIS)

Frax Price Index Share (FPIS) is the governance token of FPI and its used for three purposes in the FPI system.

- FPIS is the backstop for FPI. If ever on-chain yields are not high enough to support the peg and if the treasury runs out of excess capital, Frax protocol will sell FPIS to ensure the product stays solvent. The core profitability assumption of FPIS is that the yield the protocol earns will always be higher on average than increases in inflation. So far that has been true, but as FPI grows from the millions to the billions, it will become more difficult to find sustainable yields on-chain.

- FPIS captures all excess profits earned from yield on the collateral above the Frax Collateral Ratio (FCR). The FCR is the ratio of FRAX stablecoins directly backing FPI tokens. For example, if the FCR is 5% and there is 100m in collateral backing FPI, a surplus of 5m FRAX would need to be generated before any excess profits could be distributed to veFPIS stakers.

- Eventually, the CPI figures taken from the Chainlink oracle will be replaced with on-chain voting by veFPIS stakers. This is one of the more important parts about the new veFPIS contracts, as locked stakers will ultimately decide what the “real” inflation rate is. To prevent malicious voting, the contract has a slashing function built in to penalize stakes. It’s an economic way to prevent the protocol from paying out too much or too little to CPI.

This new ve-contract has some upgrades that the original Curve and FXS contracts do not have. veFPIS has a "’DeFi whitelist’" for smart contracts that add modular functionality to the staking system.” This will allow for third party integrations of veFPIS that can spend a user's tokens, but at the same time keep the stake locked until the end date. One of the biggest issues with the original ve contracts was that all of the locked capital becomes illiquid and inaccessible to all DeFi products. This is why protocols like Convex appeared in the first place, so that users could access liquidity for their 4 year stakes.

What are the tokenomics for FPIS?

FPIS has the following tokenomics and supply distribution:

- 10% Airdropped to veFXS back in Feb 2022

- 10% set aside for veFPIS emissions, starting at 5mil a year and halvening each year.

- 30% to the treasury and controlled by veFXS

- 25% to FPI protocol treasury

- 25% to the Core Developers & Contributors Treasury

The total supply of FPIS is 100m and no more tokens can be minted except to maintain the FPI peg to the CPI rate and keep the CR constant at 100%.

How much profit does FPI generate?

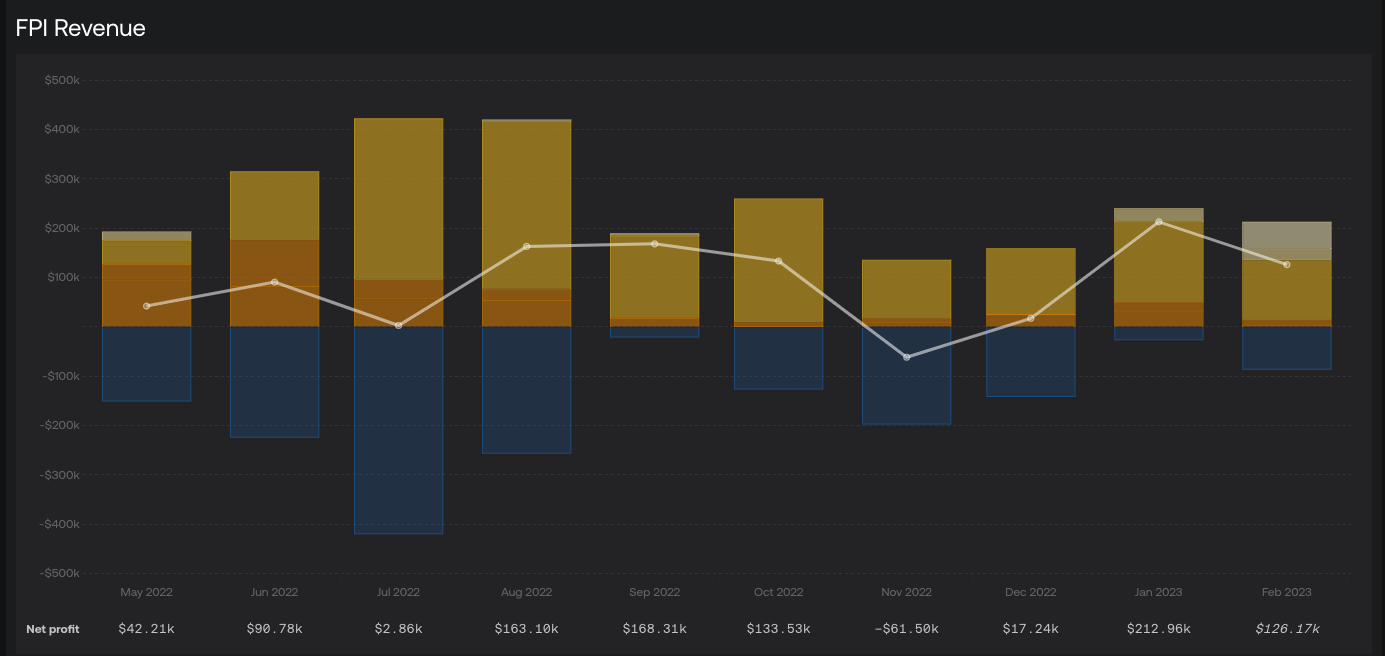

One of our favorite things about FPI is that it has a fully transparent balance sheet that updates every minute. There is no other protocol or company with such financial statements as Frax produces. Since all the data is on-chain, exact profitability figures are continuously updated.

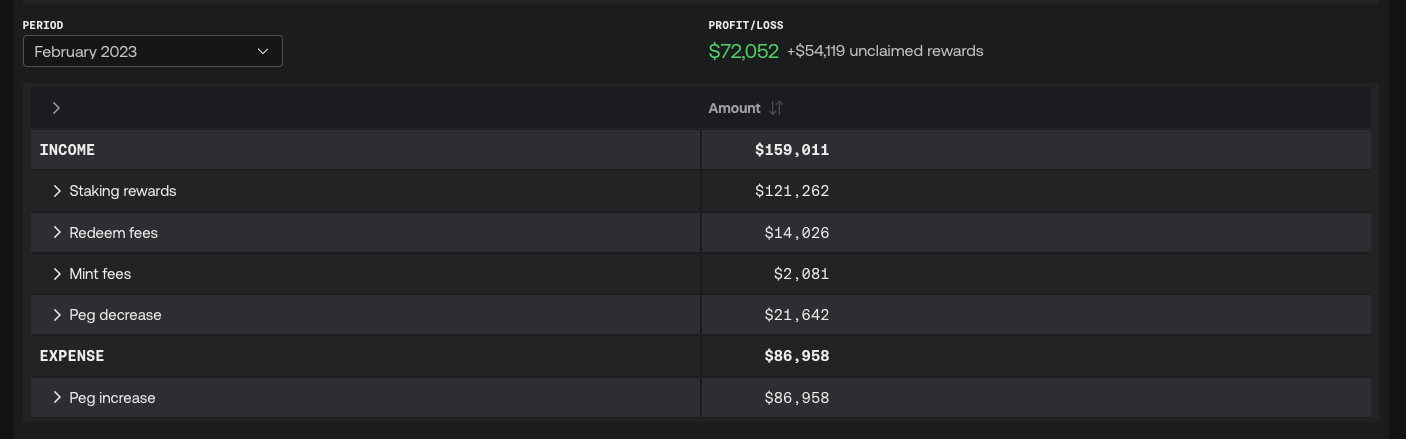

As of writing this article, there is more than $5m in excess value that has accrued to FPI. Additionally, FPI has been very profitable as well, making on average $100k a month. In just February alone, FPI has generated an excess profit of $72,052.