Welcome to Frax Check. Your weekly frax vibe check. I am your host Kapital_K and I’m joined by my cohost DeFi Dave and our producer extraordinaire Sam. We will be going straight to the source of truth via checking the chain. Before we jump in, please subscribe to the flywheel, it really does help! Please also follow us @flywheeldefi on Twitter and tg.

This week.. I call this week the “UP ONLY (mostly)” week. As the name suggests, this week things are bumping upwards. It feels good. Frax Check will now break up into two main sections: Product Lines and Profitability. As the name suggests, for the first section, we’re going to go through some of Frax’s products such as FRAX (the stablecoin), frxETH (the stablecoin), FraxBP, FraxLend, FraxSwap, you get the idea. Then we’ll investigate the Profitability across these products.

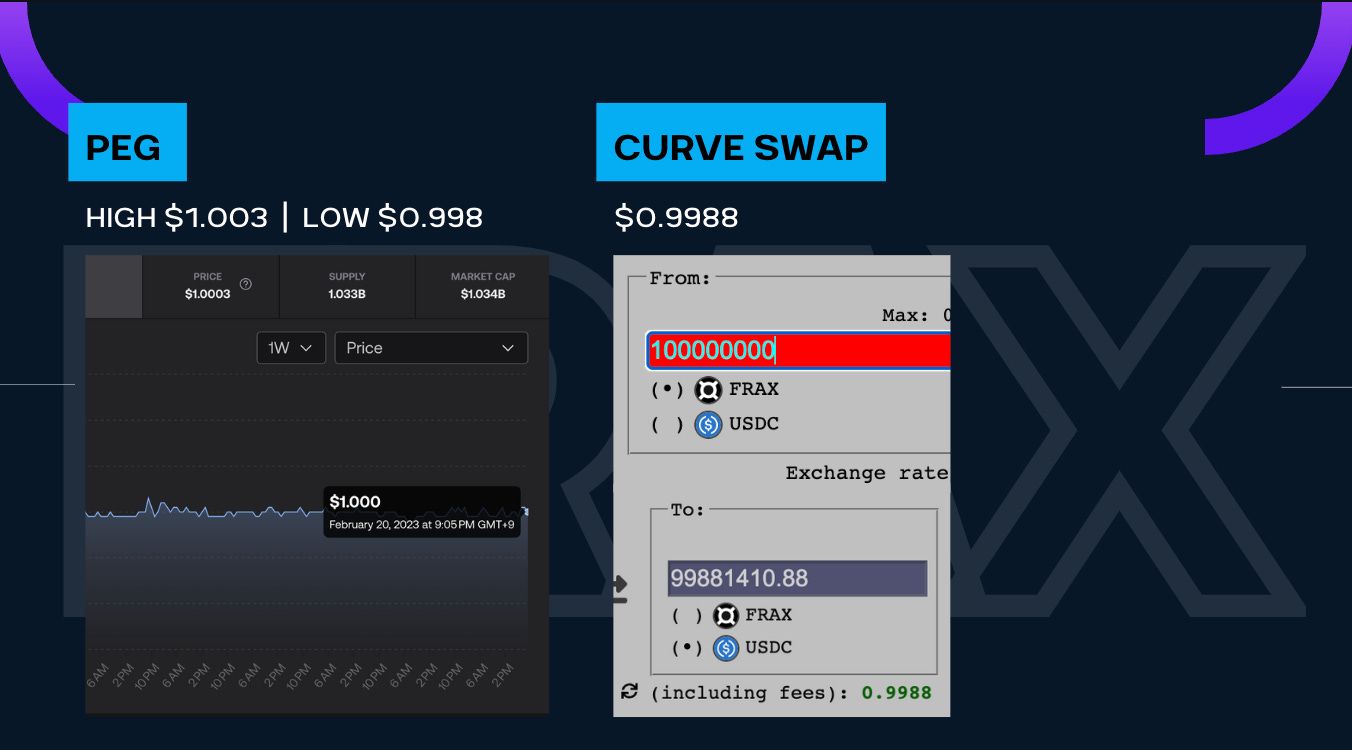

We start with the flagship product: $FRAX stablecoin. We see the Supply has been holding steady at $1B-ish for the past month or so. Not much to update here. Then obvs, we must check the peg, which got as low as $0.998 with a high of $1.003 for the week. Peg Check = Strong. We then looked at Curve via swapping 100M FRAX for USDC. We received a 0.9988 exchange rate. This is 4 bps increase over last week. Nothing newsworthy this week so moving on we have our Collateralization %.

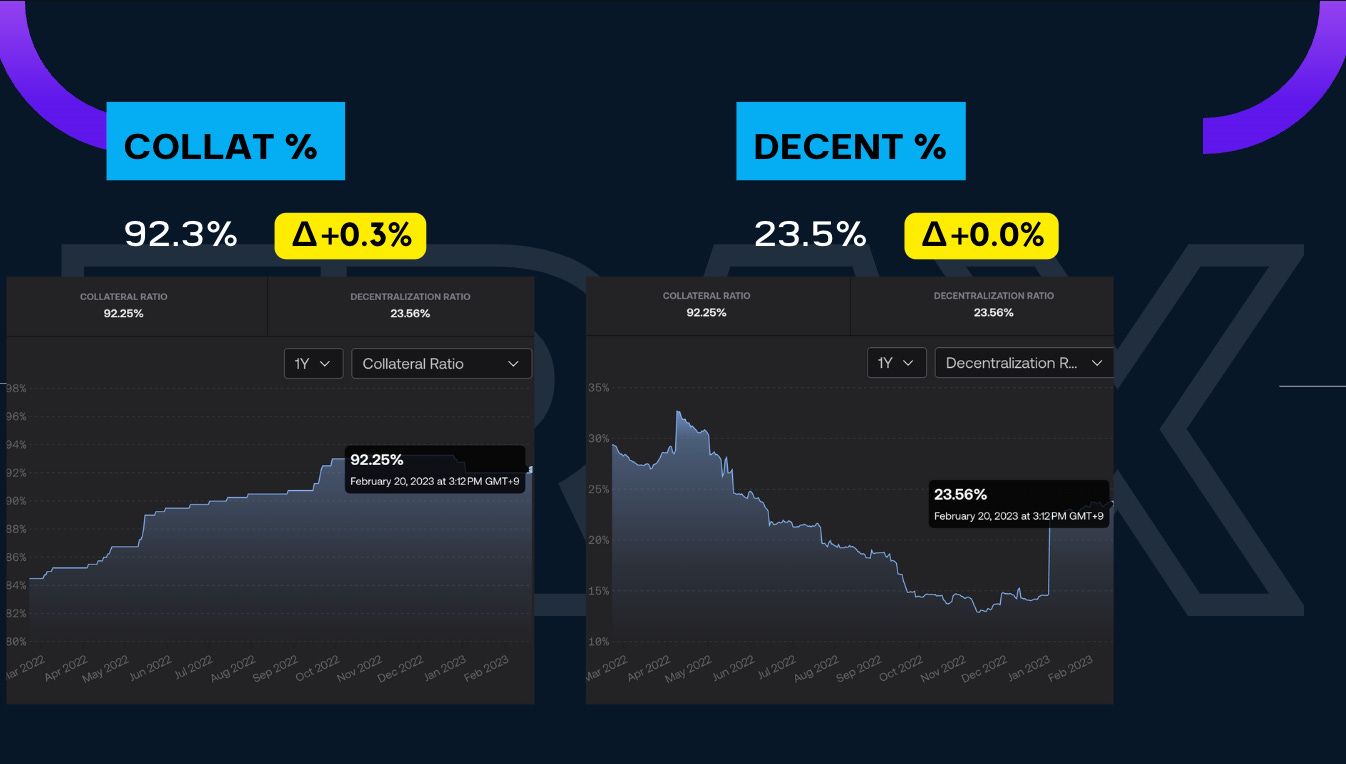

This is the % that conveys how much FXS (algorithmic) is used as collateral. We remained unchanged for the week still at 92.3%, slight 30bps movement over the last 8 Frax Checks. Following we have the Decentralize %. Pretty much unchanged at 23.5%. Still V v v v much bear market vibes across the board when it comes to these two metrics. The Frax team has a goal to get it to one hunnid! But some members of the community wants to see the Collat % going back to the low 80s and the Decent % going back to 30s.

Okay. Quick summary Health Check. Peg Good. Curve Swap unchanged Collat % could be better been stagnant. Decent % may be in a reversal to the upside. Next, we have the FraxBP product, which imo is sort of like liquidity as a service.

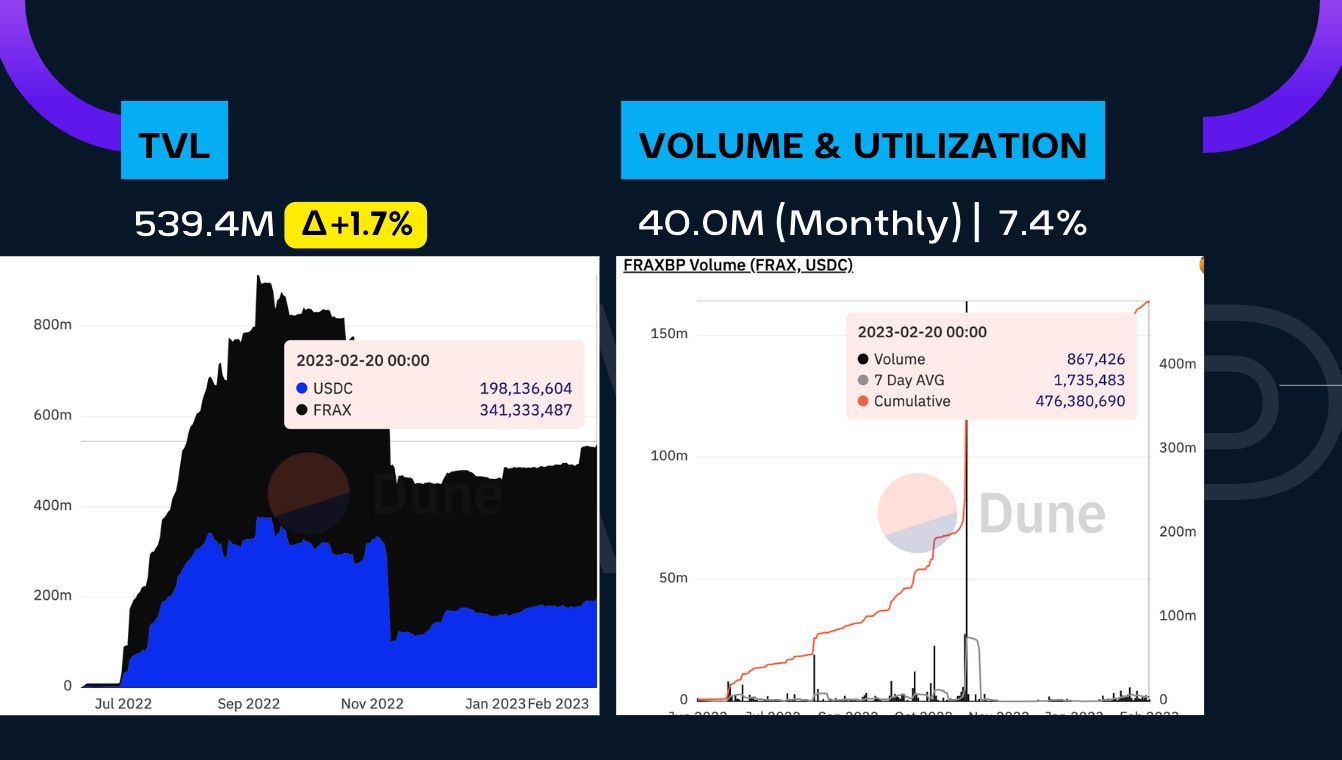

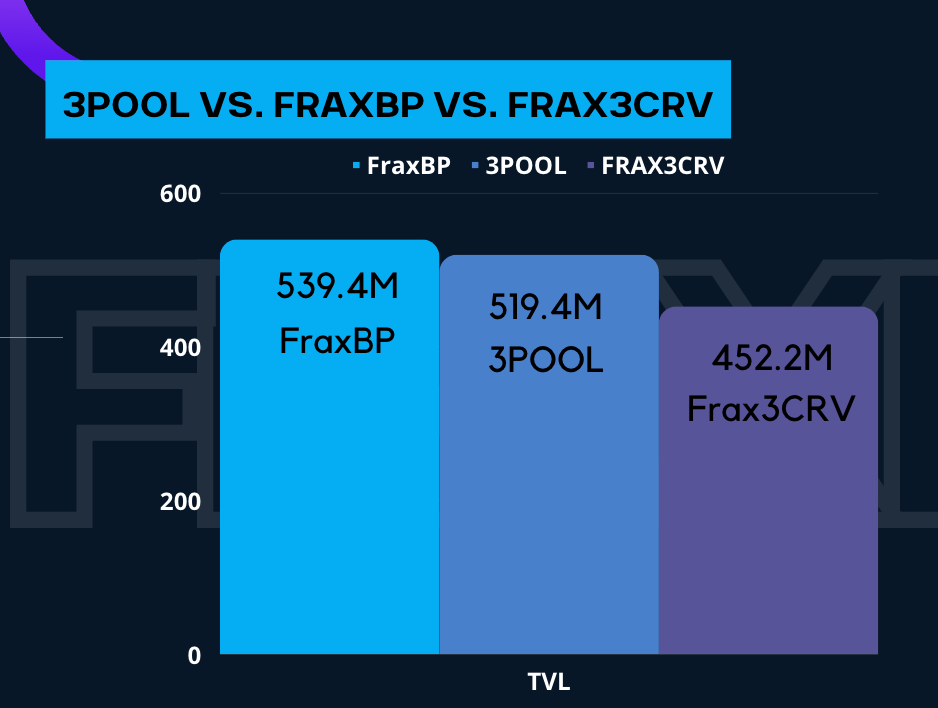

For this week we saw the FraxBP TVL got to $539.4M, which is 1.7% increase from last week. On the right side we have a new metric I wanted to start looking at which is the volume traded. For context, in January we had 12.1M, and in February we hit 40.0M already. Though, this is still only 7.4% of the TVL.

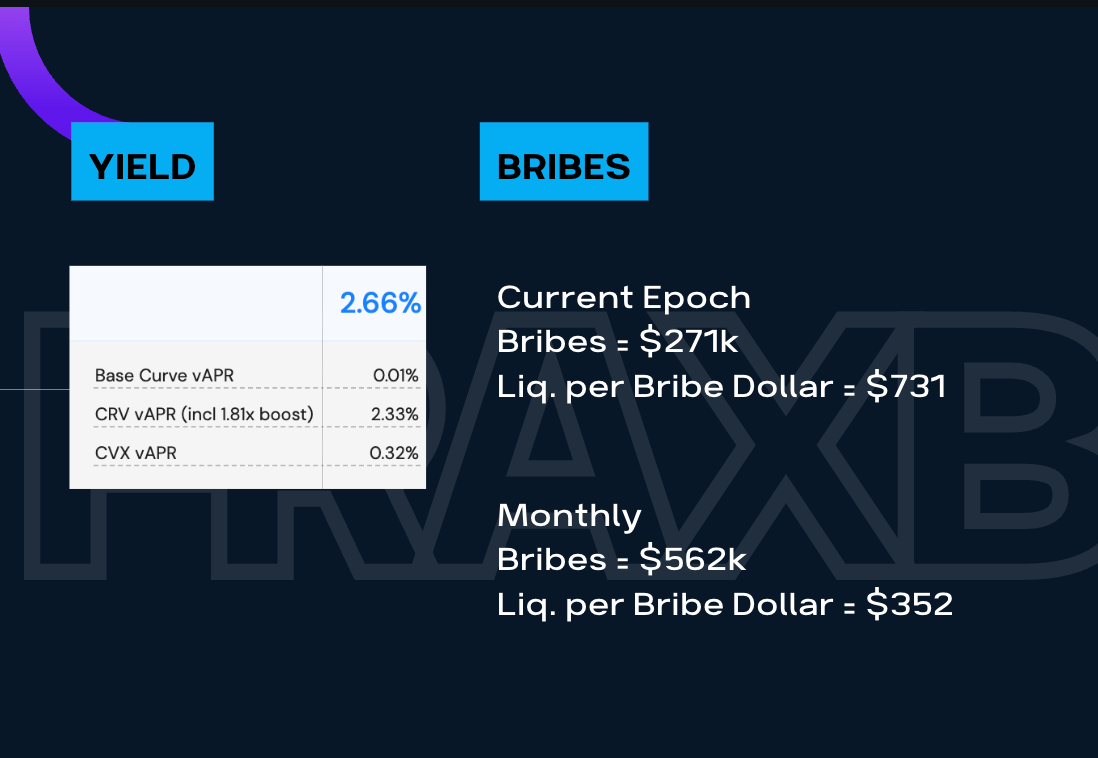

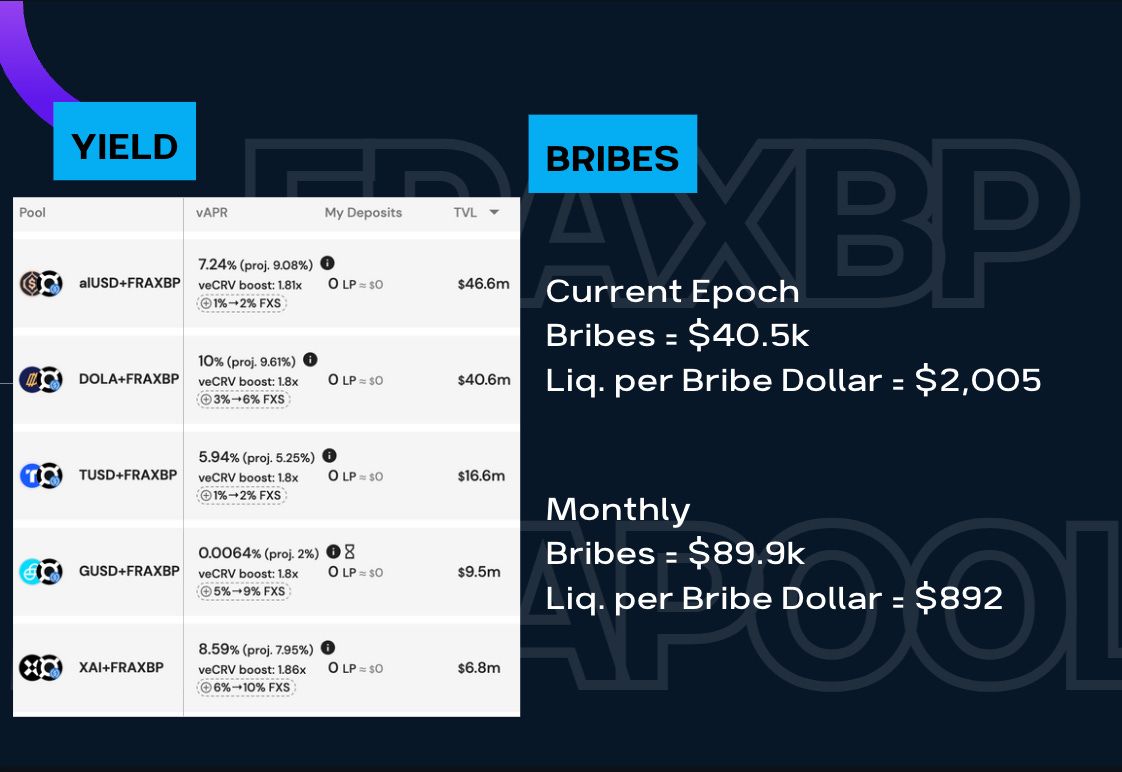

Following this slide, we have a yield and bribes section, where I look at the current yield being offered to LP into this pool and the bribes Frax Finance had to pay for the yield. You see here that there’s an APR of 2.66% for a $539M pool so the estimated $550k of yield for the 14-day epoch because Votium epochs are 14 days. Then we compare that to the bribes paid we see if there was any net gain on the bribes. This epoch so far, we paid $271k so rough back of the envelope math says we’re doing pretty good so far this month. However it’s important to note that Frax Finance’s POL isn’t the only liquidity in the pool so its reward shares are definitely diluted but that’s part of the plan as Frax wants to attract liquidity into the FraxBP. To that end, $731 of liquidity were incentivized by $1 of bribes paid.

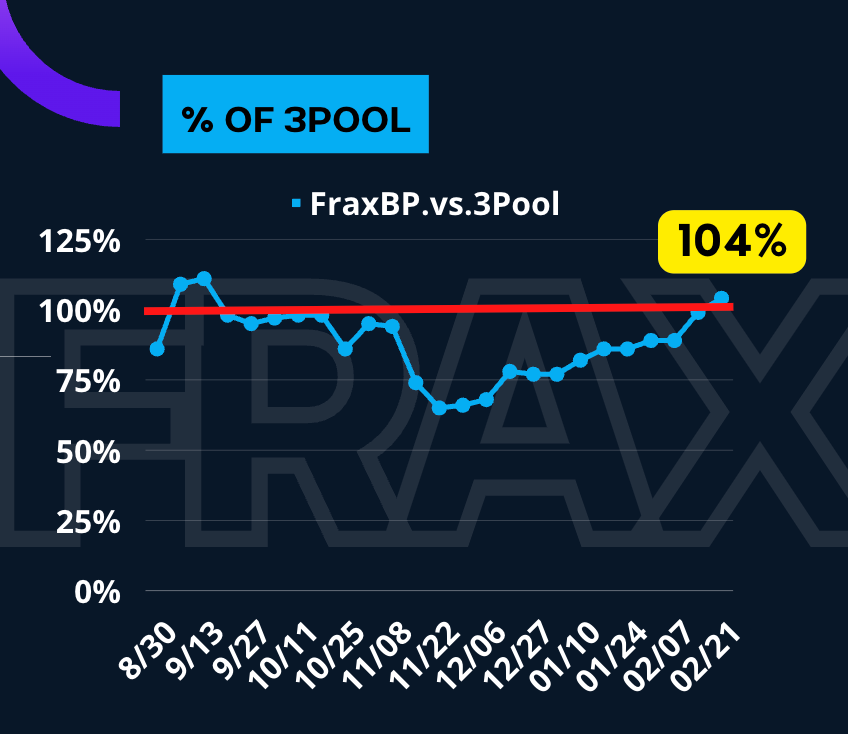

Now, we march forward to my favorite section of the Frax Check. Ladies and gents, we are… drumroll…. at 104% of the 3pool. Queue DJ Khaled’s All We Do Is Win music! UP ONLY. The FraxBasedPool is $539.4M versus 3pool's $519.4M. What’s noteworthy is that the FraxBP didn’t gain that much TVL but 3pool lost over $20M. Note that we are now way above the Frax3CRV pool!!! Now, it wasn’t easy to get to the top but now we gotta stay at the top.

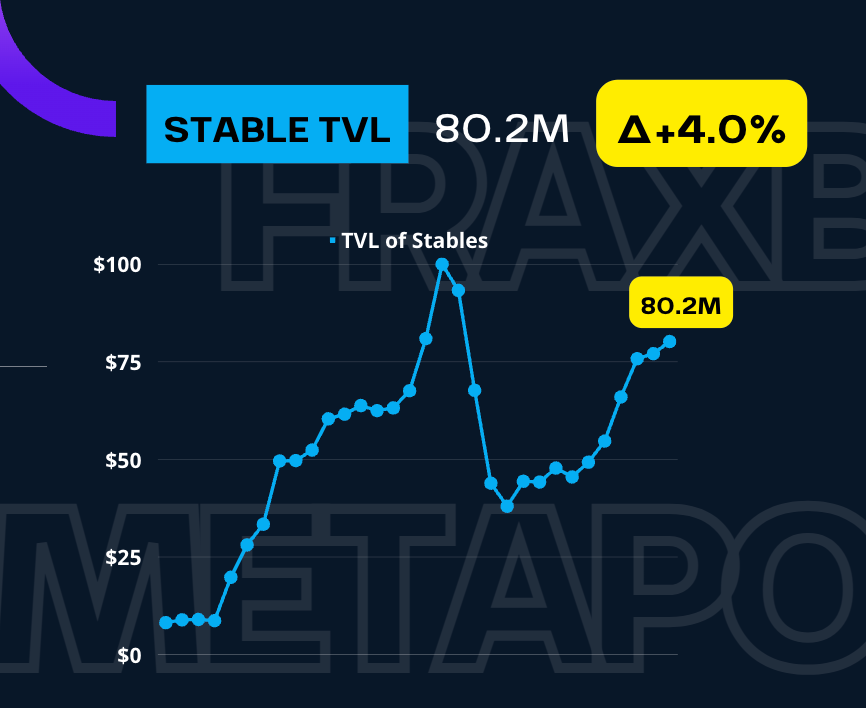

Reminder the metapool are pools that are PAIRED with the BasedPool, examples like LUSD/FraxBP. We’re at $80M, an increase of 4% from last week. On the following slide, we’ll quickly cover some yields on these metapools as well as the bribes paid. Because there are quite a few stablepair metapools, I’m only looking at the top ones by TVL. The alUSD and FRAXBP pair is paying out 7% APR at nearly $47M in TVL, this gained about $30M TVL since I talked about it last week. I like that y’all are paying attention. Honestly, still not too shabby if you believe/trust in alchemix’s mechanism and collateral set. Another thing is that BUSD basically dropped off the map with a drop of basically 90% of its TVL. If you’re a CZ fan and binance believer, could be a good chance to get some outsized APR. On the bribes front, Frax paid $40.5k this epoch. And if we look at Liquidity per Bribe Dollar, Frax was able to pull in $2,005 per $1 of bribes spent. For the whole month Frax spent $90k and got $892 of liquidity per $1 bribe dollar spent. So, c’mon people, we got some yield and liquidity for your community, so come and get some! Any projects out there looking to work with the Metapool, please join the Flywheel TG chat and DM any of the hosts for assistance.

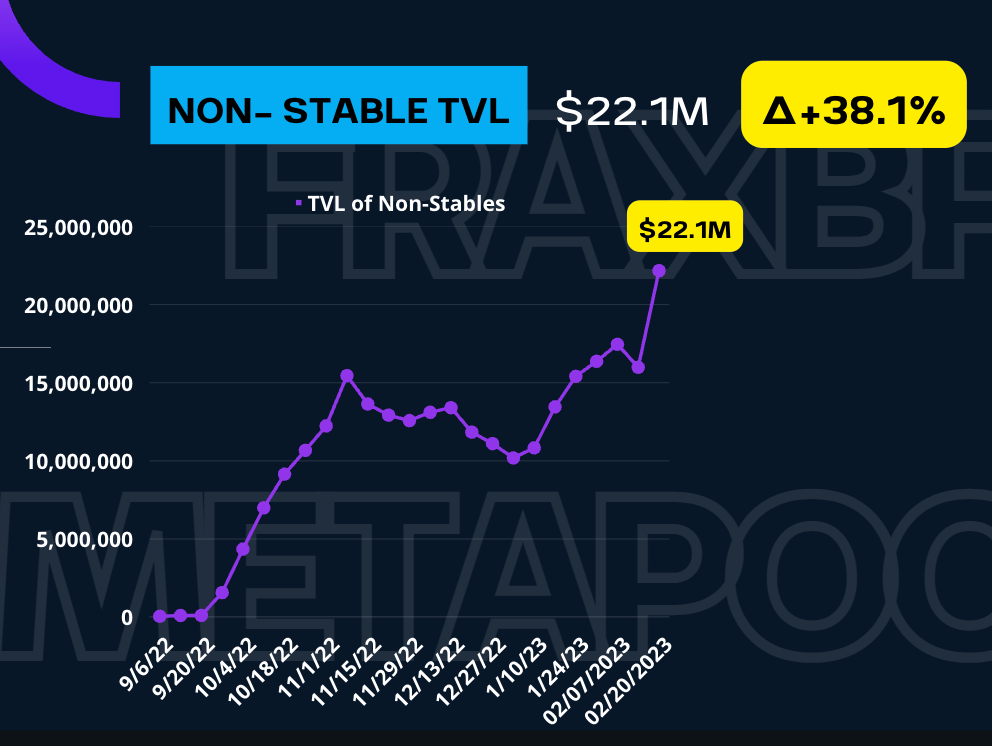

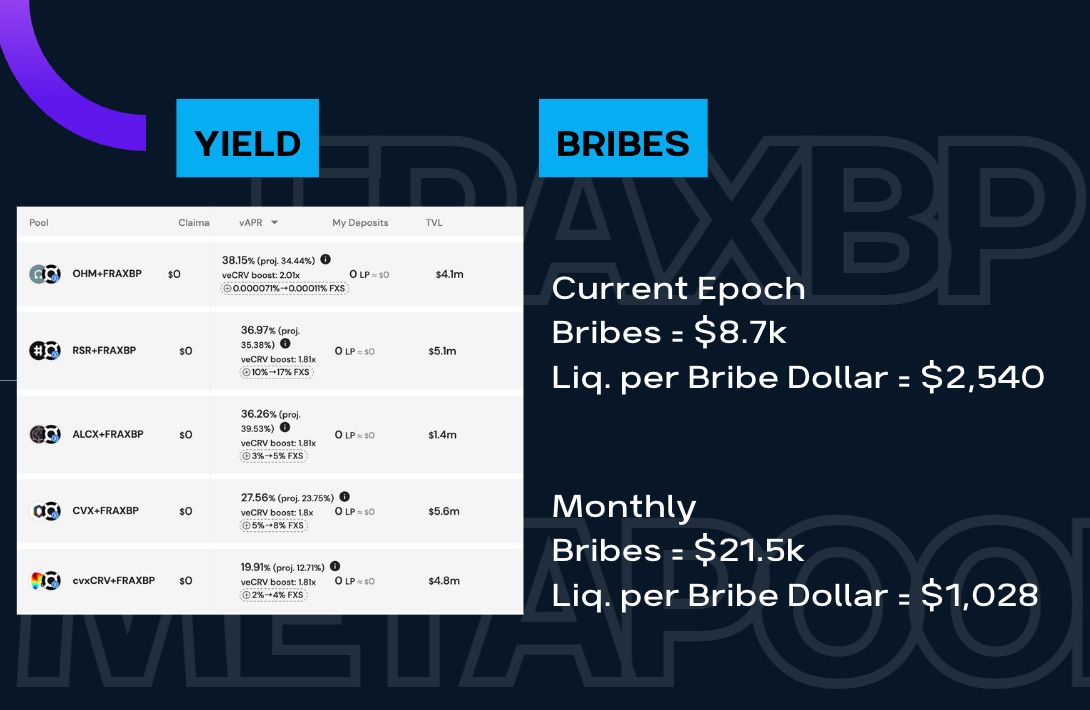

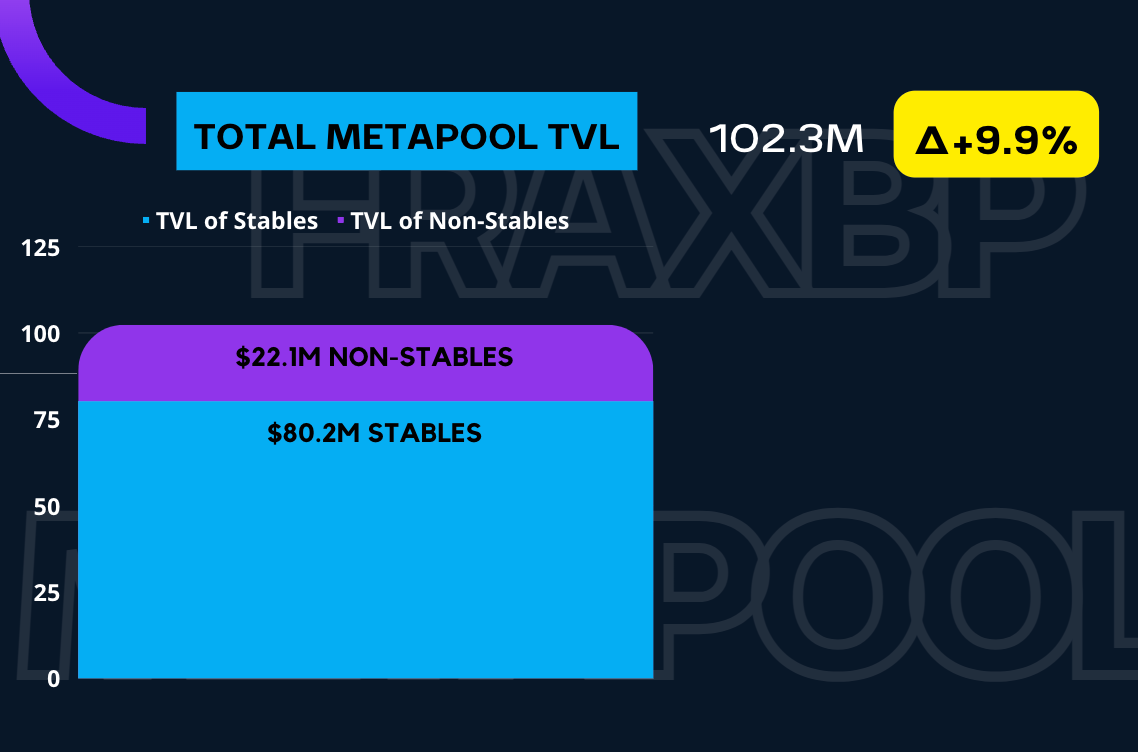

Also one quick note, we also have an additional $22M of TVL from non-stable pairs in the Metapools. These are pairs like cvxfxs/FraxBP and cvxcrv/FraxBP. That is a pop of 38% over last week. UP ONLY baby! Similarly, I wanted to look at some of the yield and the bribes for these non-stable metapool pairs. For this category, I went the other route and sorted by APR. We see here that OHM-FRAXBP is offering a whopping 38% APR! Wooh! That’s at least 3 weeks of that 35%+ APRs and OHM been pretty stable (but maybe you don’t want that in this echo bubble we got here) Then we have the usual flywheel suspects of CVX, cvxCRV, and cvxFXS at a range between 20 - 30%. Alcx/FraxBP is also paying a nice 36%. On the bribes side, Frax paid $8.7k this epoch and incentivized over $2.5k in liquidity. So far this month, Frax paid $21.5k and the liquidity incented is $1,028 of liquidity per $1 of bribe spent.

So, adding all of the stables and non-stables TVL, we have a total of $102.3M of liquidity paired against FraxBP – up 10% this week. And we broke the 9 figure club again baby! UP ONLY!

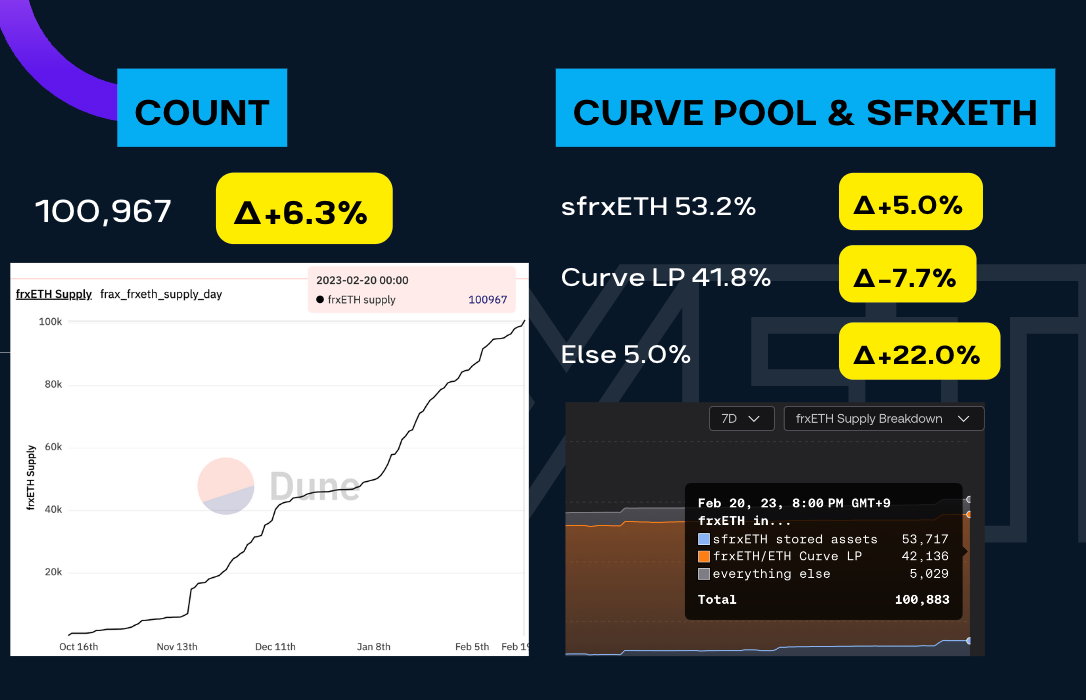

Next, we have our FrxETH segment. We start by checking the frxETH supply. As always, it’s up only! The count is at 100,967. And look at that chart, I know you can’t read it but just appreciate the verticalness off that graph. +6.3%. Hot. I do think we may slow down in percentage growth terms as we’re getting to size but I hope we don’t! Let’s look at where the frxETHs are hanging out! As a reminder, You can stake your frxETH into the sfrxETH vault to earn the native ETH staking yield. And in that vault we see that 53.2% of the frxETH is chilling and stacking ETH earning a nice 7.4% APR. The other place you can take your frxETH is to the curve pool of frxETH/ETH, where you can join 42% of the frxETH supply earning 7.7% APR in CVX, CRV, FXS. The remainder 5% is floating in the ether somewhere. I think the yield parity between the sfrxETH and Curve pool is reflected in the current split. Unless Frax cranks up the bribes a bit more, I think we’ll see this heavier flow into sfrxETH. And also lets note that there’s 5% of frxETH just chilling. But enough talk of the supply and the yield, let’s get down to the peg.

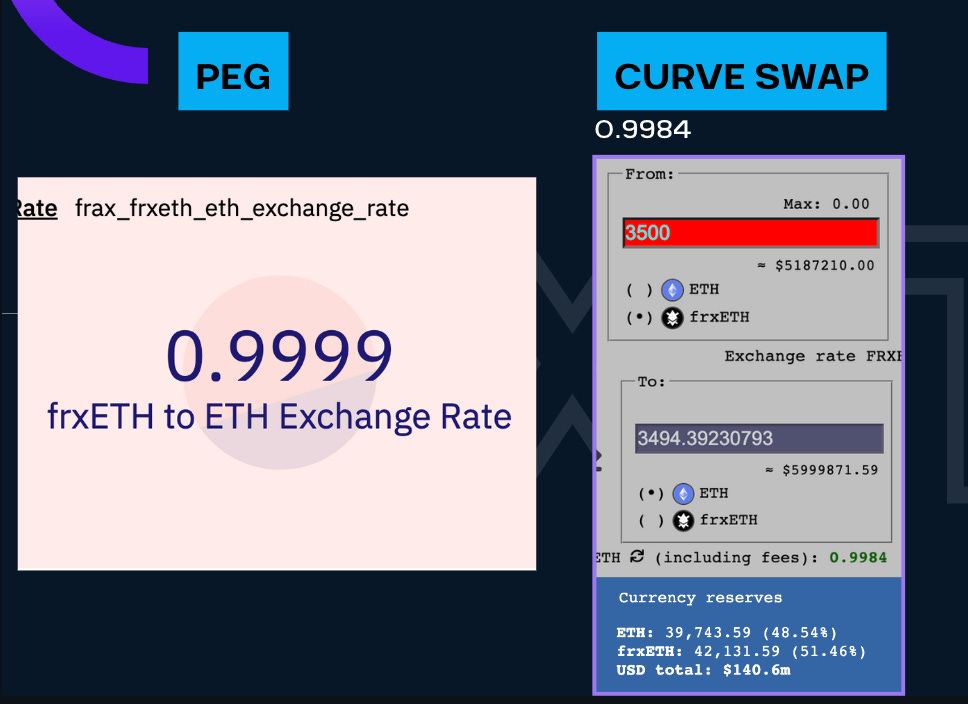

Peg check is pretty much as strong as it could be, you see the price delta at 0.0001 between frxETH and ETH. UP ONLY! But, we obvs have to go into the market and check this ourselves and you see here that I tried to swap a 3500 frxETH which is roughly the amount of the largest frxETH holder and I get an exchange rate of 0.9984. And also let’s just note the TVL here, we’re at $140M. Still 9 SOLID FIGURES baby. So far so good, let’s see how we stack up with the others.

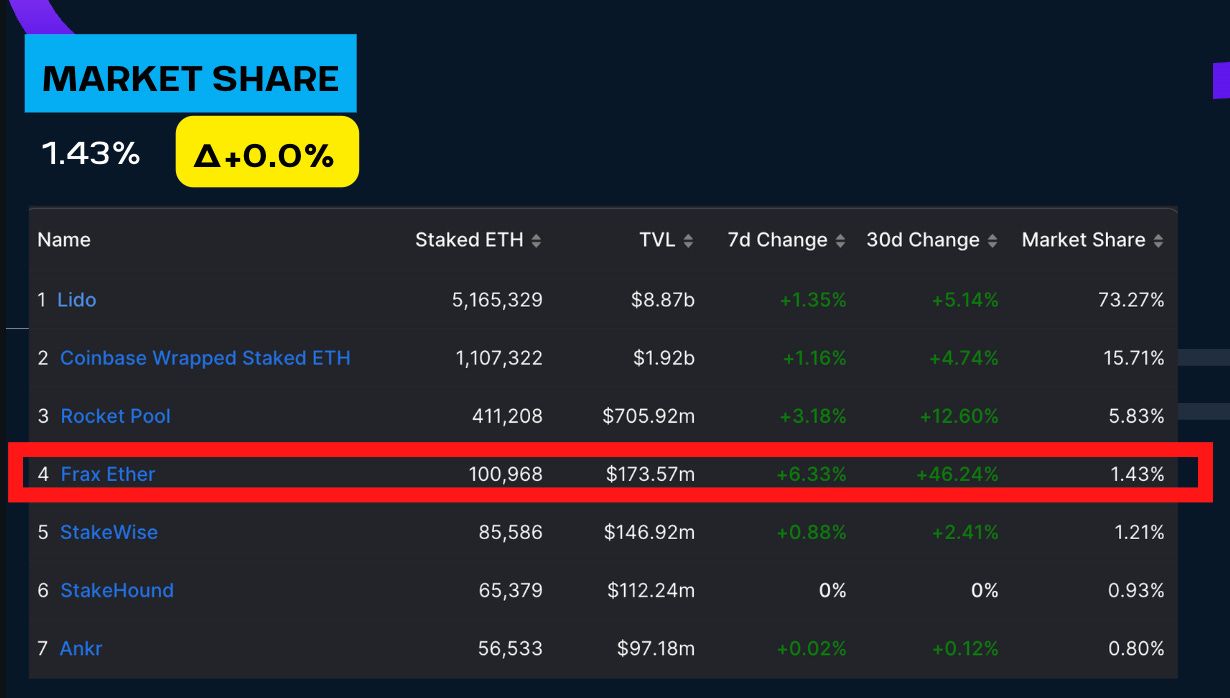

Here we layout the LSD market landscape. Obvs, we have Lido in the lead with 73% of the market but you can see here that Frax REMAINED the highest 30-day delta in the group, at +46% so far. FrxETH’s market share is at 1.43%. We’ve official flipped Stakewise. I did some dirty math and if we keep up this monthly growth and Rocketpool keeps up their growth, we’ll flip Rocketpool in 4 months-ish. Let’s keep fighting the good fight! On the yield landscape, frxETH pretty much dominates with a 7.4% and the closest competitor is Stakewise at 5.2 %. We are the best game in town so come get some of this gud gud!

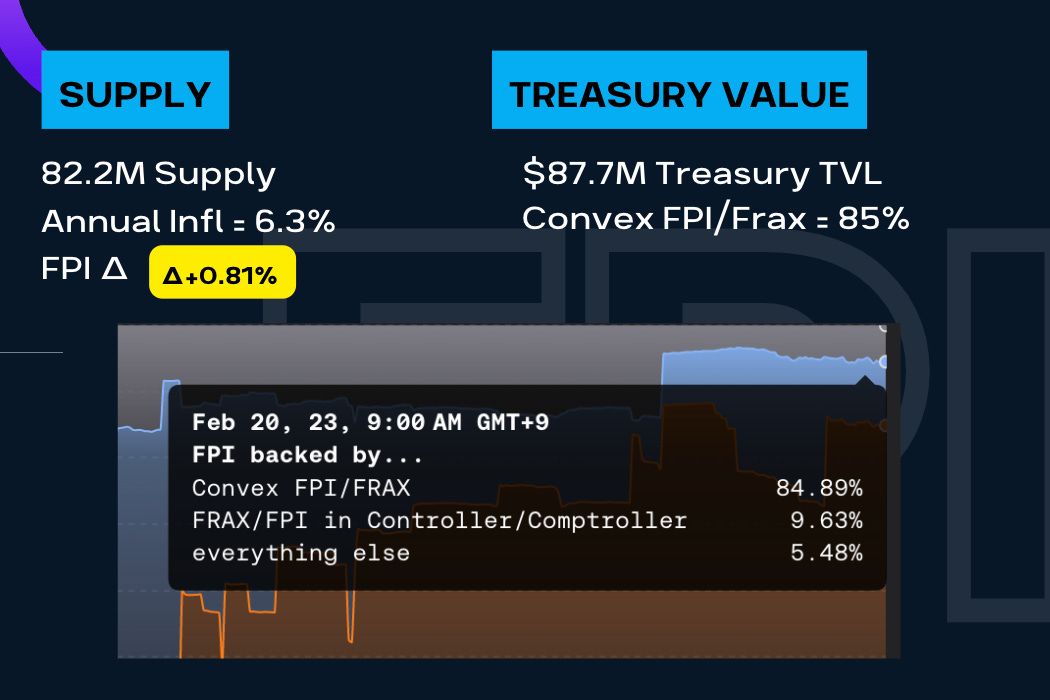

Next we have a new section I added. Another one of Frax’s product that might not get as much as love as the other products is FPI. Quick refresher, FPI is a Frax Price Index, which is a stablecoin that tracks inflation. This is the first product of its kind on chain. So lets run through the numbahs! So far, we have 82.2M supply of FPI, current inflation reading (since Dec 2022) is 6.3% and the FPI peg is ABOVE by 0.81% of its peg. And you’re wondering how does it maintain its peg to inflation, well that’s what the treasury is for. For the record, FPI’s treasury is at $87.7M. Like how the AMOs work for Frax stablecoin’s treasury, the FPI’s treasury is made up of FPI, FRAX, and a small percentage holding of FXS. As you can see 85% of the treasury is in the FPI/FRAX convex, with another 10% just consisting of FPI & FRAX chilling in the Controller/Comptroller smart contracts. All these assets are put to work just like in the AMO to earn that needed yield to keep FPI at the inflation peg.

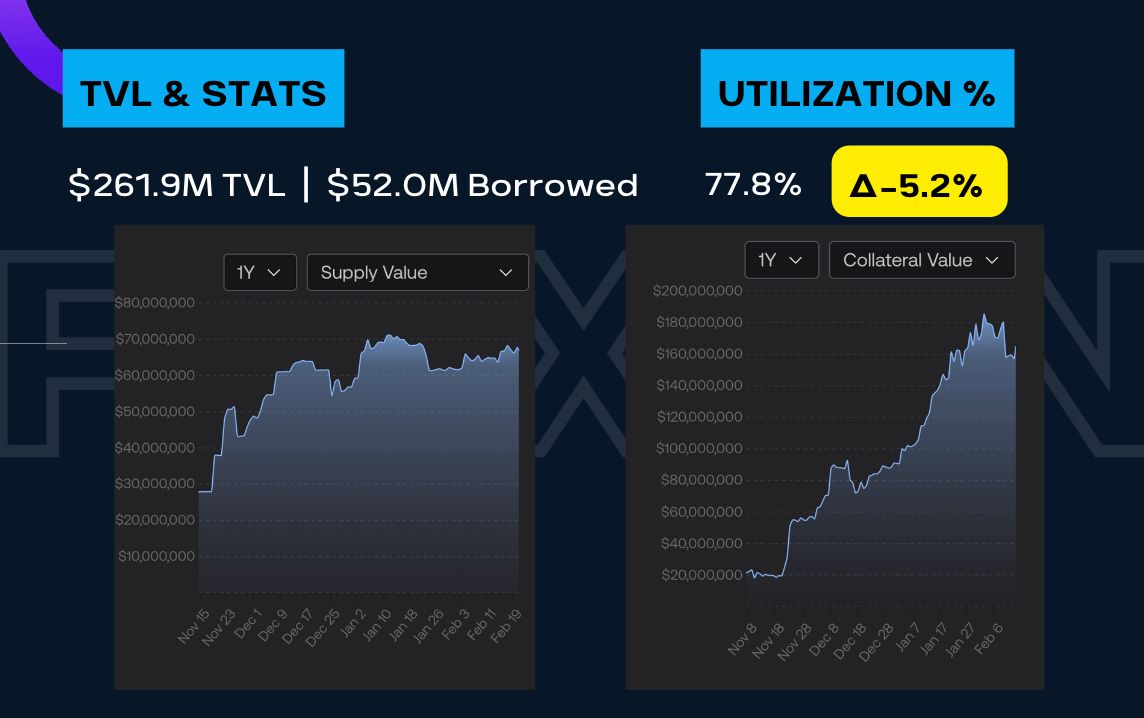

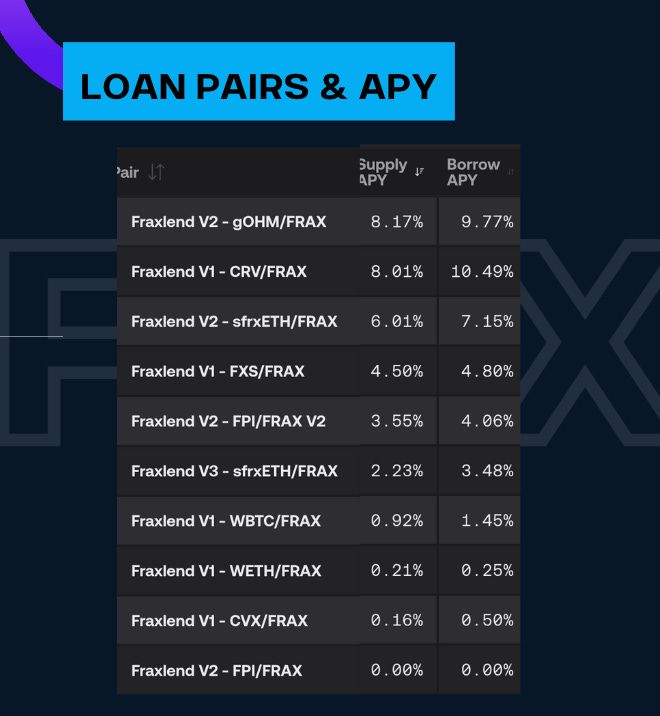

Next we have our FraxLend section. We’ve snatched a TVL of $261M with $52M in borrowed FRAX. The charts I like to look at are the Collateral Value and the Supply Value. These are great proxies for trust in the product. A good confidence check and you see the graphs are trending up and to the right. Following that I like to check the utilization %, which for me is how much of the total supply has been borrowed, and we’re at 77% utilization rate across all the lending pairs. This is a slightly different way of looking at utilization rates, but I prefer it. Currently, there are many pairs being offered on FraxLend but more and more are being added. Also take a look at the current Supply APY for gOHM/FRAXpair. A whopping 8%. Be sure to listen to our Governance Roundup to get any alpha on any future pairs. A little further down the list you see there’s the sfrxETH/FRAX pool with a respectable 6% APY.

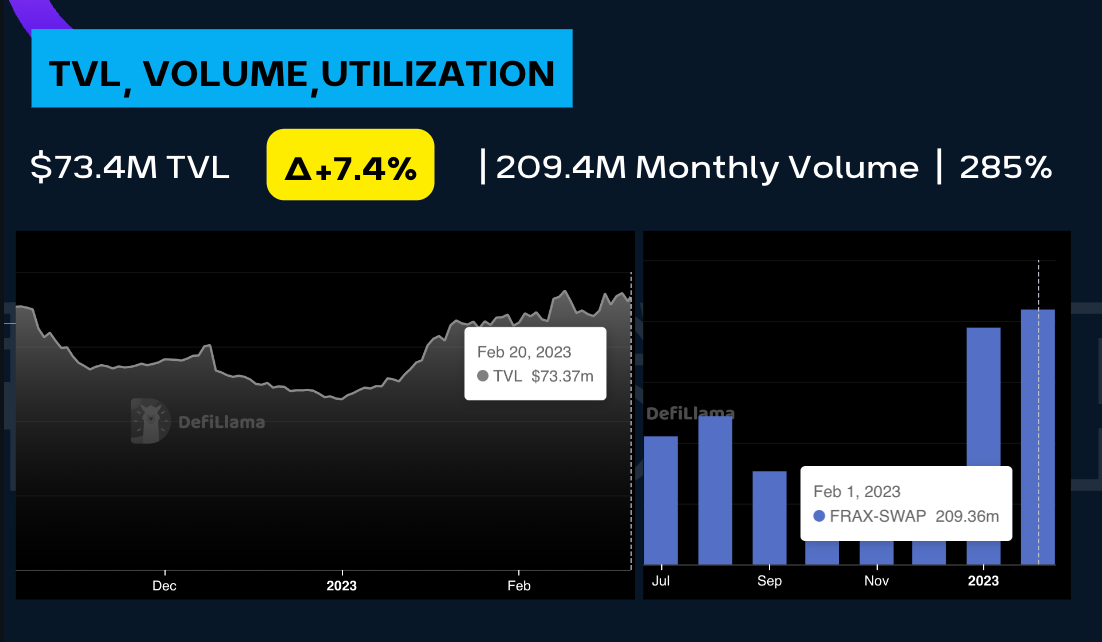

The last leg of the DeFi Trinity: the DEX aka FraxSwap. Per DeFi Llama, the TVL is $73M with a 209M monthly volume so far for February. I just took the Monthly volume divided by the TVL to get a utilization rate of 285%. Granted the volume this past month has been picking up so if you look at December, which looks to be about a third so utilization rate could be in the 70%s, but that’s still pretty good. In February so far, we’ve passed January’s volume and its only the 3/4 way through February. Now there is a slight discrepancy between DeFi Llama’s reported TVL and the one on Frax Facts but that’s because of the massive $85M FraxFPI pool that DeFi Llama isn’t including in the TVL.

Finally, let’s jump into our profitability section starting an overview of the AMO holdings. We have a grand total of $1046.1M across all the AMOs. This was a $6M change over last week with $3M going to the Investor AMO and $3M going into the Liquidity AMO. The Curve AMO is at 710M, Liquidity $83M, Lending $71M, and Investor 183M.

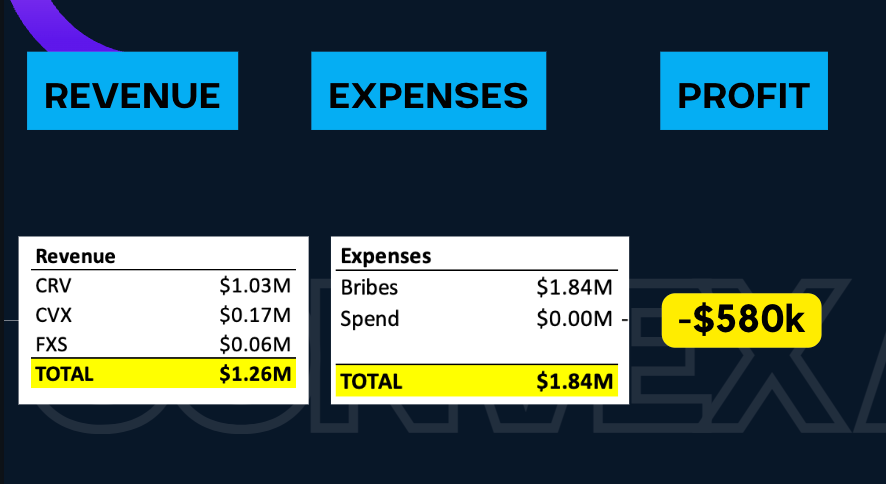

Onto the profitability of the Convex AMO. For the month of February so far, we have $1.26M in revenue and $1.84M in bribe expense. As you can see, most of our revenue comes from CRV rewards, magnitudes larger than the CVX and FXS rewards. With a net loss of $580k to start our month. We have a long way to climb to get over this profitability hurdle but it’s growth time so we gotta pay to play.

ACCESS TO SLIDES: Here

~~~~

Follow Flywheelpod Twitter: https://twitter.com/flywheeldefi

Telegram: https://t.me/FlywheelDeFi

~~~~

Listen to Flywheelpod Wherever You Listen to Podcasts:

~~~~

Connect with DeFi Dave Twitter: https://twitter.com/DeFiDave22

~~~~

Connect with Kiet Twitter: https://twitter.com/0xkapital_k

~~~~

Connect with Producer Sam Twitter: https://twitter.com/traders_insight

Telegram: https://t.me/ssmccul

~~~~

Not financial or tax advice. This channel is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This video is not tax advice. Talk to your accountant. Do your own research.