Welcome to Frax Check. Your weekly frax vibe check. I am your host Kapital K. As always, I'm joined by our producer extraordinaire Sam, Dave is traveling today so Sam will take on the gov check for us. We will be going straight to the source of truth via checking the chain. Before we jump in, please subscribe to the flywheelpod and follow us @flywheelpod on twitter and tg.

This week.. I call this week the “We told ya” week. You’ll see what I mean, and I’m glad if you guys got to see last week’s Frax Check!

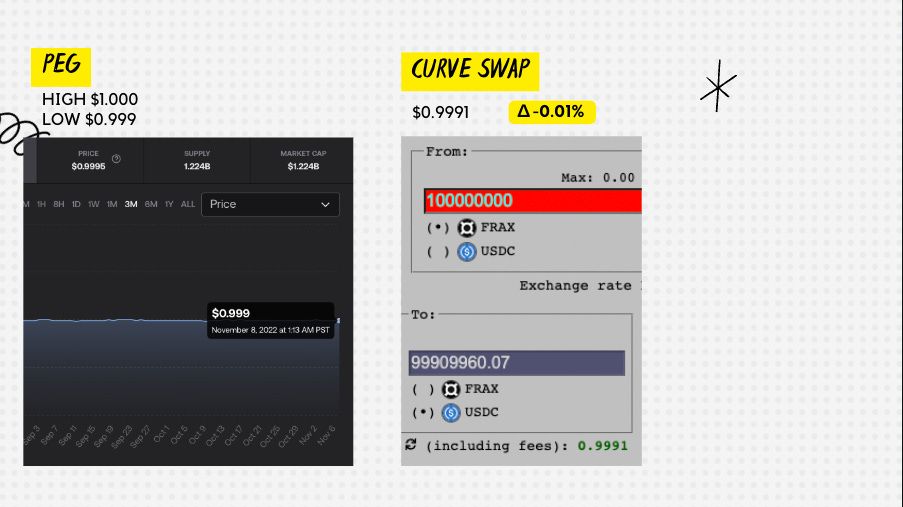

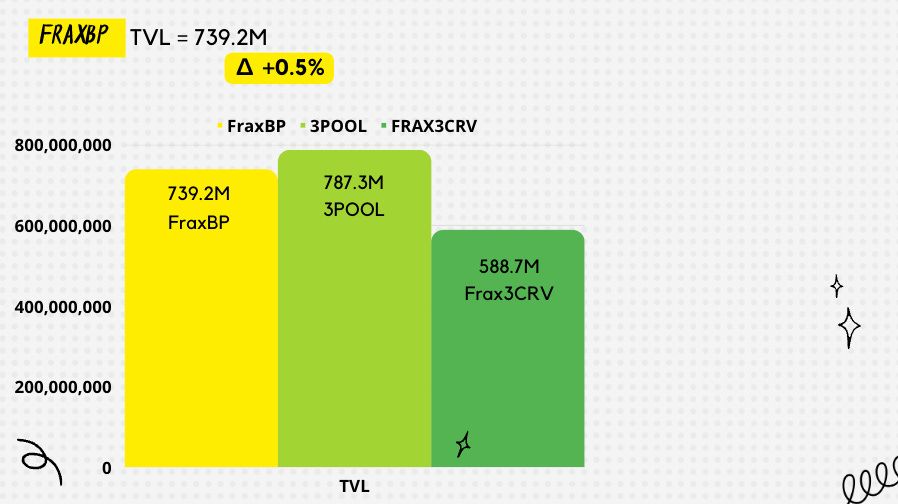

Let's begin our regular programming with the Peg. We saw it get as low as $0.999 with a high of $1.000 for the week. Peg Check = Strong. We then looked at Curve via swapping 100M FRAX for USDC. We switched it up since the FraxBP is now larger than the Frax3CRV. We received a 0.9991 exchange rate, which is pretty much unchanged compared to last week’s. Moving on we have our Collateralization %.

This is the % that conveys how much FXS (algorithmic) is used as collateral. I want to highlight the collateral ratio for the OUTSTANDING FRAX aka non-Frax controlled. A reminder, Frax protocol owns a lot of its own FRAX and theoretically, Frax won’t ever redeem its own underlying collateral backing so the only real collateral ratio we should monitor is that of the OUTSTANDING FRAX, which currently sits at 92.0%. Following we have the Decent %. We are at an ATL of 14.0%. V v v v much bear market vibes across the board when it comes to these two metrics. We want to see the Collat % going back to the low 80s and the Decent % going back to 30s.

Okay. Quick summary Health Check. Peg Good. Curve Swap Good. Collat % could be better Decent % new ATL.

This is a new segment that I’ll be adding going forward in all Frax Check. And today’s theme was “We told ya” so let’s do a recap on what happened with FrxETH.

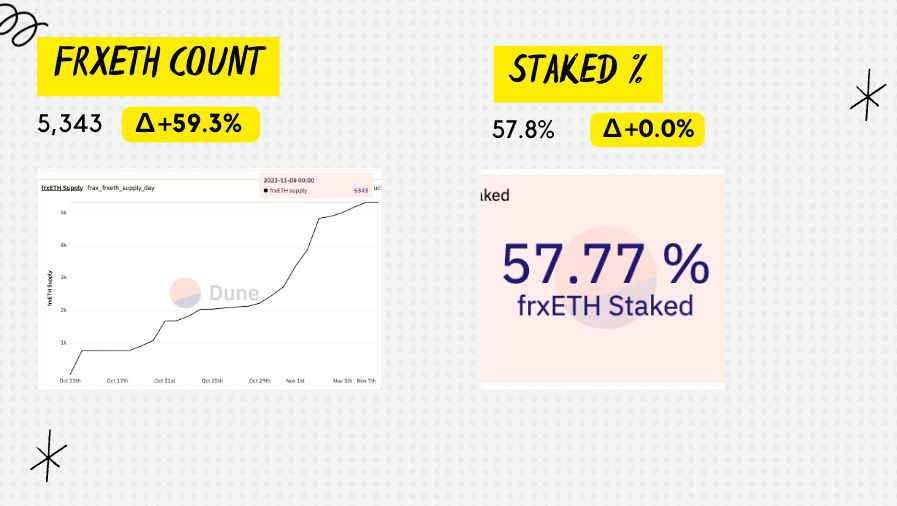

As always, we check the peg. But before that, quick shoutout to the homie Struct3r who built this dashboard. Frax community is the coolest. Join us in telegram @flywheelpod on telegram. So let’s dive in. Peg check here is strong you see the price delta is only 9 bps between frxETH and ETH. We obvs have to go into the market and check this ourselves and you see here that I tried to do a 700 ETH swap which is about $1M and I get an exchange rate of 0.9948. That’s pretty dam good. Also, last week we had 12.5% of the frxETH staked in the Curve pool, and now we have FORTY-TWO % of the supply inside curve. Let’s see what the count looks like this week.

The count is at 5,343. And look at that chart, I know you can’t read it but just appreciate the verticalness off that graph. +60%. Hot. On the staked side we see that 58% of all the frxETH is being staked to earn the ETH native staking rewards, which is 5-7%. As mentioned last week, the flywheel is going to be turned on and we see some signs of that this week. The APR is at 6.5%, which is right on par with what the native ETH staking yields are. FrxETH flywheel has not begun yet since there aren’t any bribes on Votium yet. SoonTM. Let’s do a quick summary check.

Peg check strong. Curve swap strong. Count up only. Staked healthy.

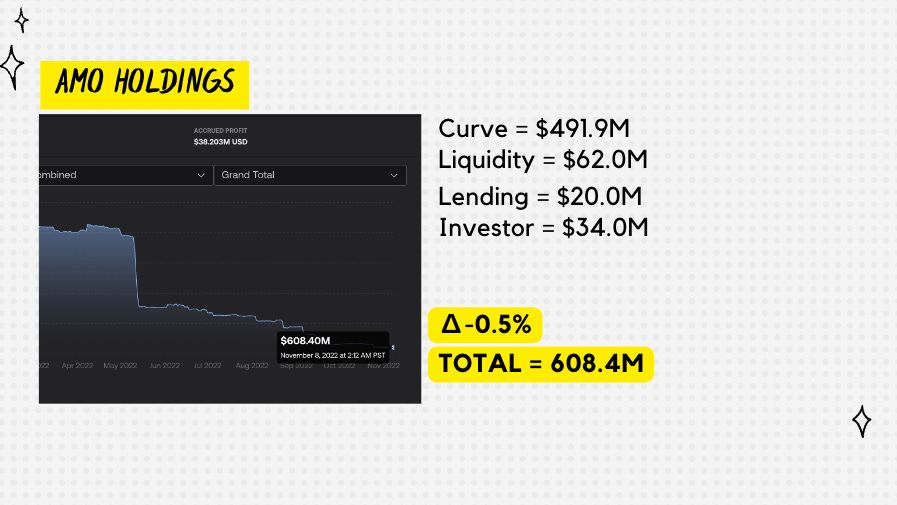

Let's jump into the AMO Holdings. We have a grand total of $608M across all the AMOs. This was a decrease of 5 bps compared to last week. All other AMOs remained largely unchanged.

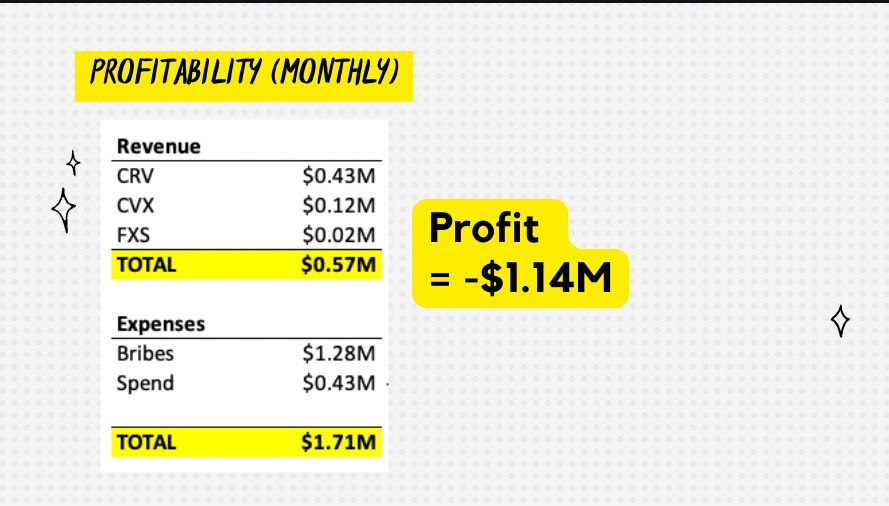

Onto the profitability of the Curve AMO. We’re now at $0.57M in Revenue for the month of October. We’re obvs down in Nov, since the month just started. We paid roughly $1.28M in bribes last week for the rewards to come this week..

Quick summary money check. AMO holdings was $608M, -5bps WoW. Profitability, we’re pretty down $1.14M. So lets see how November fairs.

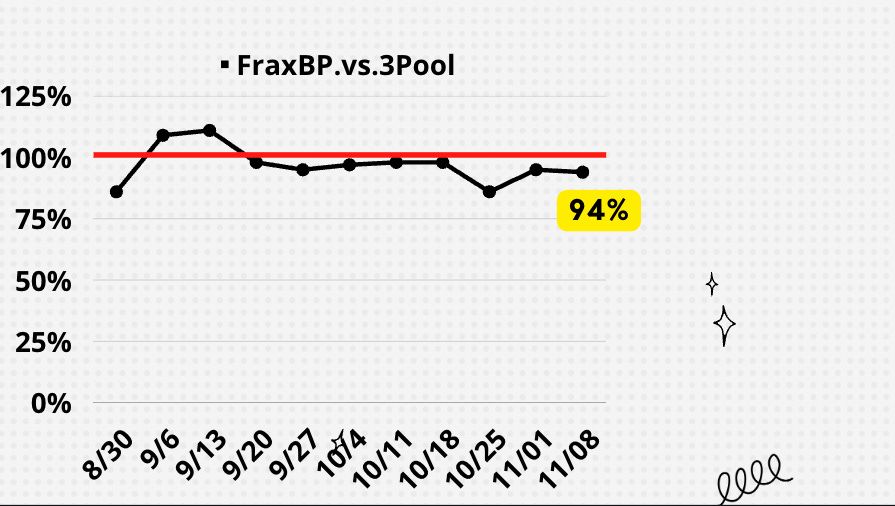

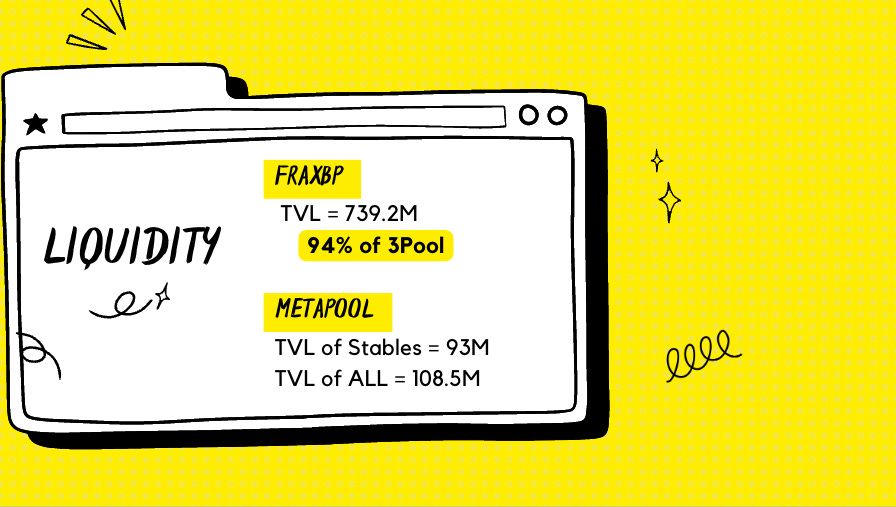

Here's my favorite section of the Frax Check. The Liquidity Check. We… we are toeing the line. We’re at 94% of the 3POOL. The FraxBasedPool is $739M versus 3pool's $787. The basedpool saw an increase of 0.5% in TVL. Holding steady. Let’s check out the metapools today.

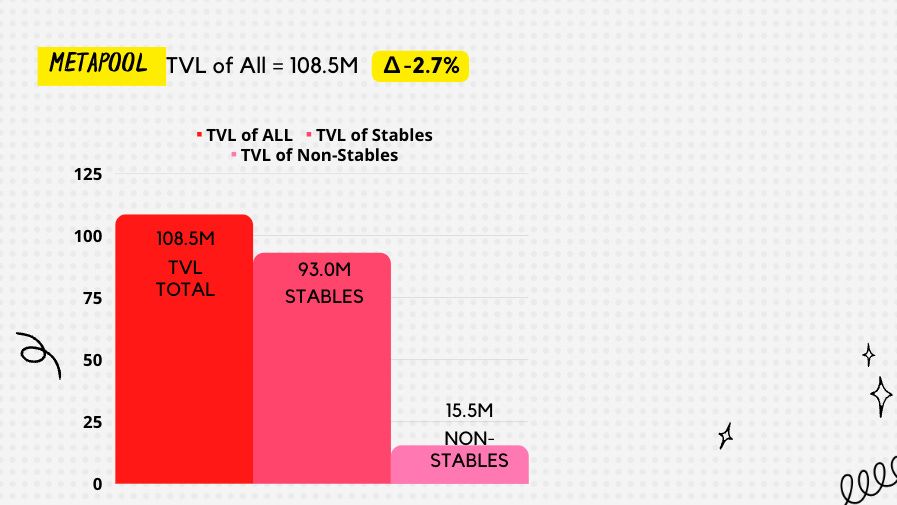

Reminder the metapool are pools that are PAIRED with the BasedPool, examples like LUSD/FraxBP. The Metapools went down a bit to 93M, so down 7% from last week. Let’s get us back to that 9 FIGURE CLUB BABY. Any projects out there looking to work with the Metapool, please join the Flywheel pod TG chat and DM any of the hosts for assistance.

Also one quick note, we also have an additional $15.5M of TVL from non-stable pairs in the Metapools. These are pairs like cvxfxs/FraxBP and cvxcrv/FraxBP. So adding all of the stables and non-stables TVL, we have a total of $108.5M of liquidity paired against FraxBP, a small down -2.7% WoW growth. Resume uponly next week please.

Summary time. Liquidity Check. FraxBP is 739M which is 94% of 3Pool. The MetaPool is at $93M for stable pairs, marking a 7% decrease over last week. And TVL of All pairs (stables + non-stables) are at $108.5M.

Lastly, the main reason why we track all of this is to make sure the FRAX supply could grow as big as possible. This week we're pretty much unchanged. We need to keep our eyes on the prize and grow this number.

ACCESS TO SLIDES: Here

~~~~

Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This video is not tax advice. Talk to your accountant. Do your own research.