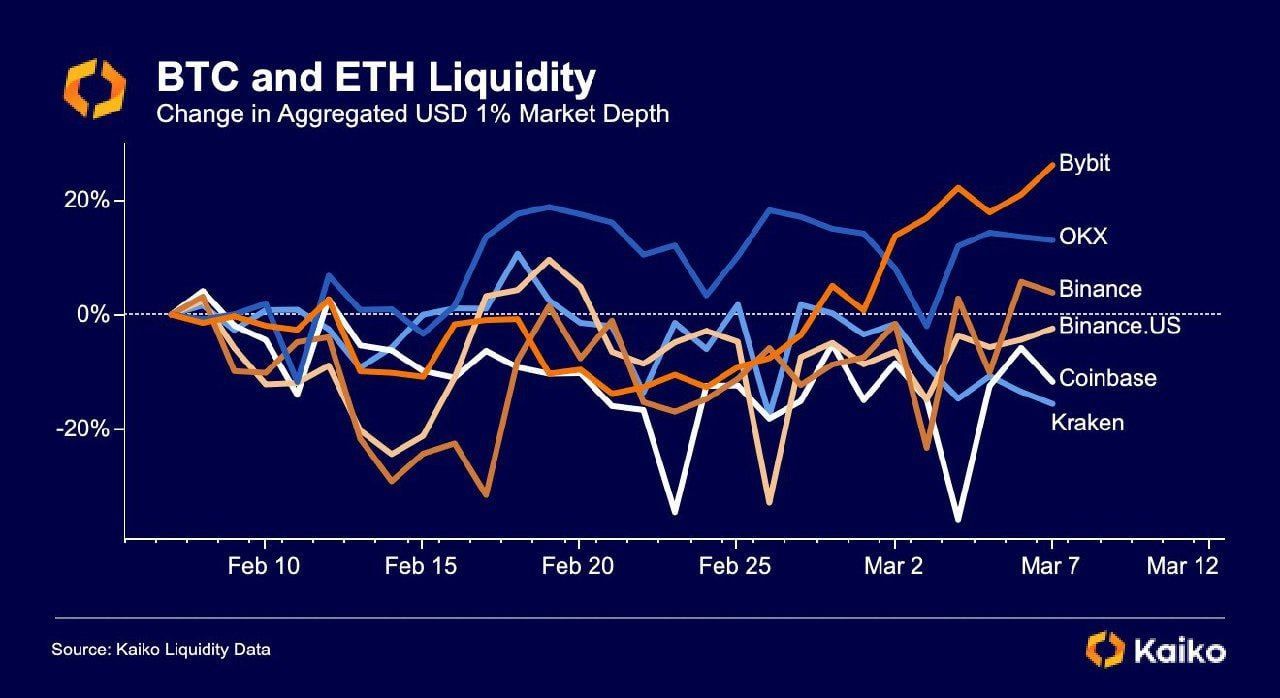

Just this past week, Silvergate, one of the largest crypto servicing banks, announced that it was winding down operations, shutting down the Silvergate Exchange Network and working with the FDIC to secure deposit accounts. It’s unfortunate because Silvergate provided a vital service for US based funds, institutions, and companies. Signature bank is a marginal replacement and US exchanges are already suffering worse liquidity as a result.

Dancing on Graves

The worst part is all of the no-coiners and other anti-crypto people dunking on Silvergate. Politicians such as Elizabeth Warren and Sherrod Brown made statements to the effect that Silvergate’s downfall was a result of FTX and a fraud that needed to be put out of business.

None of this could be further from the truth. Silvergate was killed by the US government, namely the Federal Reserve and the FHLB.

Time is Money

To understand Silvegate, we need to do a quick refresher of how banks operate. I’m taking much of this info from DeFi Surfer, who has done a fantastic job of outlining the problems Silvergate faced on his Substack.

Banks take in deposits from customers, they then invest that money into debt assets like treasuries and bonds. Normal banks typically buy a mixture of both short and long dated debt to maximize revenues. Banks make most of their money from this process.

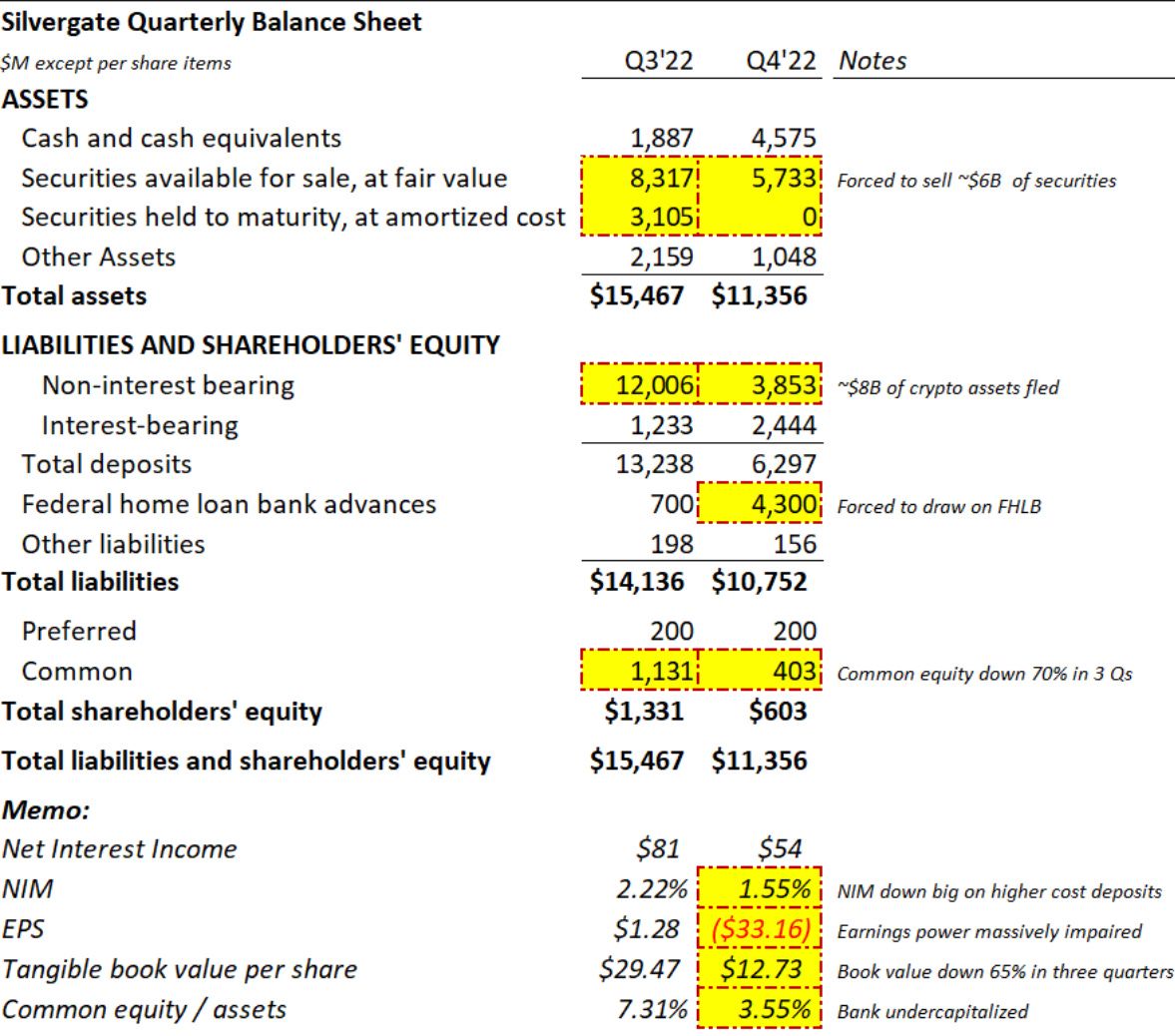

Normally this is all fine and well. Depositors come and go, but they don’t all run for the exit at once. We live in crypto land though, where constant boom and bust cycles endlessly produce and destroy capital. LUNA’s collapse wiped out a $60bn asset in a couple of days. FTX is dead and Sam’s going to jail for life for leaving a $8bn hole. These two events put the fear of Craig Wright into people who pulled billions of dollars out of the crypto markets in just a few months. Silvergate was no exception. In just a few months depositors pulled more than $8bn out of the bank, almost a 90% reduction. If Silvergate had other clients than crypto companies, they probably could have weathered the shock, but their exposure was total and so they were forced to sell all of the treasuries and bonds they had invested into. Unfortunately for Silvergate, while their services focused on crypto related activities, their investment portfolio did not reflect. Silvergate bought billions in long-duration municipal bonds and mortgage-backed securities (MBS) during the absolute lows of a 50 year bond bull run.

Bonds are a funny thing. It’s a debt instrument, so when you buy one, it will always pay back the principal at the end of its term. But if you buy when rates are low and then they increase by a ton in a short time, the price of the bond will plummet. Unlike stocks, pricing bonds is an exact science. If Silvergate had been able to hold the bonds until term, they would have incurred no losses and would not be shutting down today. Interest rates skyrocketed over the last year, going from lows of under 1% for a 30 year bond, to a high of 4.2%. Rate volatility is a fucking destroyer of worlds (said without sarcasm here). The entire UK pension scheme was “hours away from disaster” last Summer before the Bank of England had to step in. Japan essentially has nuked its currency to keep rates low. I use these two examples as these are complex modern economies that nearly lost the plot because of rate volatility. Smaller players like Silvergate don’t have the power of the purse and just can’t whip up trillions to throw at the market to remain solvent.

In fact, Silvergate got screwed by the government, leading to its eventual shutdown, for trying to shore up its books with a government bailout. Silvergate took a $4.3bn loan from the Federal Home Loan Bank of San Francisco to stave off the massive run on deposits. In January, the FHLB told Silvergate they were cut off and they needed to repay the loan before the end of term. The struggling bank sold more assets at a loss and fully repaid the bank after 2 months No reason was given as to why, but given what orthodox economists and democrats are saying, they were shocked that the bank was provided taxpayer funded support to shore up its crypto banking services.

Duration risk, the mismatch between short term deposits and long term debt, is one of the two main reasons banks and other financial institutions fail. If Silvergate had been through a few boom bust cycles with crypto they would have known the severity of capital destruction and draw down risk endemic to the industry. Rates were so low for so long that they had no option but to invest in long term debt instruments that didn’t match the risk appetite of their customers just so they could turn a profit and stay afloat. They were not prepared at all for the largest rate volatility event in decades caused by massive stimulus, Fed incompetence and supply chain implosion.

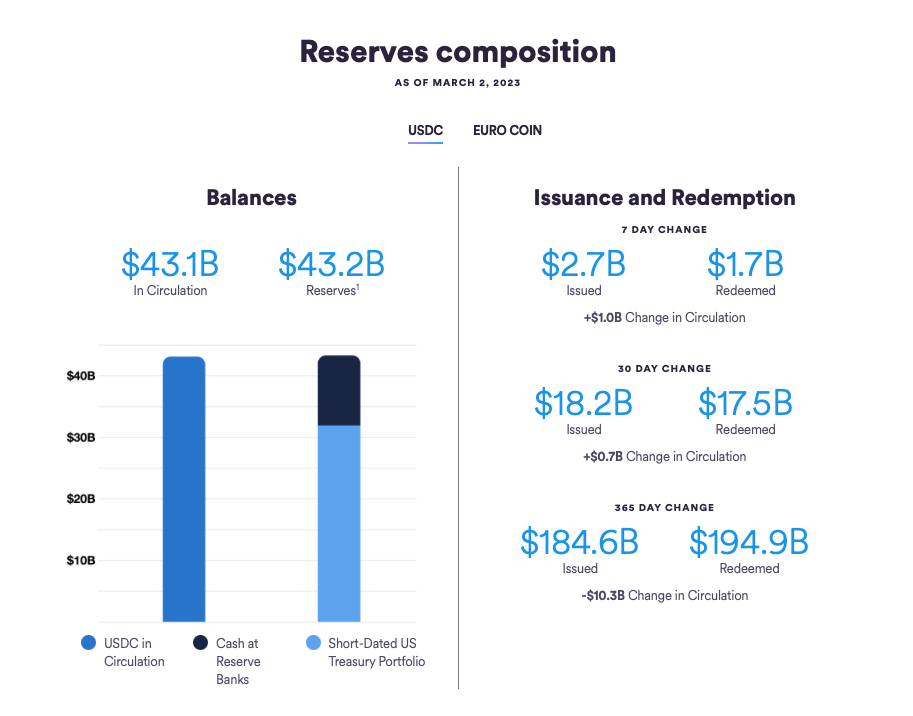

Stablecoin issuer Circle, who operates much like a bank, was much better positioned for outflows. They keep their collateral in 20% cash and 80% in short term securities with an average duration of 3 months. Yes they make less money, but they are built with bank runs in mind. Silvergate wasn’t and suffered the ongoing consequences, most likely shuttering and filing for bankruptcy in a few days.

Silvergate’s demise should be remembered by the industry not as a self-inflicted wound, but rather a sinister strike by the powers at hand. Regulators have had full insight into their banking practices, as the industry is one of the most highly regulated in the world. Their actions are a key attack on the movement of funds between all crypto institutions, as they hope to irrevocably harm the industry in the depths of this multi-year crash.

Frax and Off-Chain Assets

Over the last year, Frax has changed course significantly, as the DAO and core team realized the potential harms that could be inflicted on the protocol by holding off-chain assets (real world assets). Several governance proposals last year offered Frax the ability to move some of its collateral off-chain and into debt securities like what Circle and Silvergate invest into. Other decentralized stablecoin protocols like Maker have already taken up the offer and are able to offer a 1% yield to the Dai Savings Rate module.

Alluring as it might be, Frax believes the risks of default, seizure, or duration vastly outweigh the yield gained off-chain. During the LUNA collapse, more than half of the FRAX supply was wiped out in a few weeks. Had Frax been fully invested in yield bearing assets, it too would have suffered the same fate as Silvergate potentially. Founder Sam Kazemian has made it clear that the only off-chain assets Frax will ever invest into will be through a Fed Master Account to access the risk free rate offered by banking with the US government itself. The hardest part for Frax is still yet ahead. Armed with a suite of stablecoins, Frax is going to use these lessons learned to pave a path of conservative growth and expansion using the most pristine collateral in existence.