Amid a sea of macroeconomic and DeFi-level concerns, one factor has remained constant: Ethereum. After executing a successful merge, Ethereum officially became Proof-of-Stake which had a number of economic implications. Thi caused an immediate impact on supply, with Ether inflation rate sharply falling and currently approaching deflationary status.

Deflationary supply wasn’t the only major change from PoW to PoS. Now, validation of the Ethereum network is incentivized through validator staking, rather than mining rewards. This shift toward long-term sustainability created an interesting second order effect- the 32 Ether minimum stake for validation leaves many users unable to participate in security, lowering the theoretical limit for decentralization and engagement.

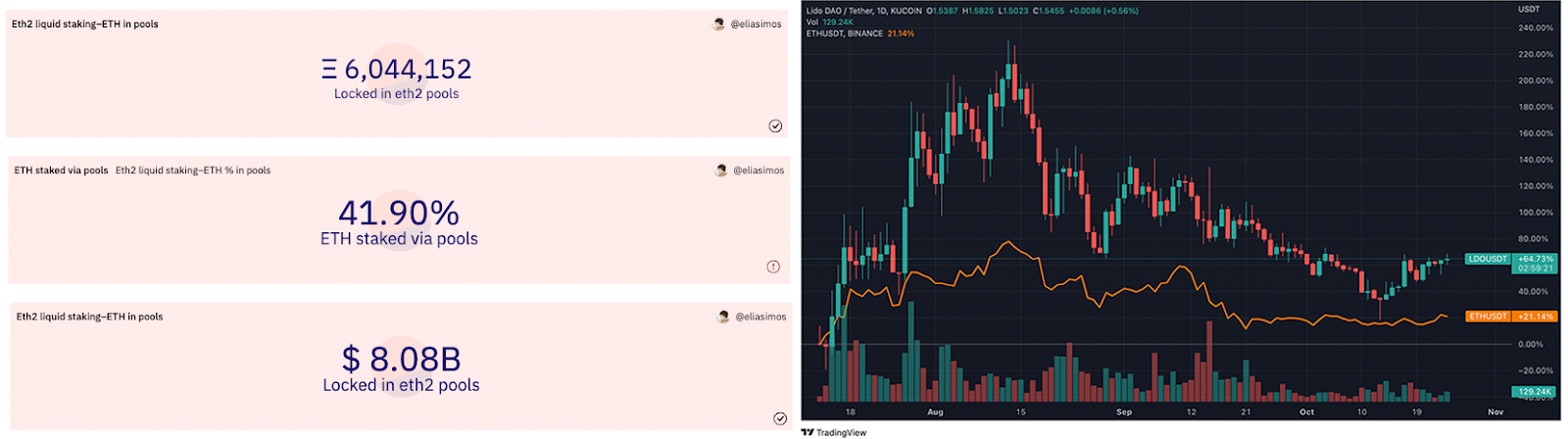

In parallel as a response, liquid staking providers (e.g. Lido, Coinbase) have emerged. These platforms allow users to stake Ether without having to deal with minimum validator requirements or logistics. Given the value proposition, use has exploded, with ~42% (or ~6mn) of total Ether supply currently in major liquid staking protocols. Such uptake led to semi-predictable results, with liquid staking providers consistently outperforming Ether over the past 90 days.

Given current market conditions, the majority of low-cap ‘Altcoin’ activity has fallen dramatically. Investors seek stable, safe yield- with staking Ether as the primary option. While liquid staking has increased access for the layperson to network validation, it hasn’t come without a cost. The largest staking infrastructure providers utilize only a handful of providers, causing validation to become increasingly centralized. Decentralized staking providers, like RocketPool, try to solve for this, but ultimately fall short due to yield-sensitive investors choosing higher centralized rates over their DeFi counterparts.

Recently, Frax released their staked Ether token- frxETH. In this piece, we’ll aim to break down frxETH’s structure and run through the key points on which it aims to compete with incumbents.

Let’s dive in.

Structure

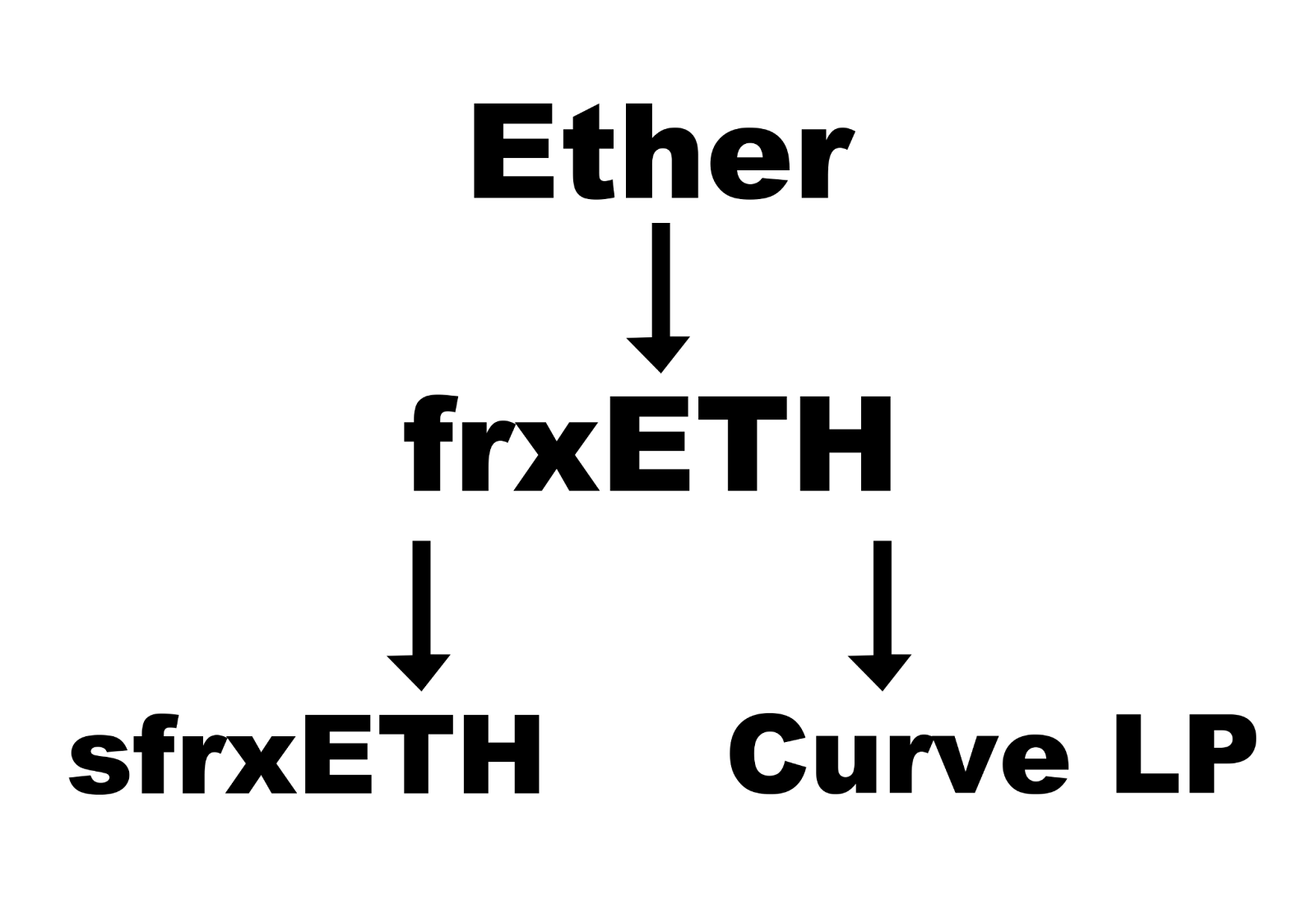

Unlike its peers, Frax chose to avoid a rebasing structure (e.g. stETH), splitting the implementation into two tokens instead with frxETH (Frax Ether) and sfrxETH (Staked Frax Ether). The first, frxETH, is a ‘stablecoin’ that is soft-pegged to Ether, and fully backed by the protocol’s staked Ether and related AMOs. The latter, sfrxETH, operates like a Yearn vault, rising in price as staking yield accrues.

This split was done for two primary reasons. First, it allows the token to be immediately used off-the-shelf, maximizing ease of use in smart-contracts. Peers like Lido offer wrappers, which creates added cost around implementation. Second, separating staking into an Ether-pegged ‘stablecoin’ (frxETH) and a Staked Ether derivative token (sfrxETH) allows for creative implementation through Frax partners such as Curve and Convex as well as in the future as collateral on Fraxlend.

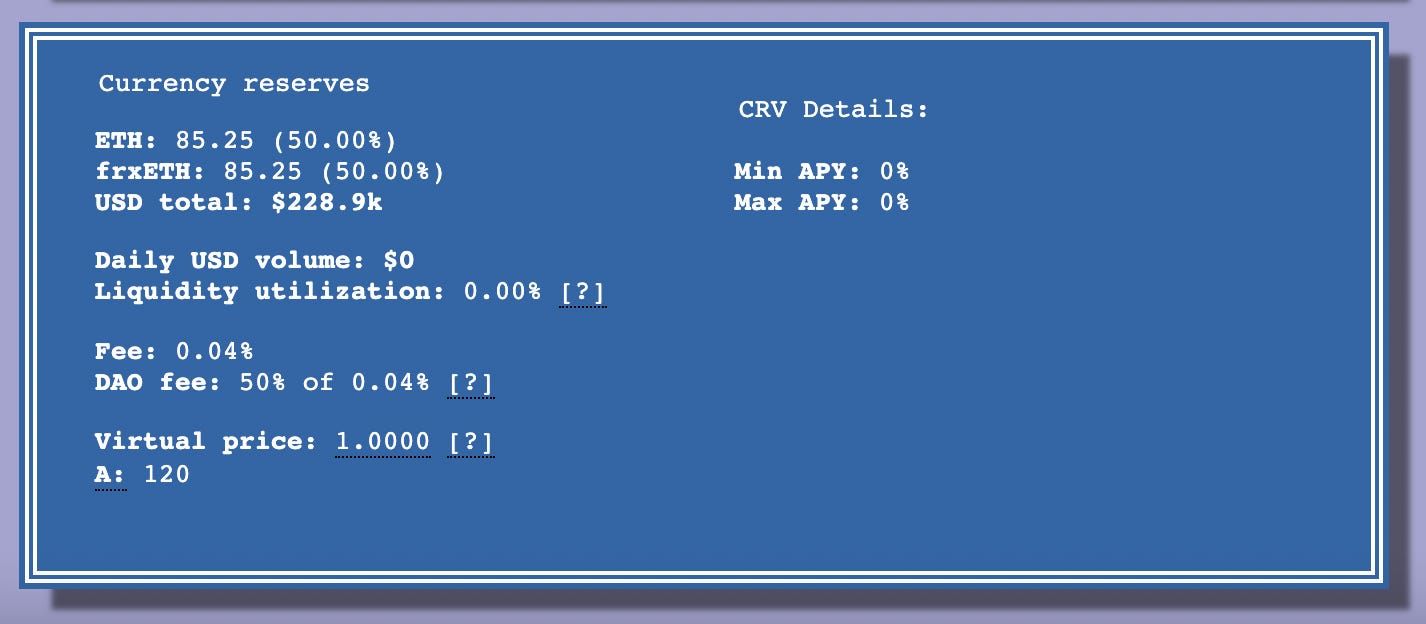

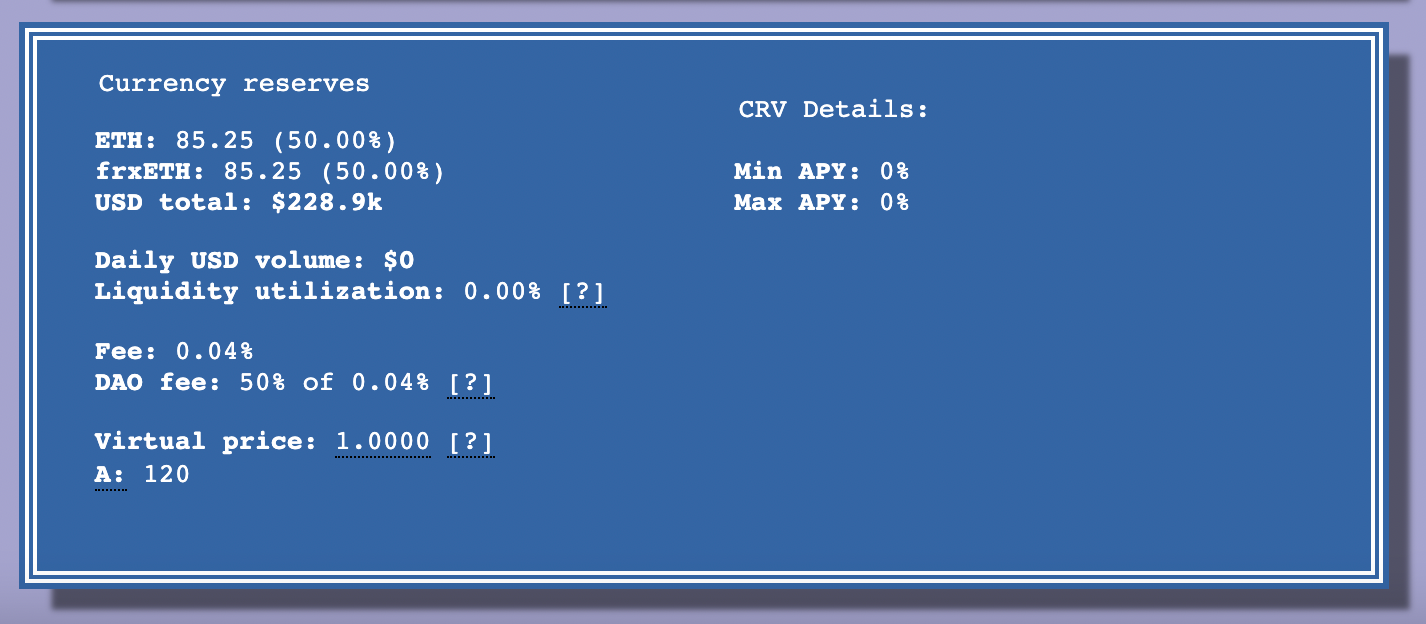

The byproduct of this decision is that solely swapping ETH to FrxETH does not entitle the holder to staking rewards. Rather, frxETH is intended to serve a role closer to Wrapped Ether, facilitating the transfer of Ether liquidity within the Frax ecosystem and beyond. Holders of frxETH today are currently given two options to then earn yield; either providing liquidity to the frxETH-ETH Curve Pool (peg stability), or earning staking yield by converting to sfrxETH.

This creative tokenomic decision creates a unique opportunity for Frax. As a result of their tremendous warchest of Curve and Convex, the protocol will be able to incentivize large amounts of liquidity to the frxETH-ETH pool. While this move will have the obvious sustained effect of strengthening frxETH’s peg, its real benefit is much more important: helping sustain higher yield (organically) than other staking derivatives are able to offer.

By creating a second (fairly low-risk) option to earn competitive yield on frxETH, Frax is effectively able to limit the number of people in the staking pool. This reduces the total number of people with claims to staking yield (holding sfrxETH), while keeping the same total amount of Ether staked, as frxETH is staked in validators regardless. The end result is a natural equilibrium- too many people pile into sfrxETH, and the rate falls relative to the Curve pool, incentivizing some to transfer liquidity to Curve, and raising sfrxETH yield for everyone else.

LSD Competitive Landscape

As fun as this section stands, these days LSD refers to a ‘Liquid Staking Derivative’, or any liquid staked Ether token like sfrxETH, stETH, or rETH. As demand for liquid staking has grown, so has the number of providers. At a core level provider seek to compete across:

- Decentralization

- Liquidity & Composability

- Staking Rate

Users have shown that organic yield rate is the biggest factor in selecting a liquid staking protocol. Given that the majority of validators are running similar OpenMEV software, differences in staking rate are hard to come by. Frax’s unique structure promises a slight edge in staking rate - which may be enough to capture market share.

In addition to greater staking yield, frxETH has a few other unique opportunities that help differentiate it from other peers. Unlike any other liquid staking provider, Frax is the only platform that has built in infrastructure for both lending and trading (Fraxlend and Fraxswap). This gives the protocol unparalleled flexibility in offering lending and borrowing opportunities against staked Ether, allowing users to leverage against long-term positions.

On top of that, liquidity incentives driven to frxETH-ETH pool on curve should help the ‘stablecoin’ maintain its Ether peg prior to the enabling of staking withdrawals, allowing frxETH to trade closer to peg than other decentralized liquid staking platforms.

Finally, frxETH’s modular structure will allow it to decentralize much more easily, while always offering competitive rates. While short term decentralization of staked validators networks isn’t as much of a focus as competitive yield & composable tokenomics, unlike centralized peers Frax has a clear path to validator decentralization. In the future through Fraxlend, potential validators can bond their ETH in order to obtain permission to run a validator on behalf of Frax.

Value Accrual from frxETH

In the short term, the main benefit to the Frax ecosystem from the launch of frxETH will be increased network effects in Fraxswap and Fraxlend. Additionally, the platform expands its arsenal of stablecoins from dollar-related tokens (FRAX, FPI) to include non-Fiat currency as well, helping diversify the underlying risk profile of the balance sheet.

In the mid-to-long term, frxETH uptake could result in meaningful additional yield being based through to veFXS stakers for Frax. As users continue to leverage and trade against frxETH positions, accrued protocol revenue will get passed through.