Let’s face it, although Uniswap v3 has revolutionized DEX’s and trading on-chain, it’s simply hard provide liquidity in a sustainable fashion unless you know what you are doing. It’s no wonder why Kassandra has framed Uniswap v3 as a “liquidity computer” and with any computer, you need to have the right interface.

What is Arrakis Finance?

Arrakis Finance is a protocol designed for liquidity providers who want to have their liquidity managed in a more automated, capital-efficient, non-custodial, and transparent manner.

Overall, Arrakis provides the tools to program the “low-level language” of liquidity positions which are injected at various ranges that minimize risks and maximize fees.

Ok, that might seem like a lot, but let’s break down how Uniswap V2 is inadequate for market making and how and Uniswap V3 works.

Why Uniswap V2 is Bad for Market Makers

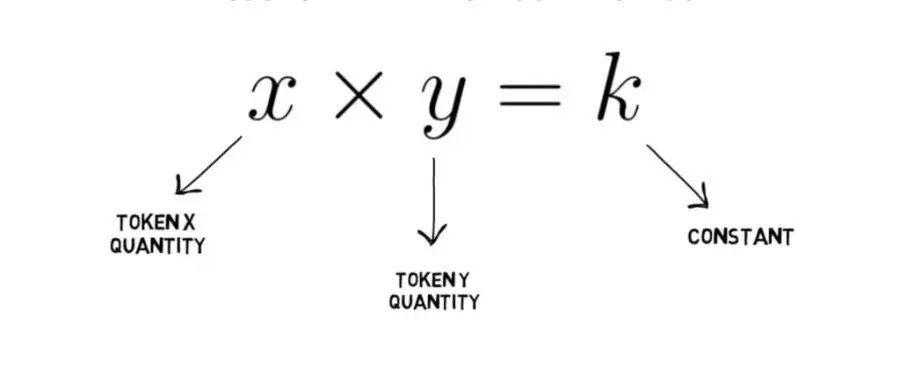

Uniswap V2 was the first AMM that gained significant market share because of its simplicity and ease of creating liquidity positions. Uni V3 is a Constant Function Market Maker, or more specifically, a Constant Product Market Maker. The formula that Uni V2 LPs used is “x*y = k,” which simply assumed that two assets should always be in equal value to each other inside the pool.

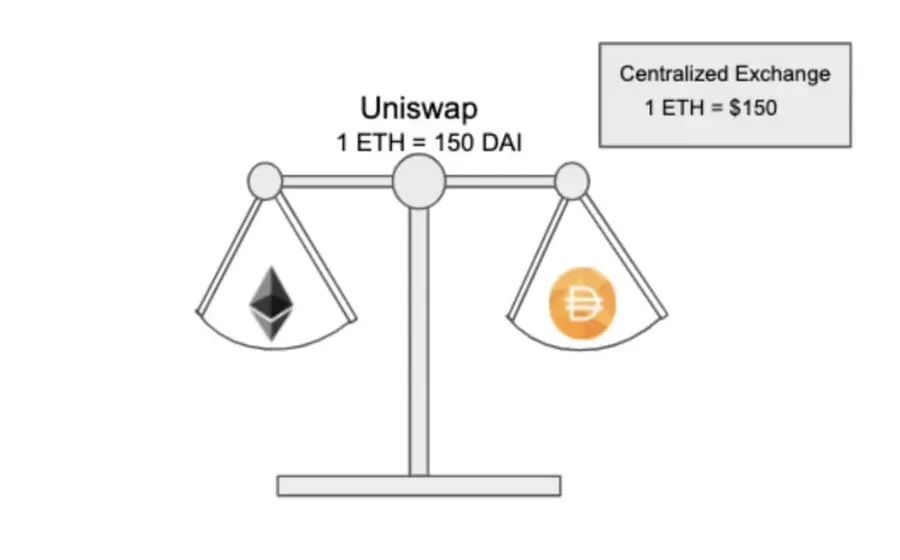

This 50/50 token ratio generalized liquidity across the full range of prices from 0 to infinity. It didn’t matter how the asset prices were trading, only the ratio was important. So when someone adds or subtracts assets from the liquidity pool, it implicitly means that prices are assumed to have changed. Uniswap V2 is a weighing machine at its core.

How Uniswap V3 Improved Liquidity Allocation

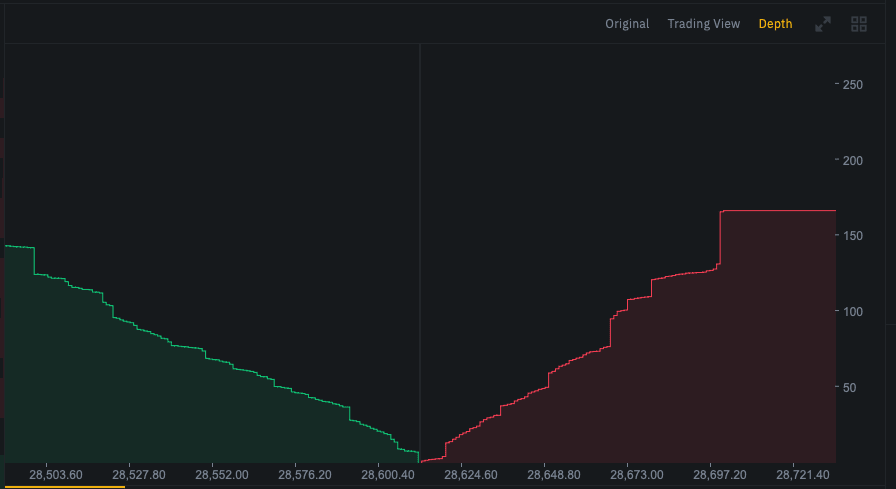

The problem with V2 contracts is that no professional market maker provides liquidity in a 50/50 fashion. Liquidity is never a constant function on centralized exchanges. Depending on market conditions, market makers will adjust their bids and offers to maximize their potential returns. Seen below, bid and asks add up in a natural way based on the market makers assumptions on risk and availability of liquidity to arbitrage against.

Market makers are able to control the spread, the amount of difference between the bid and ask so they can remain profitable over the long term and manage their inventory. Uni V2 LPs provide liquidity equally across the entire price curve, which reduces the capital efficiency since most assets trade within a range.

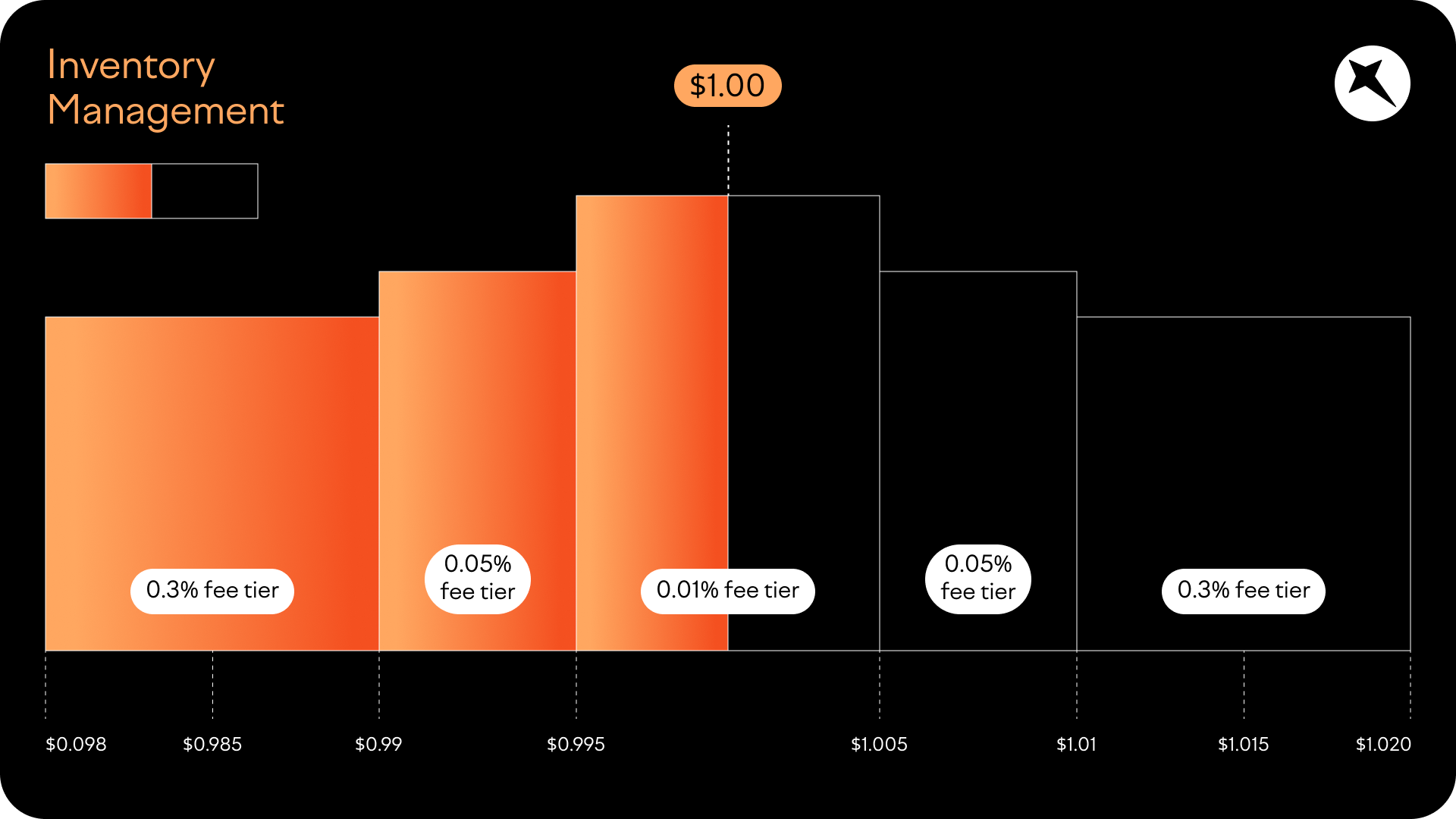

Let’s start with a simple example, stablecoin to stablecoin pairs. If you have a pool where both assets should trade at $1 all of the time, the Uni V2 formula is suboptimal, as it has ever increasing slippage as prices diverge away from the start. The optimal way to trade a stablecoin pair would be to provide liquidity only between $0.99 and $1.01. Providing liquidity outside of that range would not net any trading fees and would represent unused capital.

Uniswap V3 introduced several new features and improvements over the previous versions, including concentrated liquidity, multiple fee tiers, and range orders.

The most significant change in Uniswap V3 is the introduction of concentrated liquidity. In Uniswap V2, liquidity providers had to provide liquidity in a single pool with a fixed price range. However, in Uniswap V3, liquidity providers can choose their price ranges, which allows them to concentrate their liquidity within a specific price range where they believe there is the most demand. This means that liquidity providers can offer more liquidity with less capital, and traders can execute trades with better prices and lower slippage.

Another significant change in Uniswap V3 is the introduction of multiple fee tiers. In Uniswap V2, the fee was a fixed 0.30%, but in Uniswap V3, liquidity providers can choose between 5 different fee tiers ranging from 0.01% to 1%. This allows liquidity providers to customize their fees based on their risk tolerance and the level of demand they expect for their liquidity.

Uniswap V3 also introduces the concept of range orders, which allows traders to specify a price range and a limit order that will execute if the price falls within that range. This feature is especially useful for traders who want to take advantage of price movements within a specific range, and it allows for more precise trading strategies.

How Arrakis V2 Manages Liquidity

Given all of this, Uniswap V3 now becomes a liquidity computer for protocols like Arrakis Finance, where the exact placement of assets and fees can be optimized in a way to mimic CEX market making using their vaults.

Vaults are the vehicles that carry all the features of Arrakis V2 and serve as the interface where users can deposit liquidity into the protocol. There are two types of vaults: Private and Public. Private vaults only allow whitelisted addresses to deposit liquidity into them, while Public vaults allow anyone to deposit liquidity.

There are three different manager types for vaults:

- Trustless Vaults are managed by a pre-defined smart contract strategy and offer a trustless, autonomously managed on-chain strategy similar to Curve v2.

- Managed Vaults are operated by professional market makers who run more sophisticated off-chain strategies.

- Self-Managed Vaults are only for advanced users who want full control over their liquidity.

Additionally Arrakis V2 also enables:

- Ability to create multiple concentrated liquidity positions

- Cross fee tier vaults

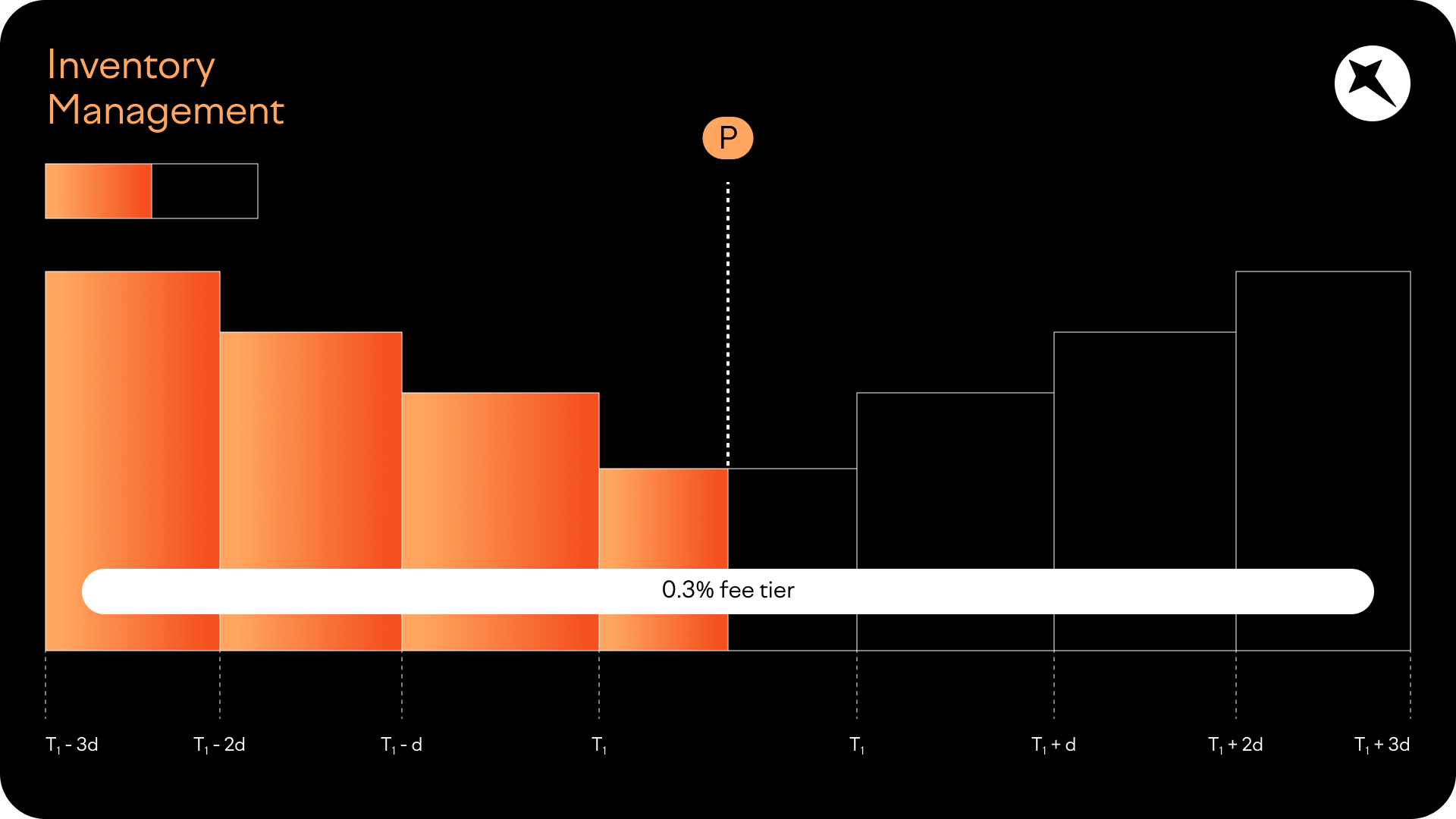

- Inventory management for LPing with customizable options

- Cross-protocol rebalancing for liquidity across different protocols and DEXs

- Non-custodial security for liquidity deposited by arbitrary depositors

- Fungibility of Arrakis V2 vaults for easy integration into DeFi and use as collateral in lending markets.

So given the stablecoin example from before, using an Arrakis V2 vault, liquidity can now be deployed closest to $1 with the lowest fees, and then decrease in size and raise fees moving away from $1.

On the other hand, for volatile assets, inventory near the spot price can be reduced and moved outwards to simulate a typical CLOB spread.

One of the biggest reasons to use Arrakis as a liquidity provider is that during setup, it creates all of the necessary Uniswap V3 NFTs beforehand, decreasing the total gas consumed by traders over the life of the product. Previously, when prices would go out of range on Uniswap V3, traders would have to withdrawal all of their liquidity and create a new NFT. This can be especially expensive during high gas environments.

Now Uniswap V3 ranges become inputs where the set of all NFTs within a range can be determined and then capital can be deployed based on modeled outcomes using fees, spread, and volatility. Uniswap V3 becomes a liquidity computer.

Arrakis PALM

The main problem with figuring out liquidity for tokens is how and who to market make with. Typically a project signs a fixed term or month-to-month contract that lends the market maker inventory to trade. The MM then uses their systems to deploy capital in a way which they believe is most efficient. Unfortunately, these systems are black boxes, where projects cannot fully see the operations of the MM and depend on them to act in a ethical manner.

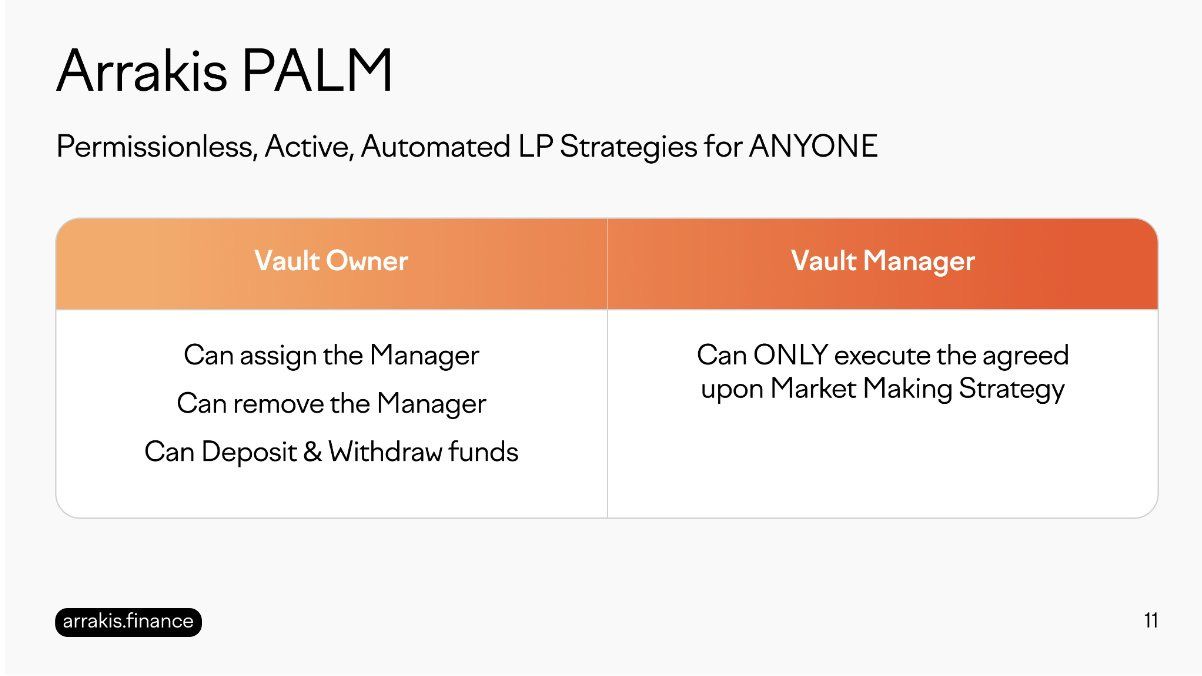

PALM stands for Protocol Automated Liquidity Management, Arrakis’ answer to opaque market makers.

PALM allows any protocol to build and maintain deep liquidity using their market making strategies built on top of Arrakis V2. It’s requires partnering with the Arrakis team, who then run backtesting and other simulations to optimize how liquidity is deployed on Uniswap V3. It doesn’t matter if a project is just launching or has been trading for an extended period of time, PALM can handle any situation.

Conclusion

Arrakis Finance takes its name from the legendary epic of DUNE as an unforgiving planet full of as many dangers as there are riches. It only takes one false move to jeopardize a strategy which makes the stakes that much higher. After years of experience and backtesting, Arrakis Finance aims to capture and provide on Uniswap v3 and beyond by cultivating a community of managers and trusted partners. Will they be able to continue to lead the way? For the sake of the spice, we hope so.

Not financial or tax advice. This article is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This post is not tax advice. Talk to your accountant. Do your own research.