Welcome to Frax Check. Your weekly frax vibe check. I am your host Kapital_K and I’m joined by my cohost DeFi Dave and our producer extraordinaire Sam. We will be going straight to the source of truth via checking the chain. Before we jump in, please subscribe to the flywheel, it really does help! Please also follow us @flywheeldefi on Twitter and tg.

This week... I call this week the “Speechless” week. As the name suggests, this week things were quite surreal.

Let’s start with the flagship product: $FRAX stablecoin. We see the Supply has been holding steady at $1B-ish, unchanged from last week – even after the whole market turmoil. Next, we must check the peg, which got as low as $0.898 with a high of $1.001 for the week. The peg unfortunately was pegged to 1 USDC rather than 1 USD as we saw USDC got to the same low range. We then looked at Curve via swapping 100M FRAX for USDC. We received a 0.9992 exchange rate. This is frankly the best exchange rate we’ve seen for the FraxBP – if you’re wanting to trade from FRAX to USDC now is the time. Moving on, we have our Collateralization %.

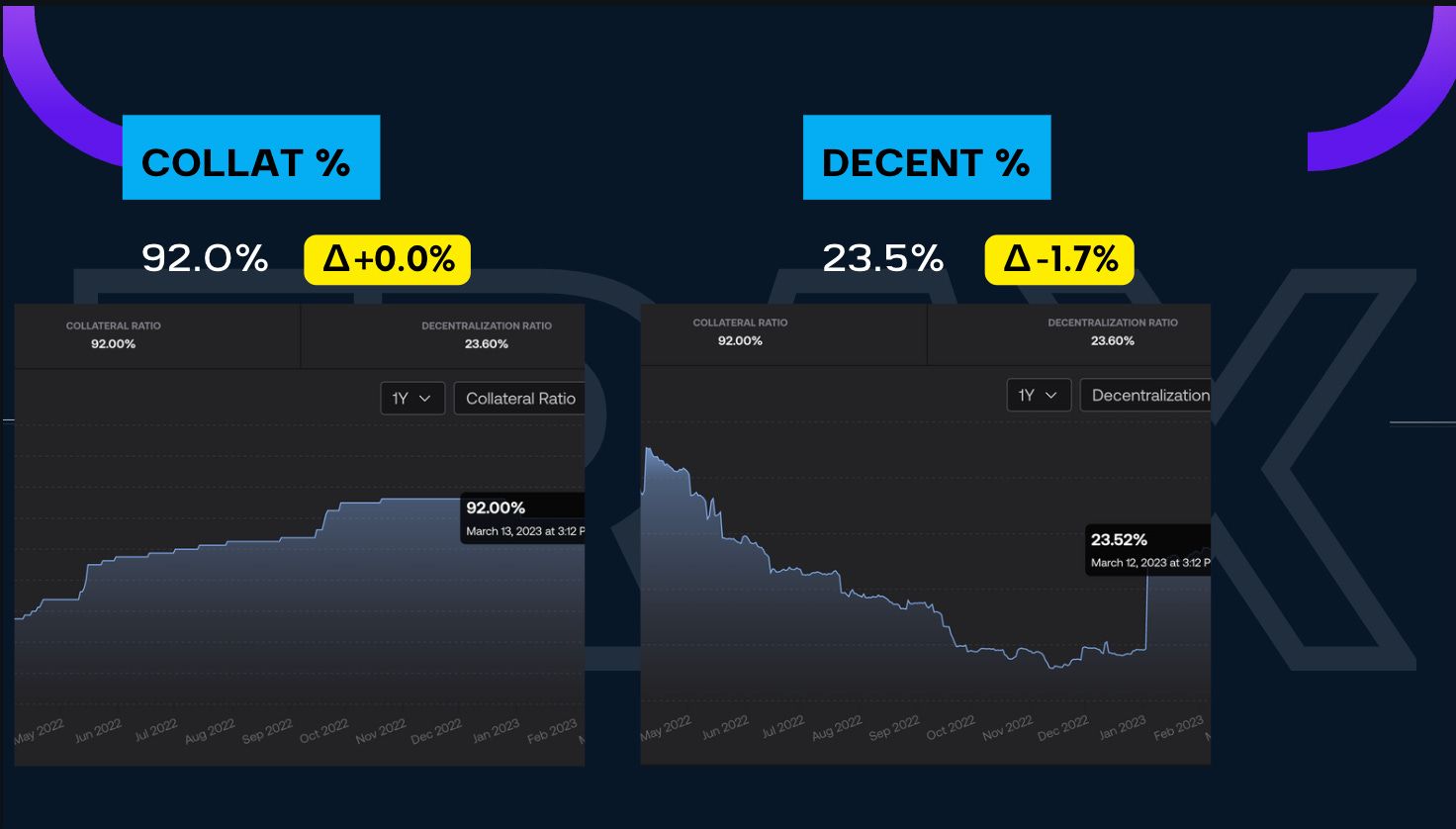

This is the % that conveys how much FXS (algorithmic) is used as collateral. We’re unchanged at 92%. Following we have the Decentralize %, which saw a decrease of 1.7% and are now sitting at 23.5%.

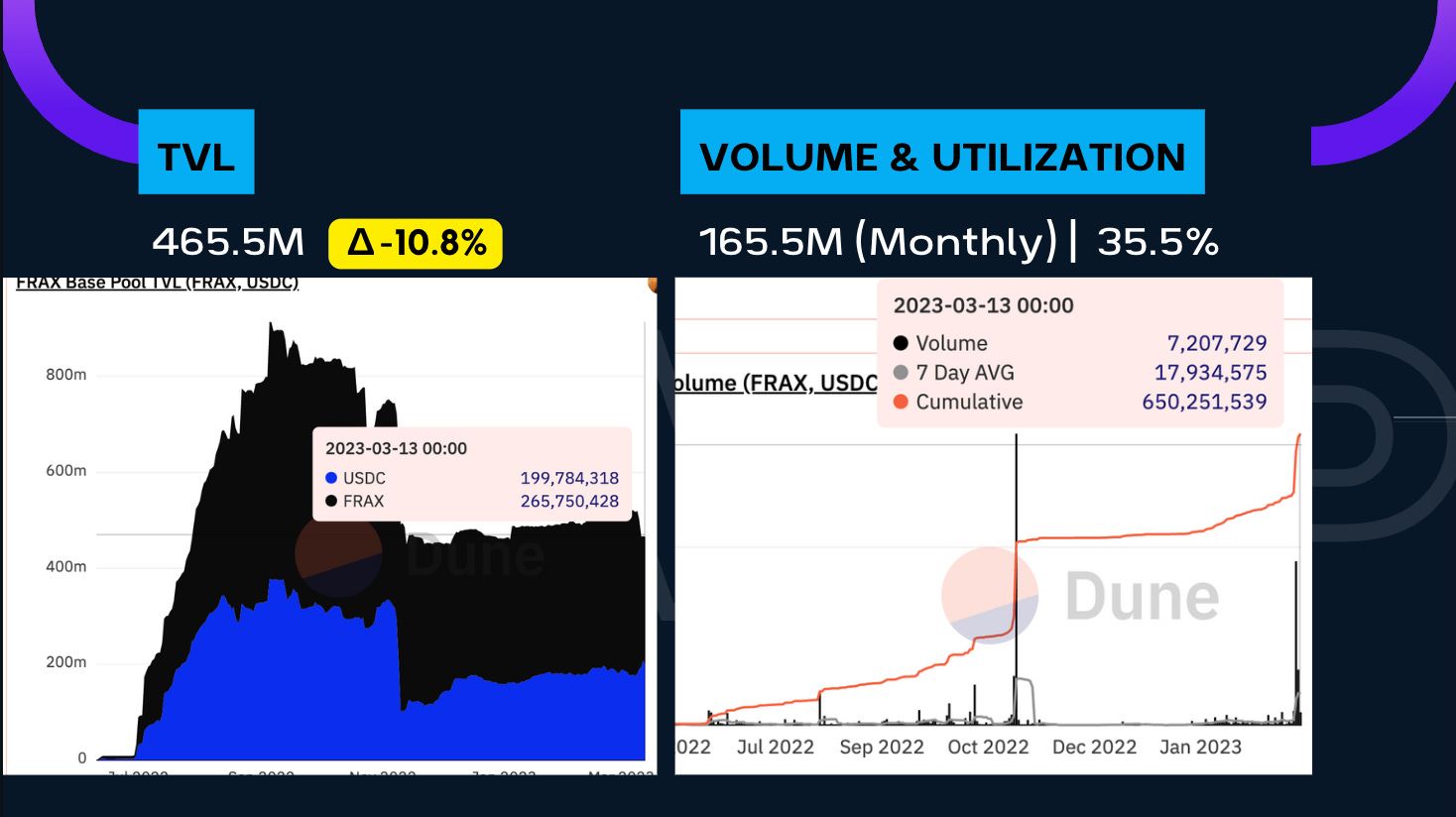

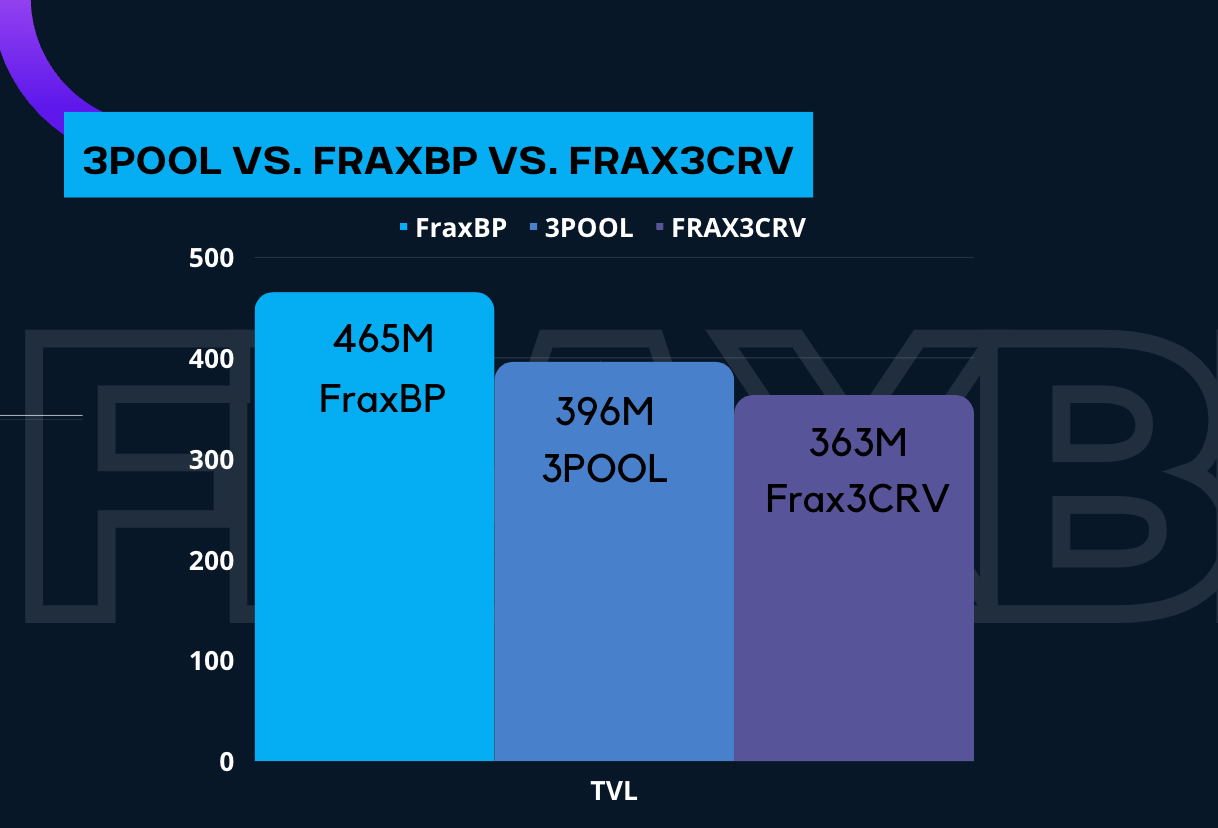

For this week we saw the FraxBP TVL dropped to $465.5M, which is -10.8% decrease from last week – tvl has declined three weeks in a row now. On the right side we have a new metric I wanted to start looking at which is the volume traded. For context, in February we hit 49.3M, and in first two weeks of March we hit 165M. This represents a 35.5% utilization rate. The Stablecoin trading volume has been ridiculously profitable for Curve this past week.

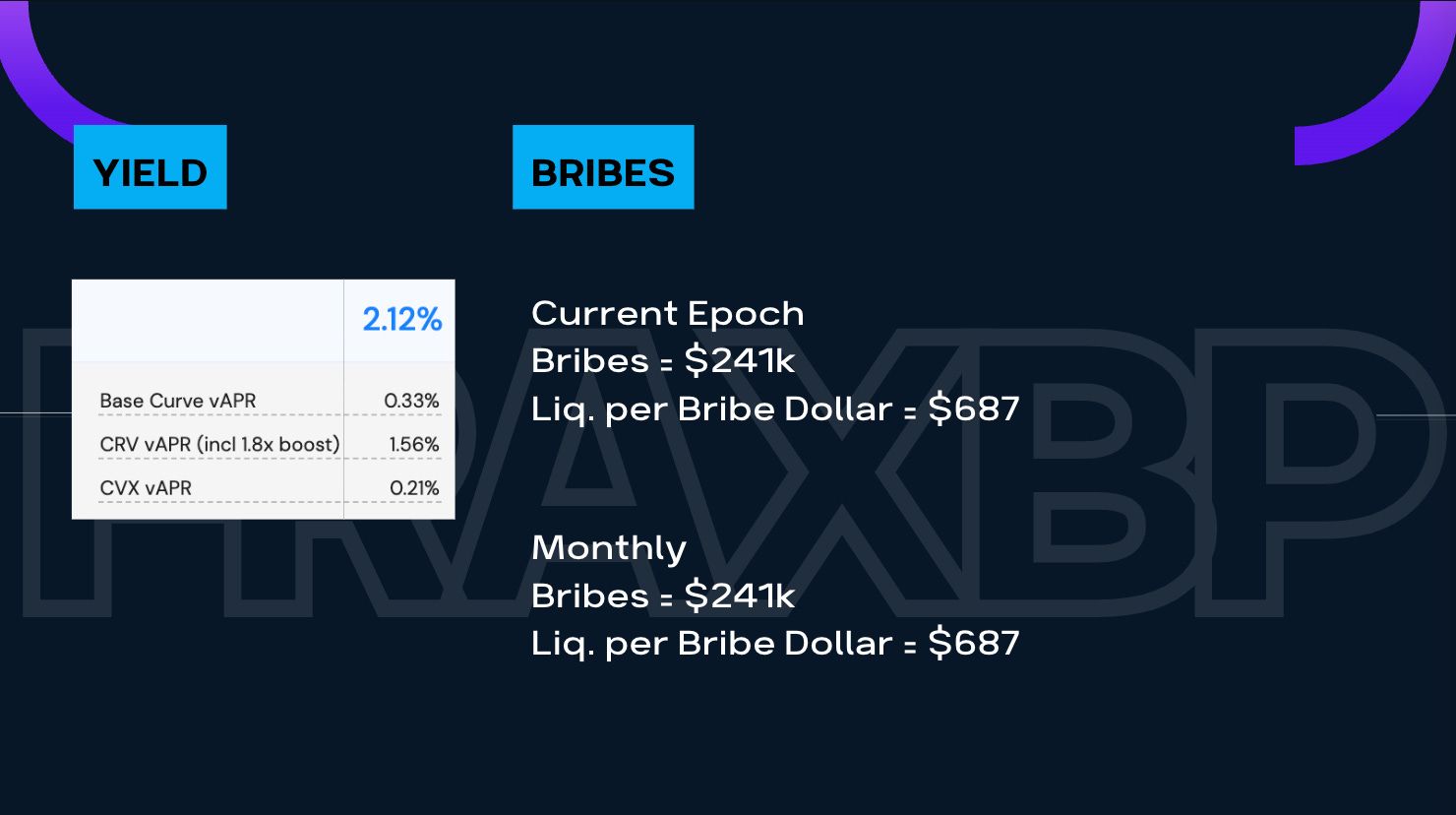

Following this slide, we have a yield and bribes section, where I look at the current yield being offered to LP into this pool and the bribes Frax Finance had to pay for the yield. You see here that there’s an APR of 1.7% so the estimated $378k of yield for the 14-day epoch because Votium epochs are 14 days, then we compare that to the bribes paid. This epoch so far, we paid $241k so rough back of the envelope math says we’re doing pretty good so far this month. However it’s important to note that Frax Finance’s POL isn’t the only liquidity in the pool so its reward shares are definitely diluted but that’s part of the plan as Frax wants to attract liquidity into the FraxBP. To that end, $733 of liquidity were incentivized by $1 of bribes paid.

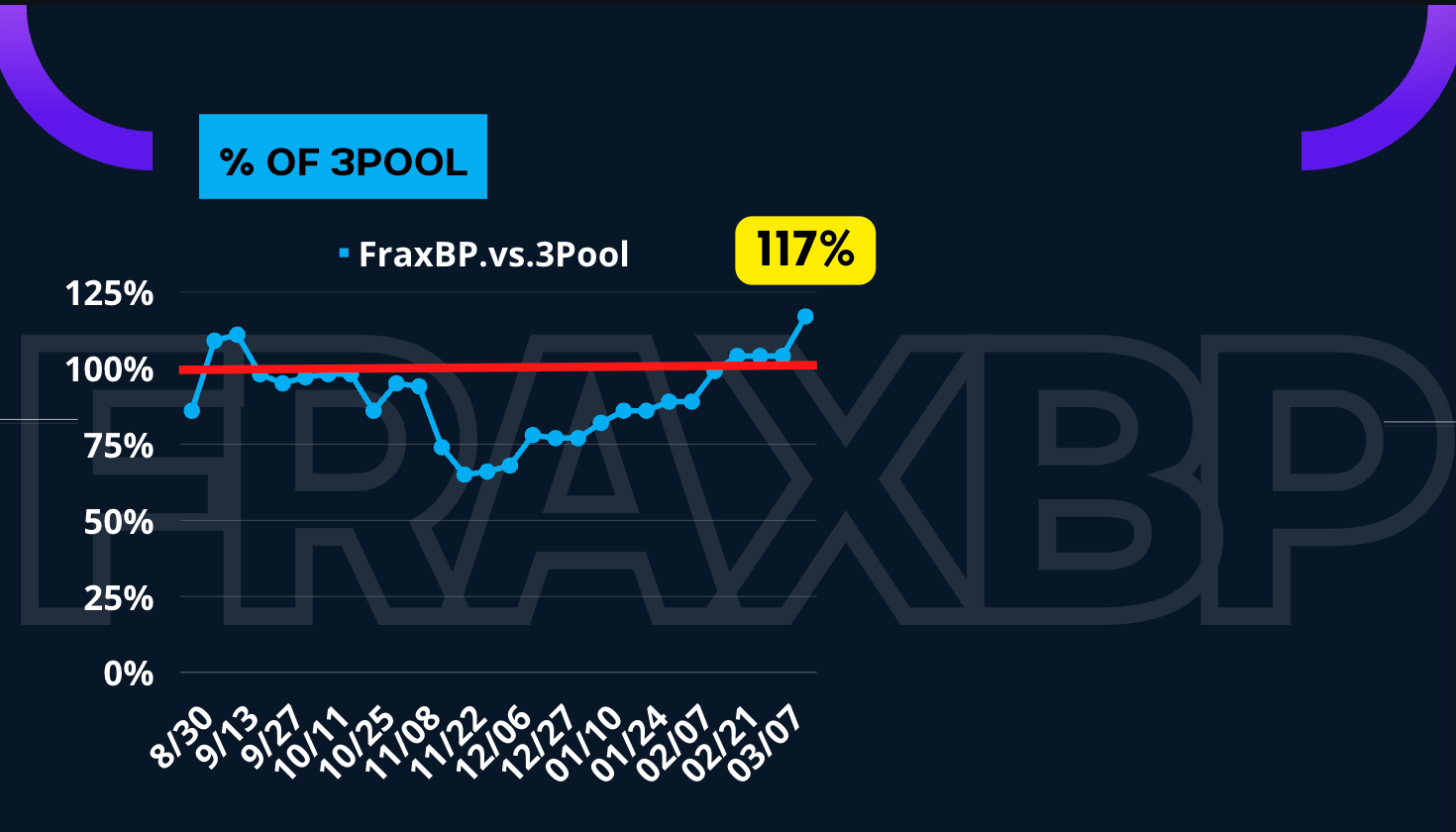

Now, we march forward to my favorite section of the Frax Check. We are 117% of 3pool. Glad there are some good news in this week’s Frax Check. The FraxBasedPool is $465M versus 3pool's $396M. Now, it wasn’t easy to get to the top but now we must stay at the top. If we’re able to maintain this ratio, then I believe the FraxBP will continue to remain at the top as liquidity begets more liquidity. The 3POOL is still highly imbalanced so I think it’s going to take some quite some time for it to find its footing again, while the FraxBP is near its best pool composition of 40/60.

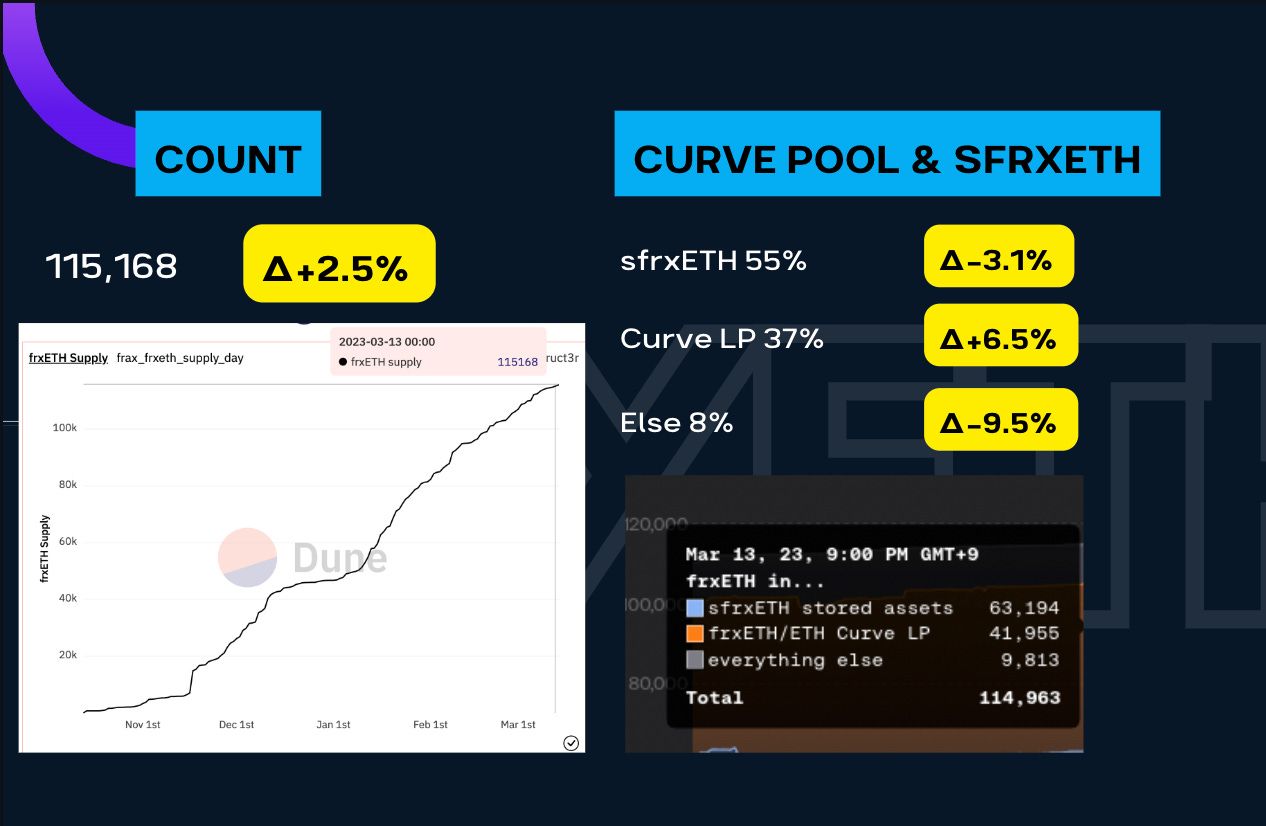

Next, we have our FrxETH segment. We start by checking the frxETH supply. As always, it’s up only! The count is at 114,961. And look at that chart, I know you can’t read it but just appreciate the verticalness off that graph. +2.5% -- not too shabby. I do think we may slow down in percentage growth terms as we’re getting to size, but I hope we don’t! Let’s look at where the frxETHs are hanging out! As a reminder, You can stake your frxETH into the sfrxETH vault to earn the native ETH staking yield. And in that vault we see that 55% of the frxETH is chilling and stacking ETH earning a nice native staking yield. The other place you can take your frxETH is to the curve pool of frxETH/ETH, where you can join 37% of the frxETH supply. The remainder 8% is floating in the ether somewhere. I think the yield parity between the sfrxETH and Curve pool is reflected in the current split. Unless Frax cranks up the bribes a bit more, I think we’ll see this heavier flow into sfrxETH. And also lets note that there’s 9% of frxETH just chilling, this number is increasing more and more these last few weeks. But enough talk of the supply and the yield, let’s get down to the peg.

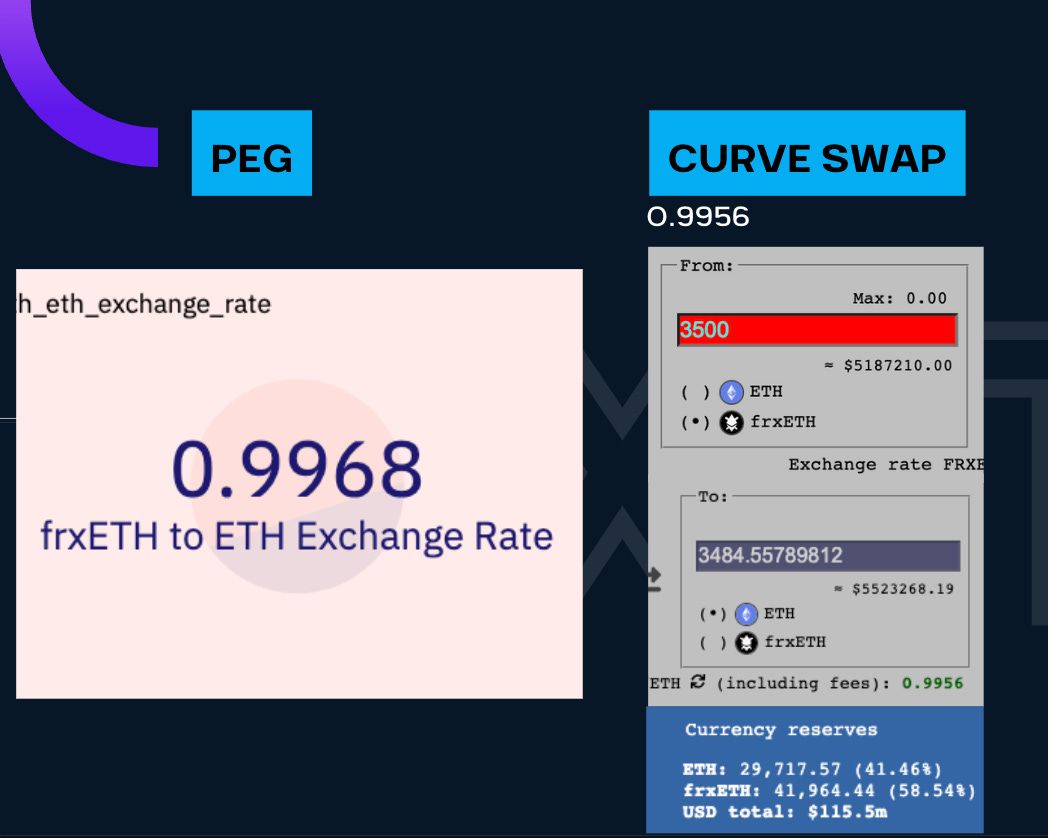

Peg check is as lowest as it’s ever been at 0.9968. But it’s actually worst when we go into the market. I tried to swap a 3500 frxETH which is roughly the amount of the largest frxETH holder and I get an exchange rate of 0.9956. This is also a historic low. Fortunately, the TVL is quite sticky at $115M, still 9 SOLID FIGURES. So far so good, let’s see how we stack up with the other competitors.

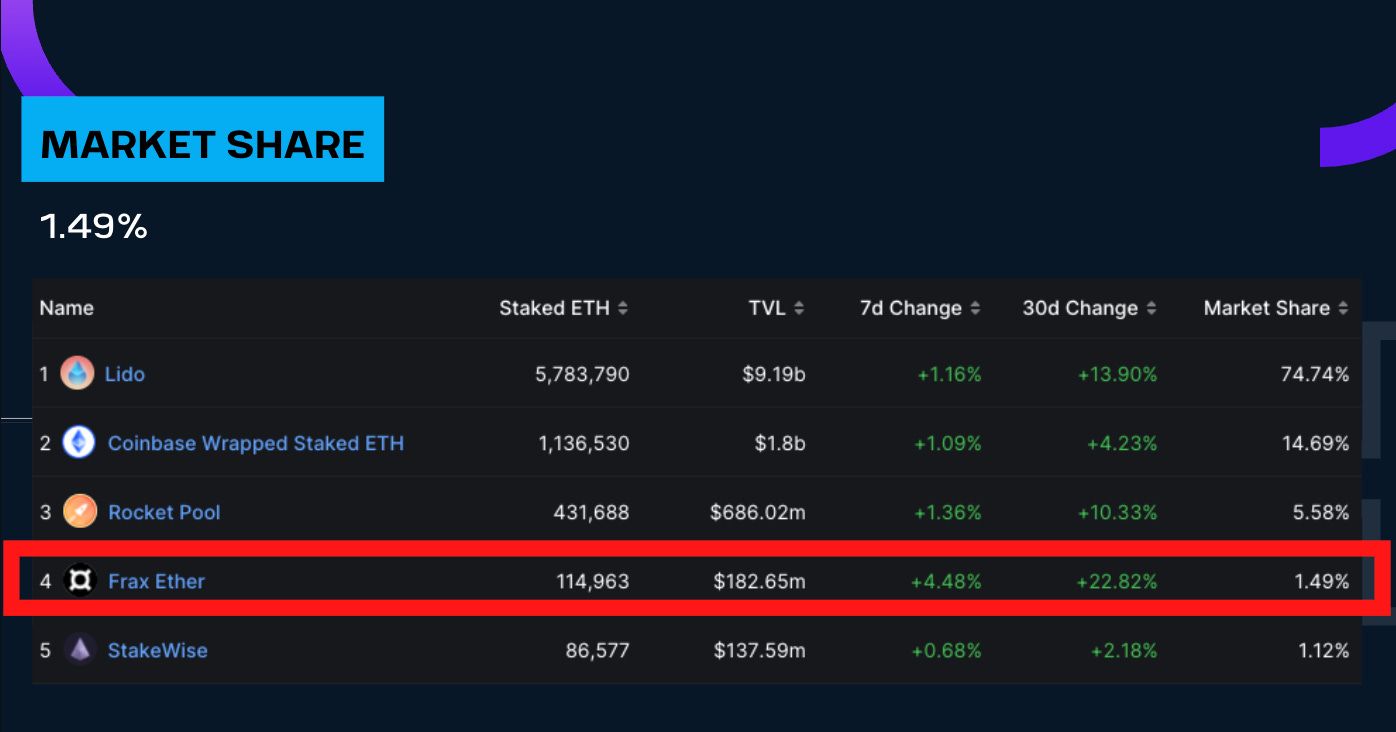

Here we layout the LSD market landscape. We have Lido in the lead with 74.8% of the market. Though, Frax REMAINED the highest 30-day delta in the group, at +22.8% so far. FrxETH’s market share is at 1.49%. Let’s keep fighting the good fight! On the yield landscape, frxETH pretty much dominates with a 6.5% and the closest competitor is surprisingly this week was Lido at 6.2%. But these figures on DeFi Llama doesn’t tell the full story as sfrxETH stakers earned 16%+ APR this week due to the massive MEV that it captured during the crazy market situation.

Peg check could be better. Curve swap could be better. Count up-only. Staked % healthy.

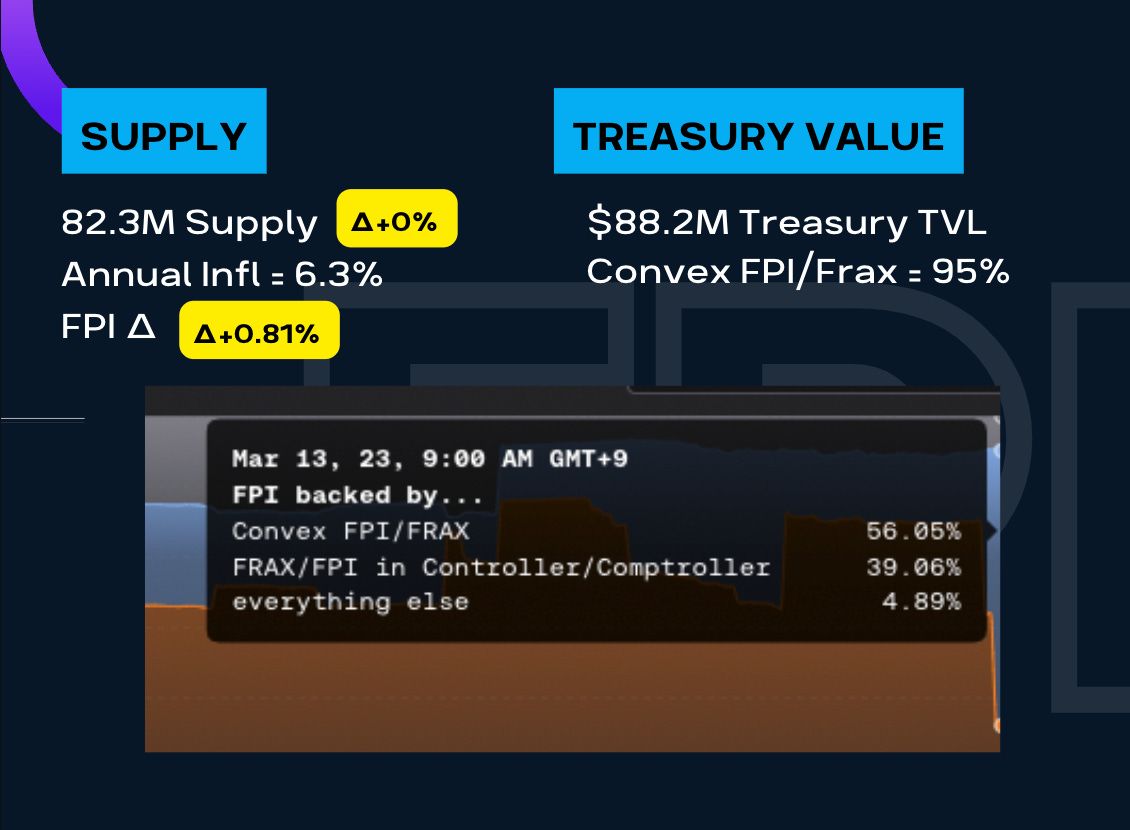

Next we have a new section I added. Another one of Frax’s product that might not get as much as love as the other products is FPI. Quick refresher, FPI is a Frax Price Index, which is a stablecoin that tracks inflation. This is the first product of its kind on chain. Let’s run through the numbers! So far, we have 82.3M supply of FPI, current inflation reading is 6.3% and the FPI peg is ABOVE by 0.81% of its peg. And you’re wondering how it maintains its peg to inflation, well that’s what the treasury is for. For the record, FPI’s treasury is at $88.2M. Similar to how the AMOs work for Frax stablecoin’s treasury, the FPI’s treasury is made up of FPI, FRAX, and a small percentage holding of FXS. As you can see 95% of the treasury is in the FPI/FRAX conve. The team deployed the 10% of FPI and FRAX that were sitting in the comptroller contract to add more stability to FPI. All these assets are put to work just like in the AMO to earn that needed yield to keep FPI at the inflation peg.

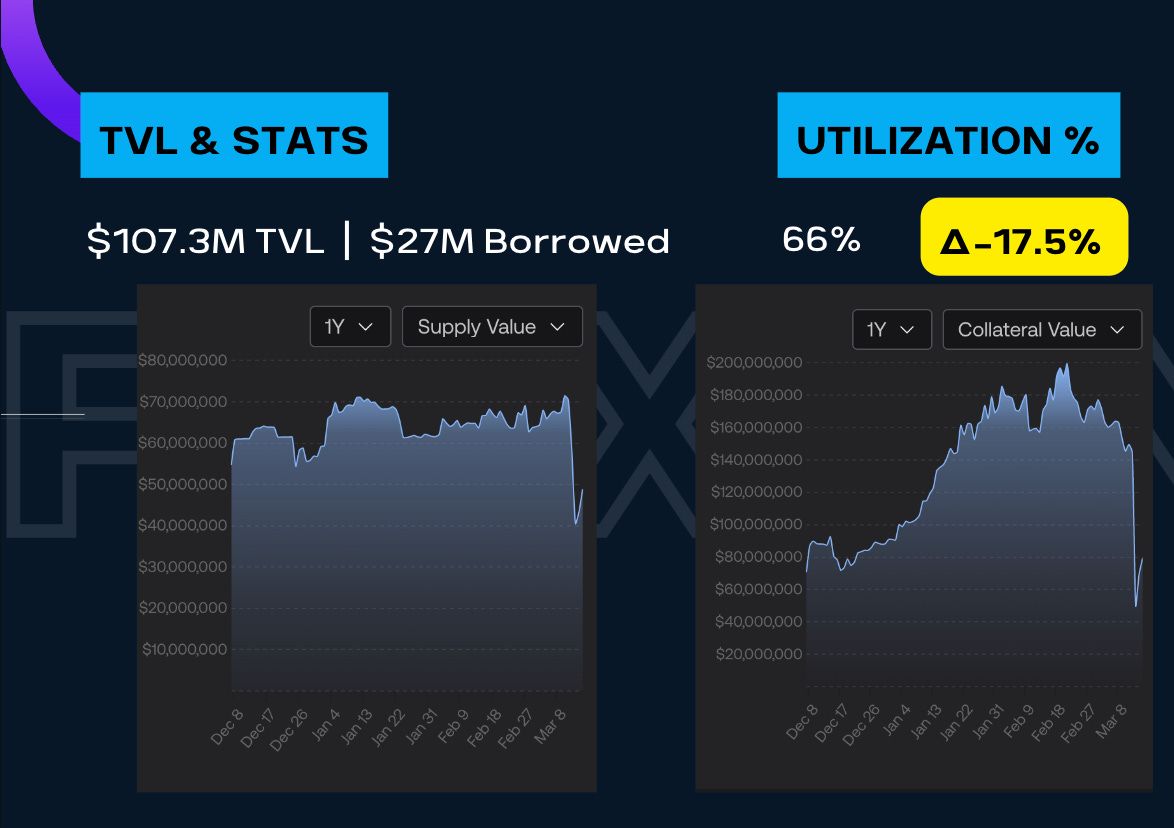

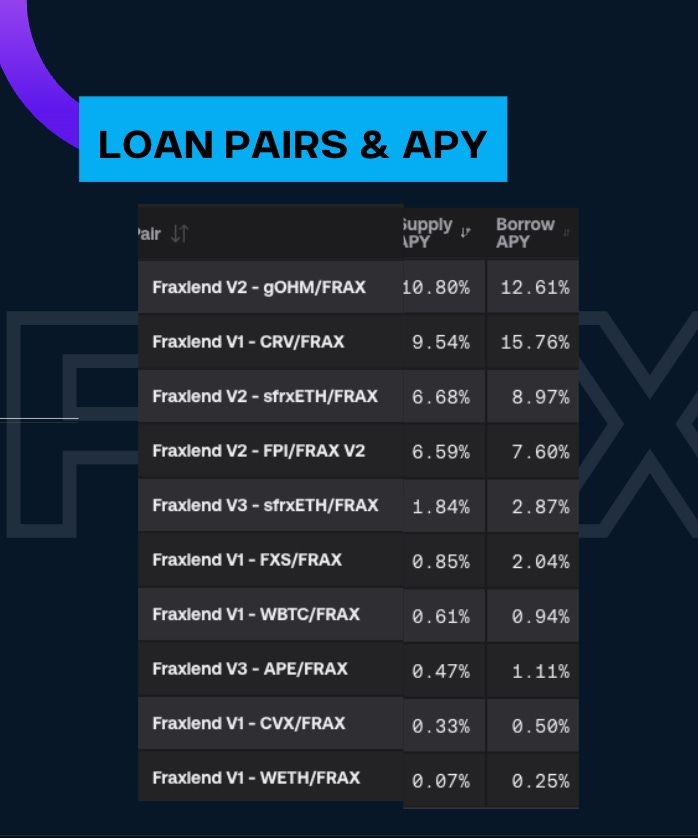

Next we have our FraxLend section. We saw a massive drop in TVL of nearly $100M. We currently at 107M in TVL with $27M in borrowed FRAX. The Utilization rate dropped by 17% down to 66% from just a week ago. From the two charts, we see that the Supply Value of FRAX just took a nose dive alongside with the Collateral Value. We pretty much hit reset on both of these values and started near the beginning of FraxLend again. Currently, there are many pairs being offered on FraxLend but more and more are being added. Also look at the current Supply APY for gOHM/FRAX pair. A whopping 10.8%. then right behind it is the CRV/FRAX pair at 9.5%. A little further down the list you see there’s the sfrxETH/FRAX pool with a juicy 6.7% APY. Be sure to listen to our Governance Roundup to get any alpha on any future pairs.

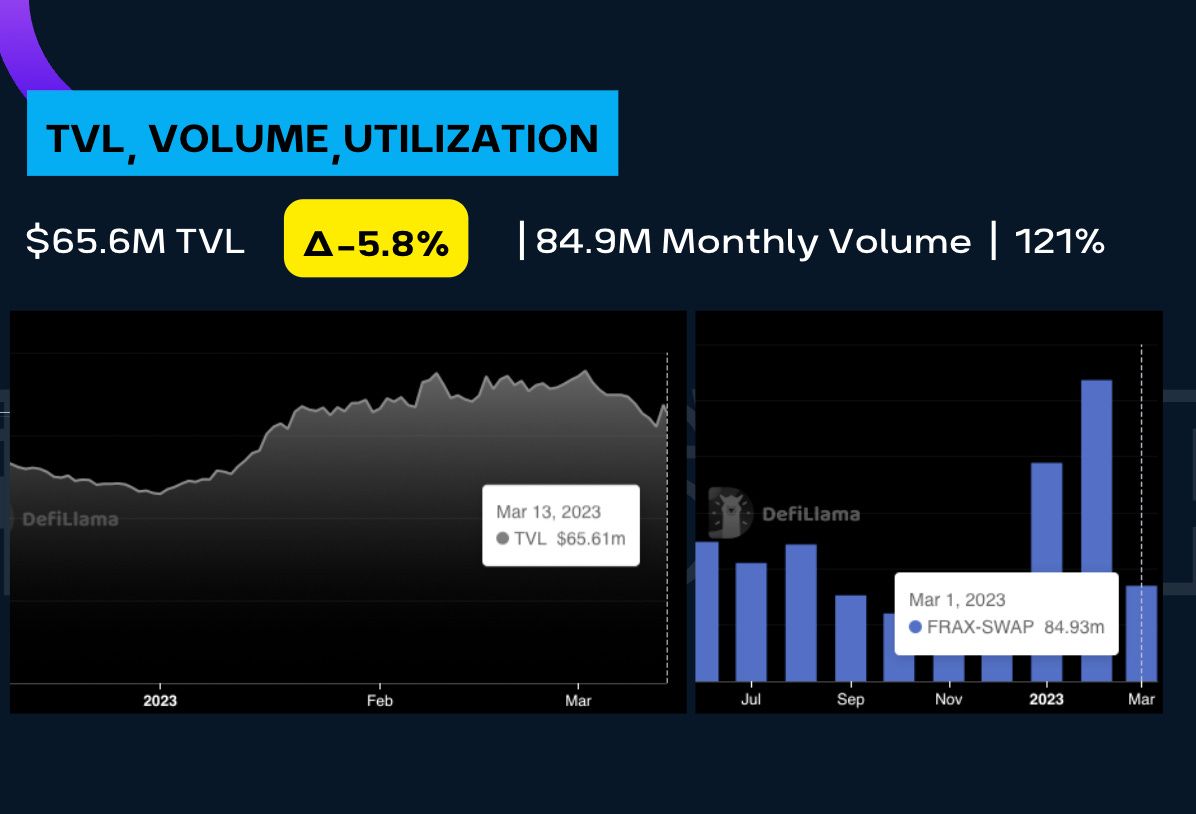

The last leg of the Stablecoin Maximalism: the DEX aka FraxSwap. Per DeFi Llama, the TVL is $65.6M with 85M monthly volume for March so far. I just took the Monthly volume divided by the TVL to get a utilization rate of 121% -- surprisingly this isn’t as high as what I thought we would see given th volume Curve was putting up.

Finally, let’s jump into our profitability section starting an overview of the AMO holdings. We are down quite badly. The grand total of all AMOs dropped by over $150M. The Curve AMO dropped by 100M down to $606M, Liquidity $75M, lost $5M, Lending $79.9M lost $15M, and Investor 179M, lost 45M. It’s going to take us quite some time to regain all of these assets into the treasury. But Flywheel DeFi will be here every week reporting in on every step of the journey.

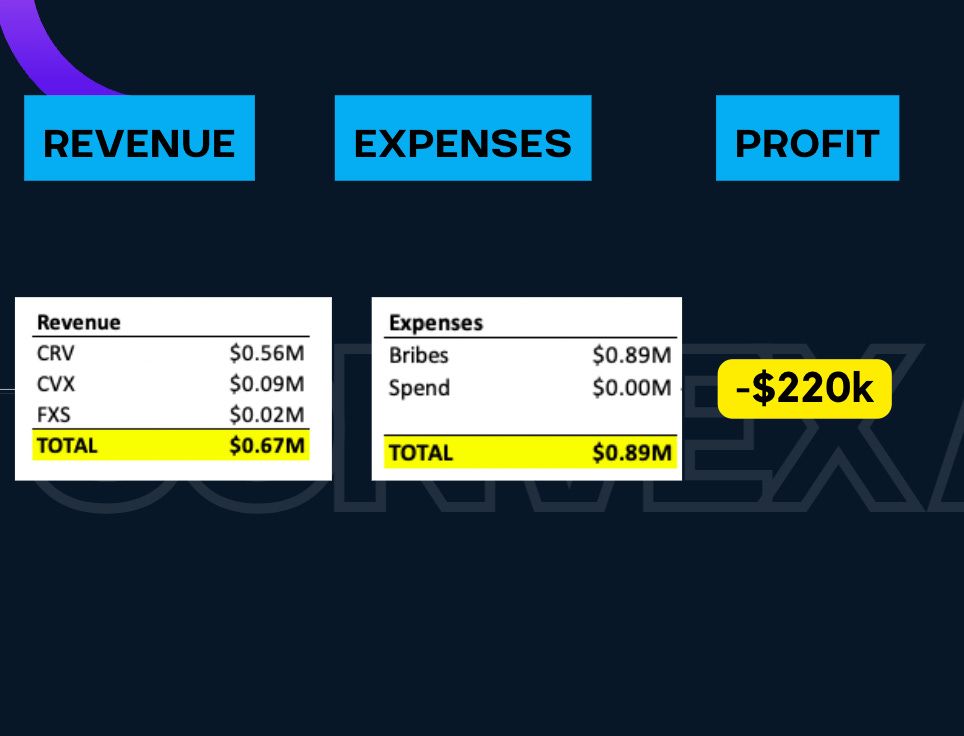

Onto the profitability of the Convex AMO. For the month of March, we have $670k in revenue and $890k in bribe expense, which means we are at a loss of $220k for March. We have a bribe payment coming up shortly so we will see higher losses for the month – with the market no longer in the echo bubble mode, I feel this is going to be a red month for us.

ACCESS TO SLIDES: Here

~~~~

Follow Flywheelpod Twitter: https://twitter.com/flywheeldefi

Telegram: https://t.me/FlywheelDeFi

~~~~

Listen to Flywheelpod Wherever You Listen to Podcasts:

~~~~

Connect with DeFi Dave Twitter: https://twitter.com/DeFiDave22

~~~~

Connect with Kiet Twitter: https://twitter.com/0xkapital_k

~~~~

Connect with Producer Sam Twitter: https://twitter.com/traders_insight

Telegram: https://t.me/ssmccul

~~~~

Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This video is not tax advice. Talk to your accountant. Do your own research.