Update: A few moments before publishing Circle released a statement on Silicon Valley Bank. Here are the highlights:

- USDC redemptions will open on Monday morning

- USDC will remain redeemable 1 for 1 with the U.S. Dollar.

- On Thursday, Circle initiated transfer of $3.3bn to its banking partners. The transfers were not settled. Circle believes that “transfers initiated prior to a bank entering receivership would have otherwise been processed normally. In other words, the FDIC should allow transactions to settle in the ordinary course through the end of a bank’s standard daily processing cycle until the FDIC takes control of the failed institution.” Circle might be unaffected by the failure of Silicon Valley Bank.

- Circle holds $5.4bn with BNY Mellon and $1bn with Customers Bank. There is zero exposure to Silvergate or Signature Bank, another potentially troubled crypto bank.

- Even if there is a shortfall from SVB, Circle will make all depositors whole, as required by money transmitter laws.

Also MakerDAO released an Emergency Proposal to limit their USDC exposure (always in hindsight).

Over the last 48 hours, the second largest banking failure in the US history has put the entire crypto industry on watch and also raised questions about the financial health of numerous other banks. And while Circle’s USDC represents a tiny percentage of the victims of this bank run, its loss of peg is representative of the wider threats to the entire economy from rapid interest rate rises due to inflation.

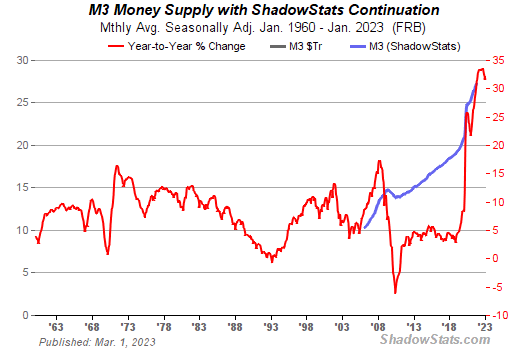

This story is one of money. Over the last 3 years since the start of the pandemic, the US money supply has expanded by 50% as the Federal government pumped trillions into the economy to fight Covid and the resulting supply chain issues. Inflation rose to the highest recorded levels since the 1970s after a decade of ultra low interest rates that spurred a monster of a bubble in tech, crypto, EVs, and more. Deploying capital into risk assets was the best option when money was cheap and yields were low.

Interest rates became boring after the GFC. The Fed funds rate went negative. The ECB was selling negative yielding bonds. Austria issued a 100 year bond that’s now lost more than 60% of its value. Governments went wild issuing debt, as they should have with rates as low as they were and the private sector bought it up by the billions. Now, the banks and other financial institutions who bought this expensive debt are collapsing now that interest rates have skyrocketed, driving interest rate volatility to its highest since the pandemic. It’s truly troubling times now.

In the past week, two banks have failed.

First, Silvergate Bank shuttered its doors after a long fight against closure. The embattled crypto bank bought billions of 10 year municipal tax free bonds at the peak of its capitalization. After the collapse of FTX, 3AC, and Luna, depositors withdrew 90% of their money from the bank, forcing Silvergate to sell its bond portfolio. While this normally is not an issue, interest rates doubled in a short period of time and Silvergate failed to hedge properly. The bank ended up realizing a loss of $1.2 bn, essentially wiping all of its profits earned since IPO. On a positive note though, Silvergate fulfilled all withdrawal requests from both insured and non-insured depositors.

Then just this past Friday, the FDIC shuttered the doors of giant Silicon Valley Bank. The bank had been suffering as its bond portfolio was only earning 1.79%, while treasuries yielded 3.9%. Leading into this week, the stock was down 60% and depositors had started to pull their money to move into the safety of treasuries. Throw in a massive contraction of venture funding and tech sector contractions and the scene was set for the events of this past week.

SVB’s collapse started with the threat of a credit downgrade by Moody’s on Monday, March 6th. On Wednesday, March 8th, the company announced that it had sold $20bn of its liquid bond portfolio at a $1.8bn loss and would also sell $2.25 bn in new shares to bolster its balance sheet to fight the downgrade. Moody’s still downgraded the bank and panic ensued. A wave of high profile investors like Peter Theil and VC funds publicly advised their companies to pull all their funds from the bank. Over the next two days, SVB’s share price plunged another 60%. By Friday the damage was total, SIVB share trading was halted, the bank failed to find a buyout and California regulators intervened, shutting down the bank and placing it into receivership with the Federal Deposit Insurance Corporation.

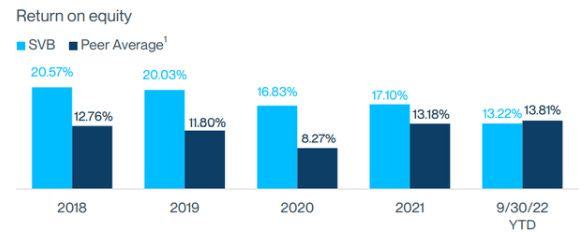

Coming into 2021, Silicon Valley bank’s stock price had suffered like the many other tech and crypto startups it provided banking services for. At one point in 2022, the bank served approximately half of all venture banked tech and life sciences startups. In the lead up to the pandemic, the company had been a superstar, financing early stage ventures when no other banking institution would, and it rode the wave of meteoric valuations to great heights. SVB was able to consistently earn a higher rate of return than its other peers.

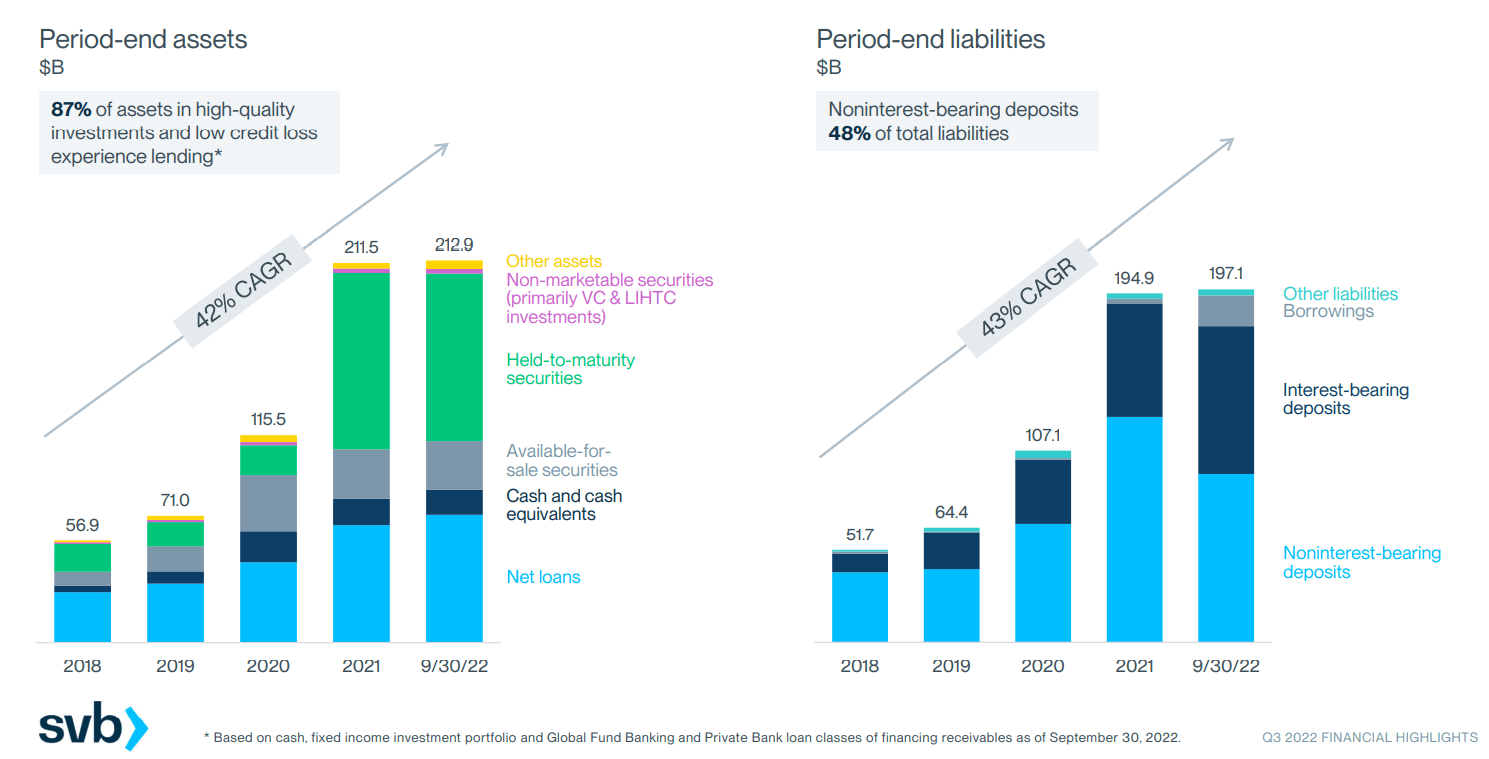

Success came with a price though, as SVB ended up with billions in excess deposits, nearly doubling in size from 20-21. The bank used the majority of those funds to buy long dated securities and expand their “Held-to-maturity” portfolio. In a weird accounting trick, HTM assets don’t have to be marked to market so long as the entire portfolio is held to term. This allows the bank to essentially hide short term losses from rate movements, which eventually disappear at the end of term.

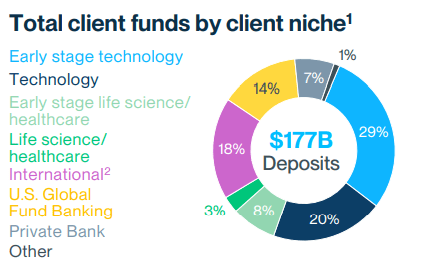

Normally this is fine for banks. Their loan books and deposit base are diversified and so even when one sector is navigating troubled markets, the other sectors bouy up any weakness. SVB catered to a very specific sector of the economy that typically endures massive boom/bust cycles. If all of your clients are experiencing the same issues, funding, payrolls, raising capital, it aligns their fears and creates stress on the bank. SVB ultimately paid this price for its chosen exposure. A 50 year old bank and the 20th largest in the United States destroyed in 48 hours.

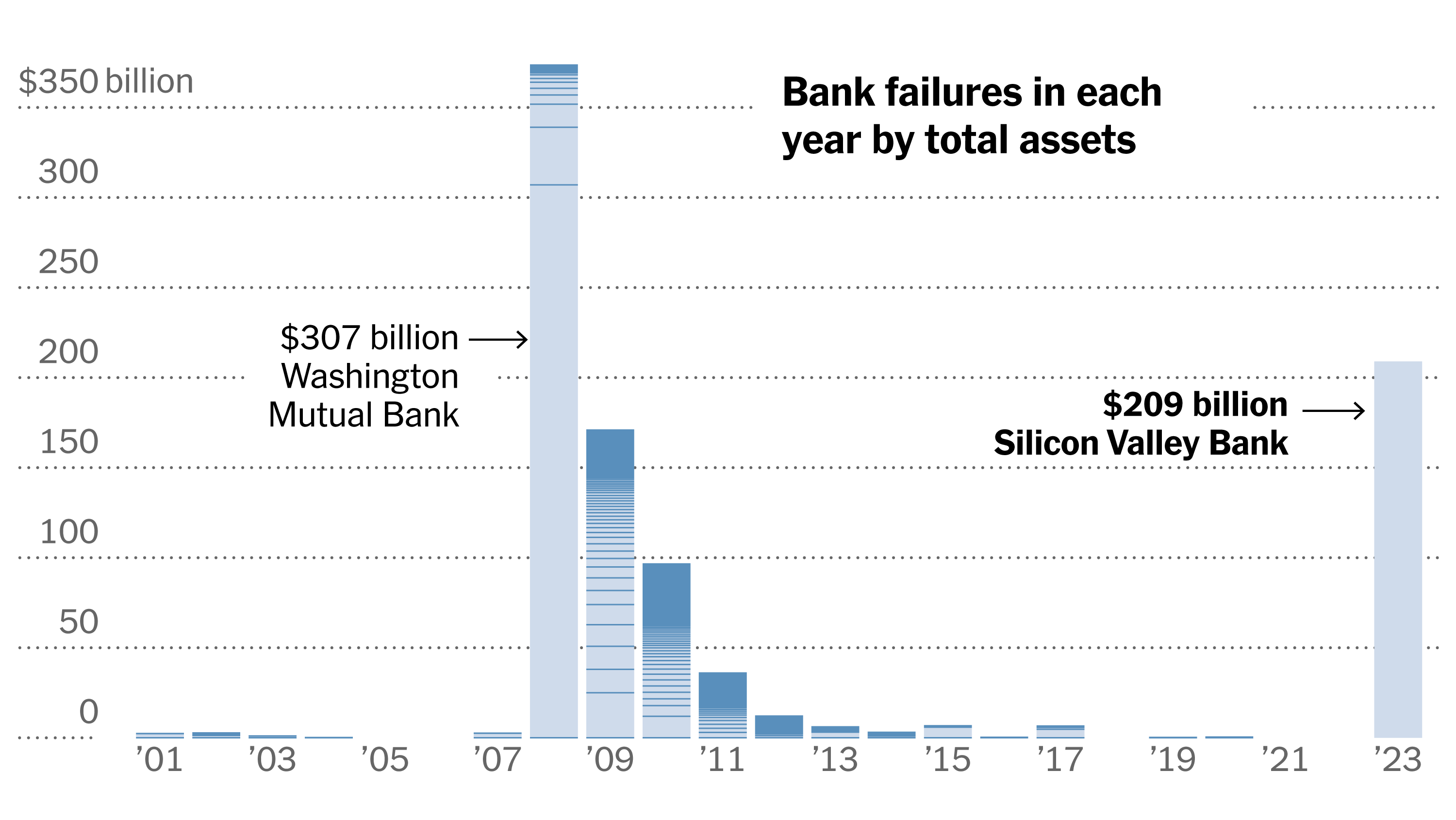

The chart above shows the total value of all banks that have collapsed since 2001. What’s stunning about the chart is the sheer size of the Silicon Valley Bank failure. It’s on the scale of WaMu during the Great Financial Crisis. Unlike then, SVB’s collapse was not a result of highly leverage bets on the US real estate market. Instead, it’s a treasuries crisis caused by the Federal Reserve.

Coming Full Circle

Once the bank was closed, names started emerging of who kept cash on the banks balance sheet. Investors into Circle shared that the company had recently disclosed Silicon Valley bank was one of 6 depository institutions it kept cash at. CEO Jeremy Allaire previously had stated that Circle held most of its cash reserves Bank of New York Mellon, so a question lingered amongst analysts as to how much exposure Circle had to SVB. It took more than 24 hours for the stablecoin issuer to disclose that it held $3.3bn in uninsured deposit accounts.

The market immediately sold off USDC. Coinbase and Circle soon announced that redemptions were paused. In spectacular timing, it was the weekend, banks were closed and they didn’t have enough cash on hand to facilitate several billion dollars worth of redemptions. Overnight USDC fell to lows of $0.88 on some exchanges, recovering to $.95 as of publication.

Most analysts covering the bank failure have estimated recovering 70-80% of deposits. Circle most likely will lose a billion dollars of its reserves. If their reserve supplied stayed at $43bn where it was last week, the loss would be minimal as the company is earning 4% against $30bn in treasuries or several hundred million after expenses.

But the real threat is that investors are now spooked and will flee USDC for other safer assets. Circle will not lose much selling its short term treasuries, like Silvergate and SVB did. Assuming the $3.3bn stays illiquid for some time, if reserves drop to $20bn, it then would represent 16.5% (priced at $.84 per USDC ) of their portfolio. At $10bn it would be 33% ($0.77 per USDC). USDC is supposed to be fully liquid at all times. Any illiquidity will be priced in, as was seen overnight.

The big question now shifts to Monday, when banks reopen, Circle and Coinbase can process withdrawals and the FDIC announces how much it expects to return to depositors. In the best case scenario, the bank finds a buyer, uninsured depositors are returned 95%+ of their capital, and Congress finally decides to pass stablecoin legislation that would prevent this from happening again.

We’ve talked extensively about what stablecoins are here at Flywheel. USDC is not bank money and its deficiencies were acutely highlighted this past week. The Federal government has delayed Circle from becoming bank, where it could directly access credit with the Federal Reserve. Instead, it was forced to park its assets with several niche crypto banks that all are failing at a the same time. Contagion risks are high for other institutions supporting the tech sector and hopefully none of the other institutions Circle banks with will fail.

The failure of lawmakers and regulators to provide a legal way for Circle to ensure the safety of its deposits is a black mark that will have significant consequences for years to come. I would expect a shift in policy debates post-hoc as Democrats call for full shutdown of stablecoin issuers in the United States and Republicans are prevented from passing targeted legislation favoring the industry until the potentially win in the next election cycle.

_____-Maximalism

Honestly, its weeks like this that remind us all why Bitcoin is around in the first place. Crypto has always thought of itself as a shield against the scourges of the banks. Where the back dealings of a shadowy banking cabal couldn’t spread into and cause crisis after crisis. For all of the questions around Bitcoin’s viability long term, it is completely non-reliant on well functioning banks and a dollar based money system.

A single bank blowing up doesn’t threaten Bitcoin, but it’s creating deep idealogical questions in the Ethereum community as to what power should be given to fiat backed stablecoins within DeFi and the ecosystem as a whole. In its current form, Circle and other stablecoin issuers will always be susceptible to custodial risk and bank runs. Ethereum and DeFi will continue to inherit these problems so long as the underlying asset is not bank money with access to the Fed.

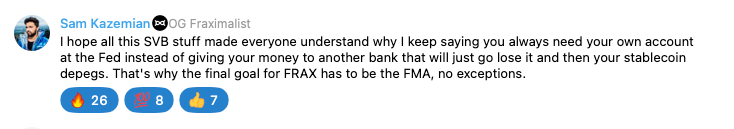

Frax Founder Sam Kazemian has long seen this day coming. Since the Luna collapse he has repeatedly stated that the only “safe” way to issue stablecoins is through a bank that has access to a Federal Reserve Master Account.

We all need to have a long and hard discussion politically about how we issue and regulate stablecoins. Leaving private companies to navigate a grey zone legally only leads to loss of confidence in the product and potential bank runs. It’s time we have a national conversation on stablecoins, how they are issued, who can custody them, how the collateral can be invested. I hope this is a wake up call for everyone in this industry. It’s time to enact new changes for the better.