What is FrxETH?

tldr;: FrxETH is an ETH based stablecoin with a two token design, frxETH and sfrxETH. frxETH is a stablecoin that is loosely pegged to ETH, but it receives no staking yields. FrxETH can be staked to receive sFrxETH, which receives the yield earned from staking. Token holders must choose where to get their yield…. Frax or Curve LP. Its a FLYWHEEL of epic proportions.

The Cream Rises to the TOP

FrxETH has the best design for a liquid ETH staking derivative (LSD) in all of crypto. If that sounds crazy to you..

Let me just give some numbers.

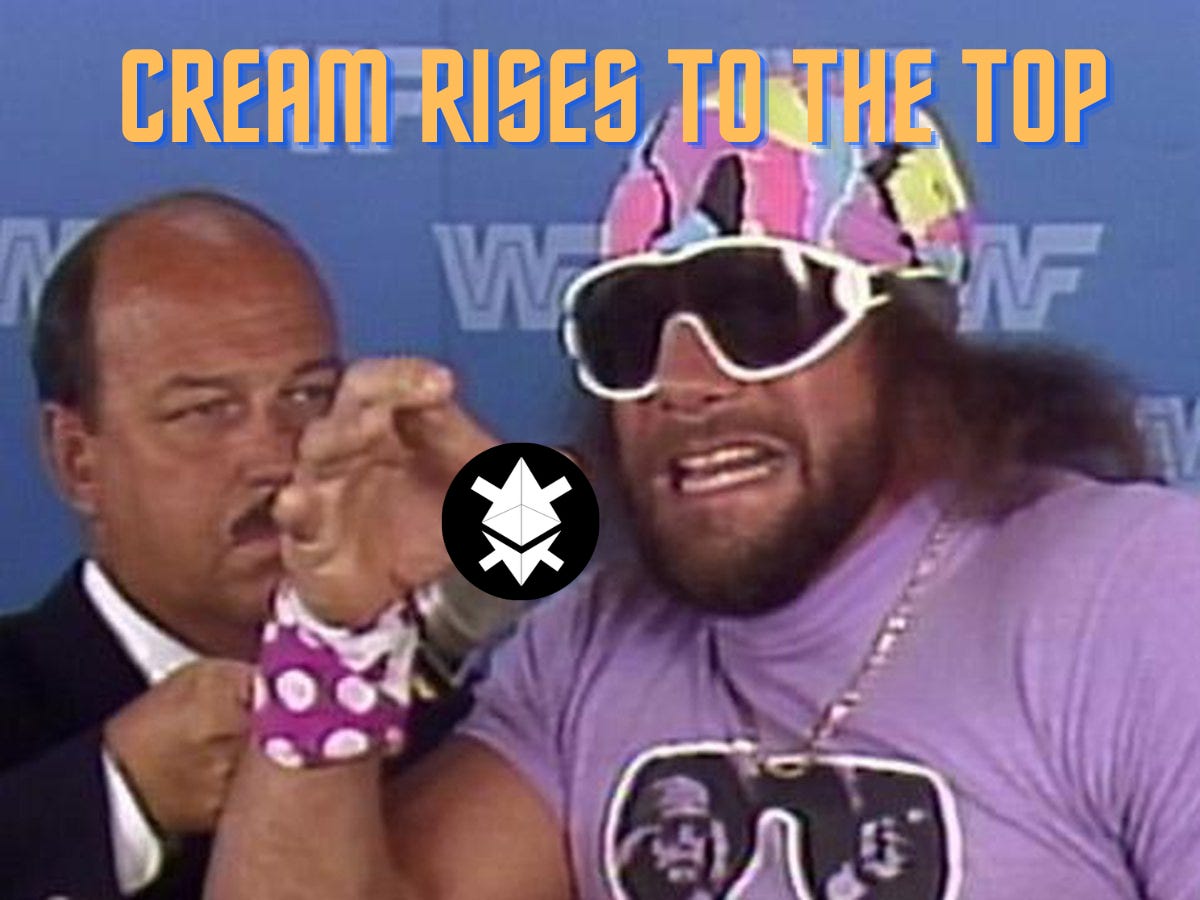

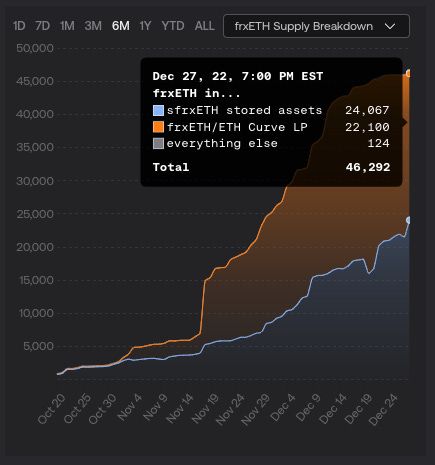

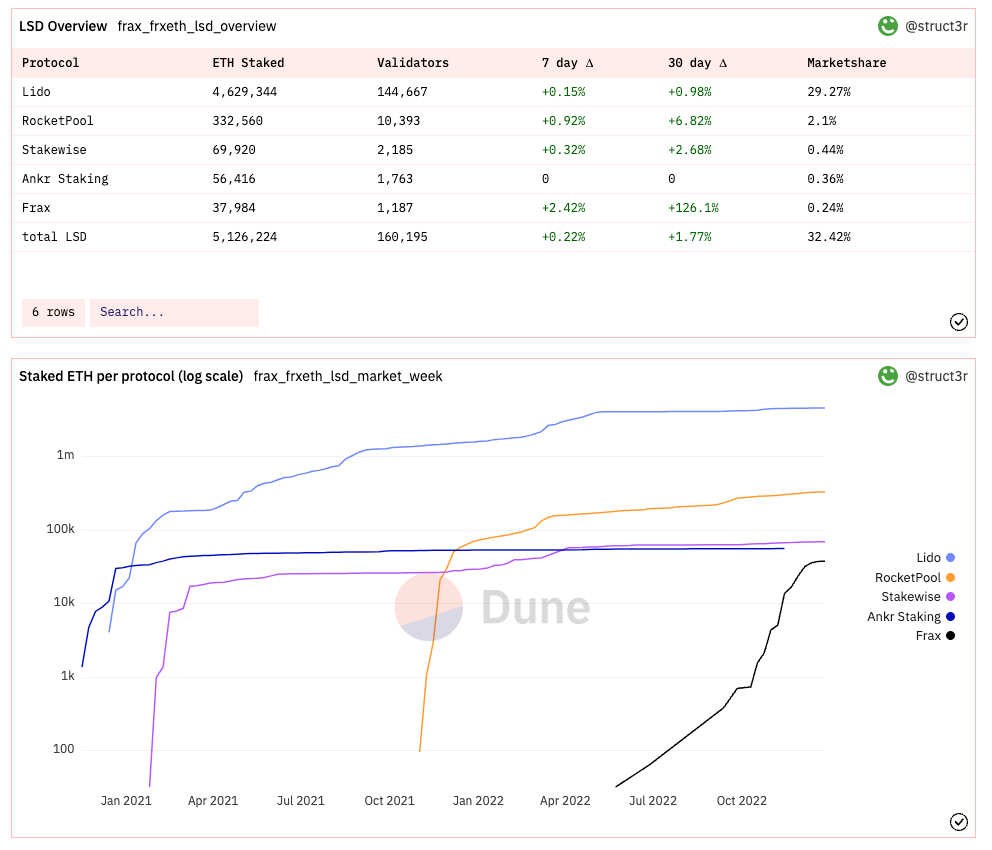

In the past 2 months more than 50,000 ETH has been staked as FrxETH. That’s 60 million dollars of capital flowing into this brand new LSD.

In what can only be described as otherworldly, the staking rewards for Ethereum have consistently broken double digits. And this is with nodes waiting to be accepted in the queue and MEV opportunities minimal with the total validator set.

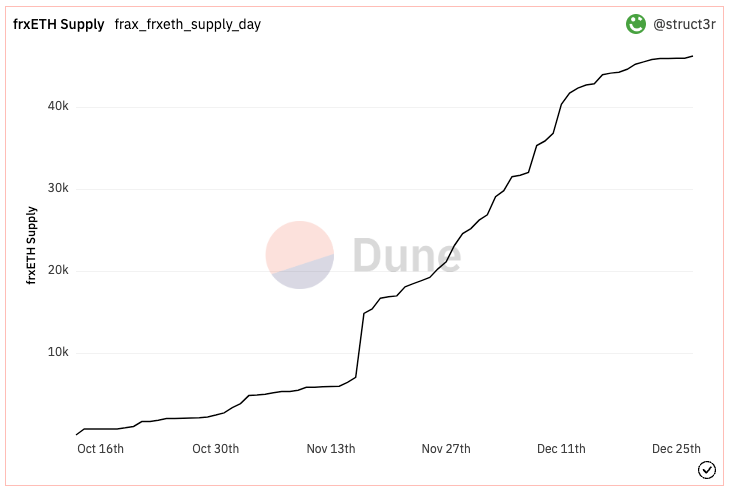

Other Liquid staking derivatives or LSD barely are earning 5-6% as their base yield. Lido’s Steth, the largest LSD by supply, is only earning 4.6%. Rocket pool’s rETH is earning a base yield of 4.48%.

So what gives? How can FrxETH earn double what its competitors are making… all while doing this in the depths of a brutal bear market and with one of the most competitive assets in crypto?

The answer lies in the core design of FrxETH and its two token design.

But Before getting into the specifics of how smartly the Frax core dev team designed the FrxETH stablecoin… lets talk about incentives.

A lot of people think that Frax is just a partially backed stablecoin. They couldn’t be further from the truth. The Frax protocol is sooooo much more than just a dollar pegged stablecoin. It’s a giant liquidity engine,, deploying billions of dollars into every single blue chip DeFi protocol.

By distributing its collateral across all of DeFi, there is no longer a single point of failure or attack. DeFi as a whole is the backing for Frax. And it has used this super power to acquire large market shares of other critically important protocols like Curve and Convex.

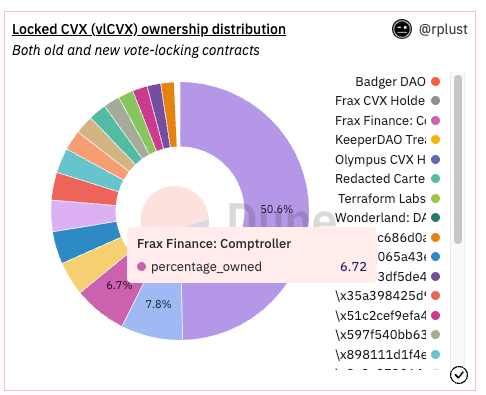

Currently, Frax owns 6% of all Convex, staking it as Vote Locked CVX and it also has a huge chunk of veCRV in its treasury. What this means is that Frax can direct millions of dollars of incentives every month towards its own liquidity pools on Curve.finance. Each week it uses its power to direct new emissions towards its preferred pools through the Votium bribe platform.

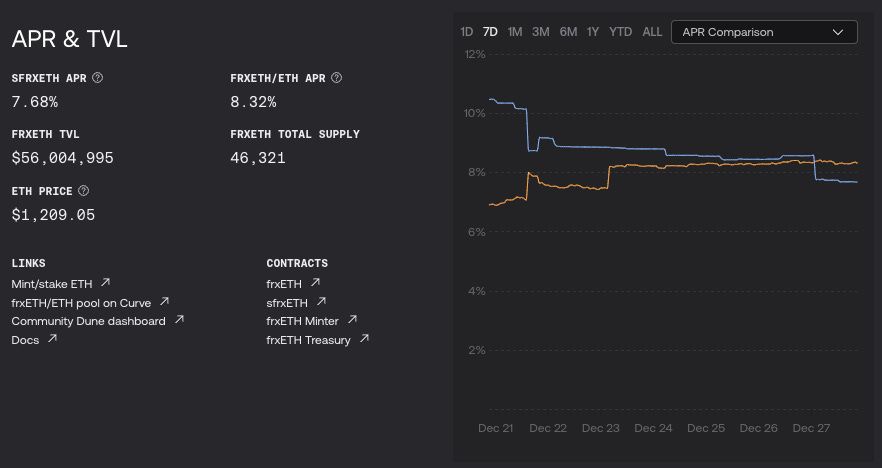

For the month of December Frax has bribed the FraxETH/ETH Curve LP with more than $1,007,554 dollars worth of CRV, CVX and FXS. In the chart below, the APR’s for the trading LP pair was well above double digits on average.

Stakers are flooding into FrxETH to capture a yield that exists nowhere else in crypto. Around the new year, FrxETH should break a total supply of more than 50,000 ETH (61m USD) staked. That’s an incredible number for just 2 months of growth. Assuming the supply rate stays constant the supply of FrxETH will hit 300k ETH. With the Shanghai unlock though, FrxETH has a chance to hit escape velocity to the millions though. But we’ll come back to this later.

FrxETH Design

FrxETH’s power is in its two token design.

FrxETH is a non-interest bearing ETH stablecoin. Its sole purpose is to remain pegged to ETH.

sFrxETH is FrxETH that is staked in a ERC-4626 vault. All rewards earned by the validators are passed on to sFRXETH in the form of FrxETH.

By offering two types of rewards in the FrxETH system, the Frax protocol achieves both liquidity for spot trading and also significantly higher base yields. It’s the best of both worlds through the use of bribes.

The market is extremely efficient in pricing bribes. The ratio of sFrxETH to FrxETH has closely maintained yields in both the staking vault and the Curve LP over the last few weeks.

The goal for Frax will be to figure out other ways for FrxETH to be used outside of the Curve LP. The more FrxETH that remains unstaked, the higher the base yield for sFRXETH will be. One idea for driving that demand would be a sFRXETH/FrxETH Fraxlend pair. Degens could use this pair to get leverage on their sFrxETH, but at the same time, lenders should not accept a rate lower than the sFrxETH staking rate. Assuming an efficient market, any difference between the two rates should be arbitraged immediately.

Another option would be FrxETH’s integration into the rest of DeFi. Without bribes or subsidies I don’t see how that happens. It’s too early to tell though with the product only being 2 months old.

Post Shanghai ETH Withdrawals

Right now it's a one way road for conversion to FrxETH. Once ETH is staked, there is no way to withdraw it. Hence liquidity is a premium and a primary reason the Curve LP bribes are so important.

In a couple of months (based on the latest announcements from the Ethereum Core Devs), the Shanghai upgrade will go live for Ethereum enabling withdrawals of staked ETH. Only a few thousand validators can unstake daily to ensure the security of the network.

Ostensibly, there will be a lot of questions about what role FrxETH will have in a post Shanghai world. The Curve LP pool will shift to being a “fast exit” for FrxETH, where a premium would be paid to return back to ETH. The overall importance of the Curve LP probably will decline substantially as withdrawals reduce the need for the current liquidity imbalance.

Currently there is a roughly 50/50 split between the LP and sFRXETH solely due to bribes. The assumption is that FrxETH should maintain the peg and allow for transfer back and forth between ETH at a slightly discounted rate. Right now there is zero withdrawal liquidity, the Curve LP has to absorb all sell pressure. Post-Shanghai, liquidity assumptions will further discount the exit period. Liquidity will only need to facilitate swaps between those who choose not to wait for their assets to unstake.

The best analogy for the Curve LP’s role post-Shanghai is how the L2 bridges work. You can swap from Ethereum to Arbitrum immediately, but the return trip takes a week. Third party bridges like Multichain or Hop provide immediate liquidity for those that can’t wait. Pricing in the delay would be a function of the hedging risk for holding ETH for 1 week. Maybe a few dollars off the price? We will see.

Free Market ETH

Another big aspect of a Post-Shanghai world is that millions of ETH locked in other liquid staking derivatives will be given market choice. Right now there is over 4 million ETH locked in the largest LSD, stETH, built and maintained by Lido.

Post-Shanghai, around 1000 validators a day will be able to unstake or around 32,000 ETH daily. The ETH can then be swapped to whatever LSD is earning the highest yield, which based on Frax’s design and incentive structure, will 100% be FrxETH. No matter what Lido introduces, they won’t be able to compete with FrxETH yields. My personal predictions for 2023 have FrxETH breaking 1 million in supply by the end of the year. The Shanghai unlock is a key part of this plan. Even if the devs don’t do something and delay the unlock to 2024, FrxETH will most likely take the #2 spot above Stakewise and Rocket Pool. You just can’t compete against the Flywheel.

Conclusion

Hats off to the Frax team for their DeFi centric two token design of FrxETH. They learned from previous mistakes that used rebasing and other sub-optimal mechanics to adjust the circulating supply. The new ERC-4626 vaults will future proof sFrxETH for all DeFi protocols that want to include it. Some of the early entrants like Balancer have already made great LP pairs that feature all the various LSD types.

There are still several risk factors the core dev team needs to decentralize to fully enable FraxETH to scale massively. Notably, the validator management is currently run by the core devs. This will have to be changed in the medium term in 2024. Additionally, post-Shanghai bribe strategies might change significantly when token movement becomes more liquid. Otherwise, FrxETH is poised for a breakout year in 2023. With several high profile DeFi protocols like Gearbox planning to add FrxETH as a deposit asset, its future seems very bright.

Want to read more? Check out

Everything you need to know about FrxETH with Jack Corddry Frax Core Dev