Now that the Shappella upgrade has been successfully deployed, there is no reason not to move your ETH into an LSD. And as always, we believe that frxETH is the best option. But then again we are biased!

There are a variety of options for where to find yield once you have frxETH. Let’s go through them all.

sfrxETH & Curve ETH/frxETH LP

The easiest way to find yield for your frxETH is to deposit it into the sfrxETH ERC-4626 vault or the Curve frxETH/ETH LP. These were the first to yield options for frxETH and are the best place if you are looking to deploy millions of dollars.

The second token of the two token model, sfrxETH received all of the native staking rewards. As of writing, it is yielding 6.73%, the highest rate amongst all of its peers. Currently there is 98,271 sfrxETH ($186,714,900 USD value) staked.

The other option is to deposit into the Curve frxETH/ETH LP where are the current rate is 5.57%. Typically, the yield on curve is higher than the native yield, but recently there lag of bringing new validators online. The APR composition for this LP is 3.15% CRV, 0.35% CVX, 2.01% FXS and .06% from trading fees.

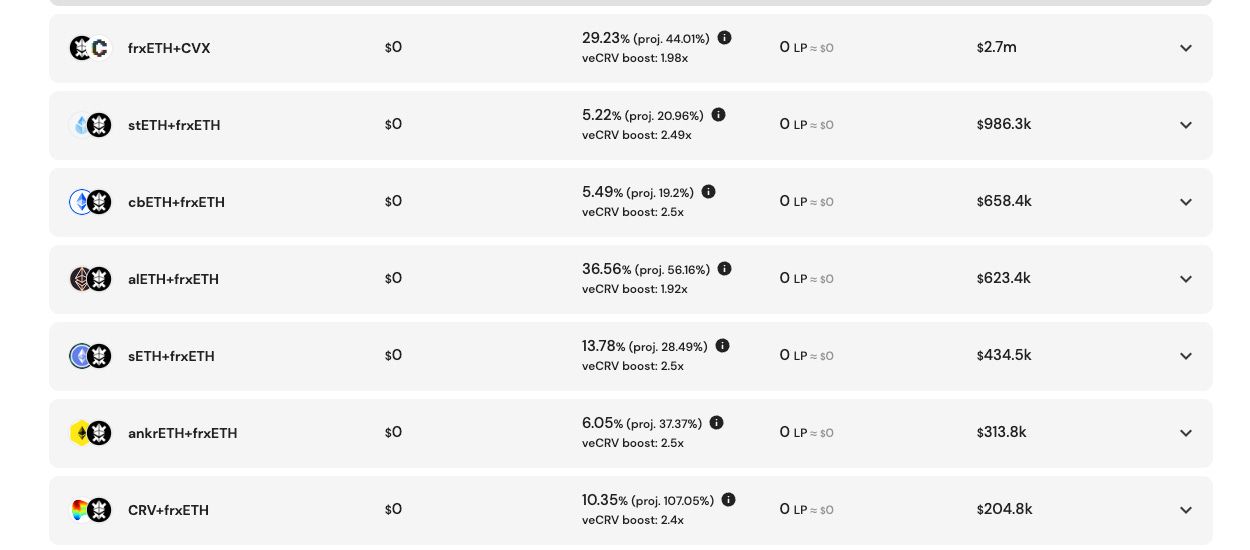

Curve/Convex LPs

Other than the main curve pool there are several other alternative LP choices that provide yield. All of these are part of the WETHR program that Frax's is running to attract more liquidity to be paired against frxETH. The assets that are included in the program are: stETH, cbETH, alETH, sETH, and ankrETH. Notably, alETH is yielding 38.56% and sETH 13.78%.

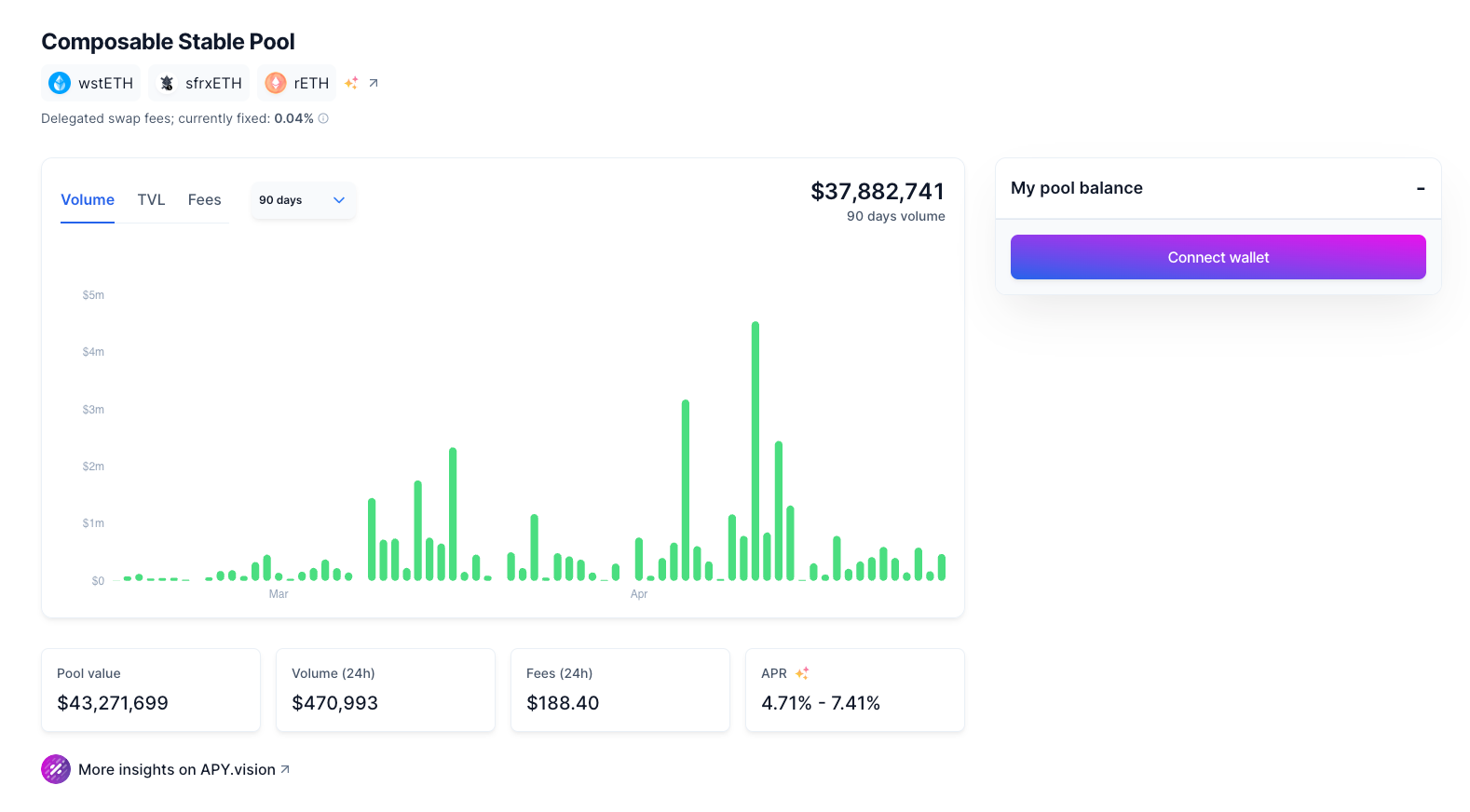

Balancer (ETH)

Balancer is one of the largest DEX’s on Ethereum and they offer a composable stable pool for sfrxETH, wstETH and rETH. With more than 43 million in TVL this is one of the largest LPs, competing with Curve even. This pool is currently yielding between 4.71% - 7.41% depending on the boost using veBAL.

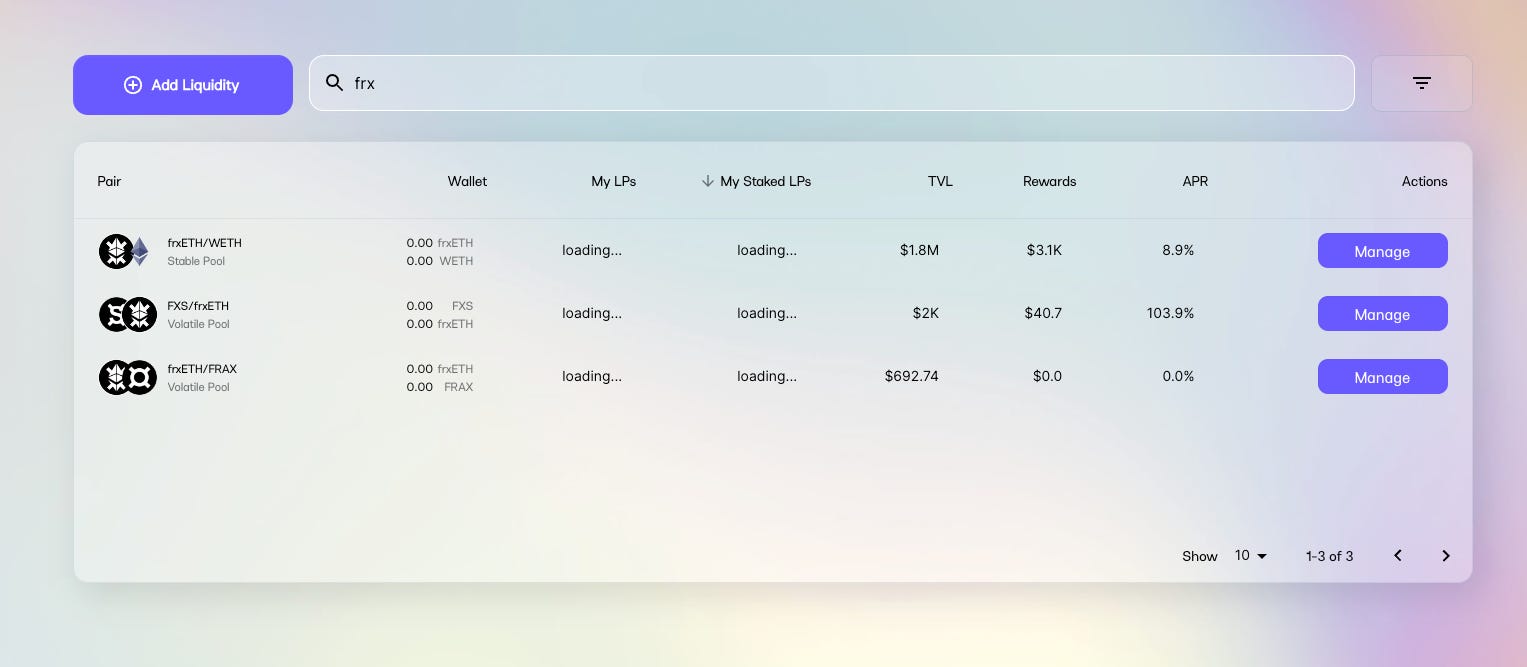

Solidly (ETH)

Solidly has one pool for frxETH, with a total TVL of 2.4 million and yields 8.9%.

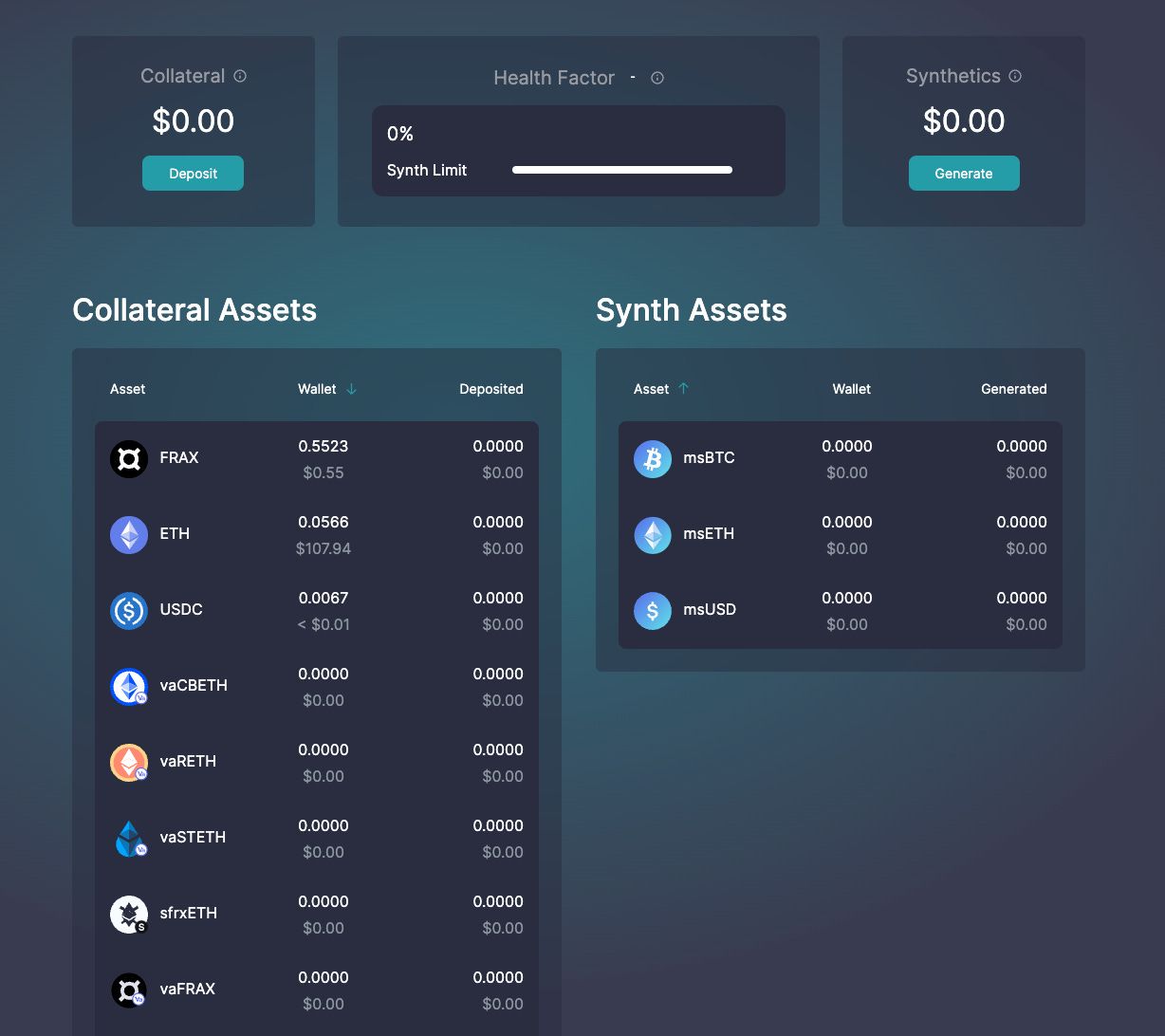

Metronome (ETH)

Metronome is a DeFi protocol that issues synthetic assets, allowing for leverage on Ethereum. By depositing sfrxETH, you can mint msETH, a synthetic version of ETH. Then you can sell the msETH, buy more sfrxETH and repeat for leverage up to 5x.

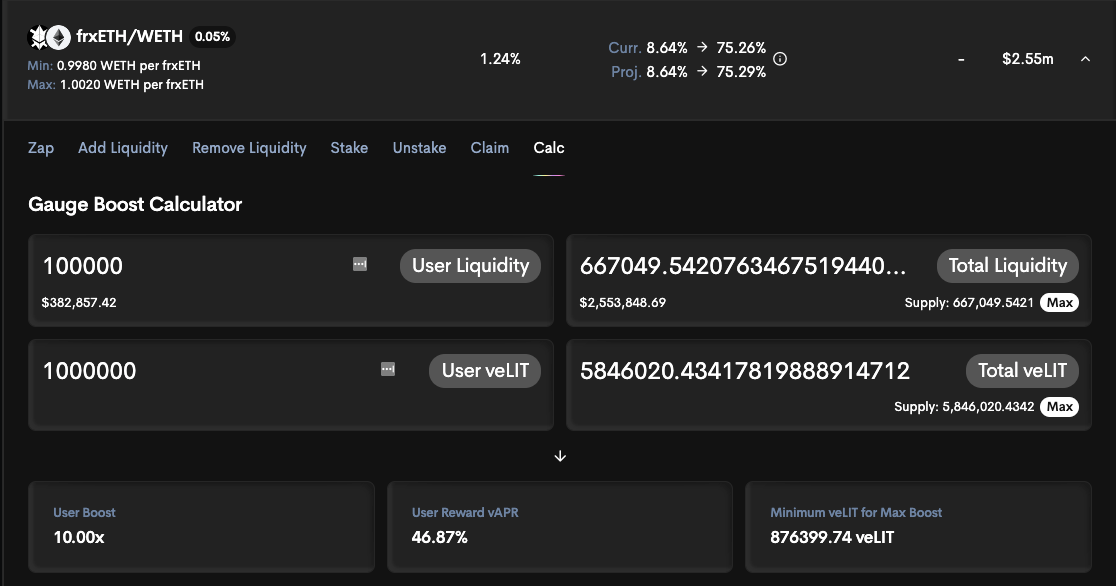

Bunni (ETH)

Bunni is a Uniswap LP locker with ve tokenomics. Deposits can be boosted with the LIT token for an increase of up to 10x boost to yields. Bunni currently has a frxETH/ETH pool with a base yield of 8.64% that can be boosted up to 75.26% using LIT. The pool currently has 2.5 million in TVL.

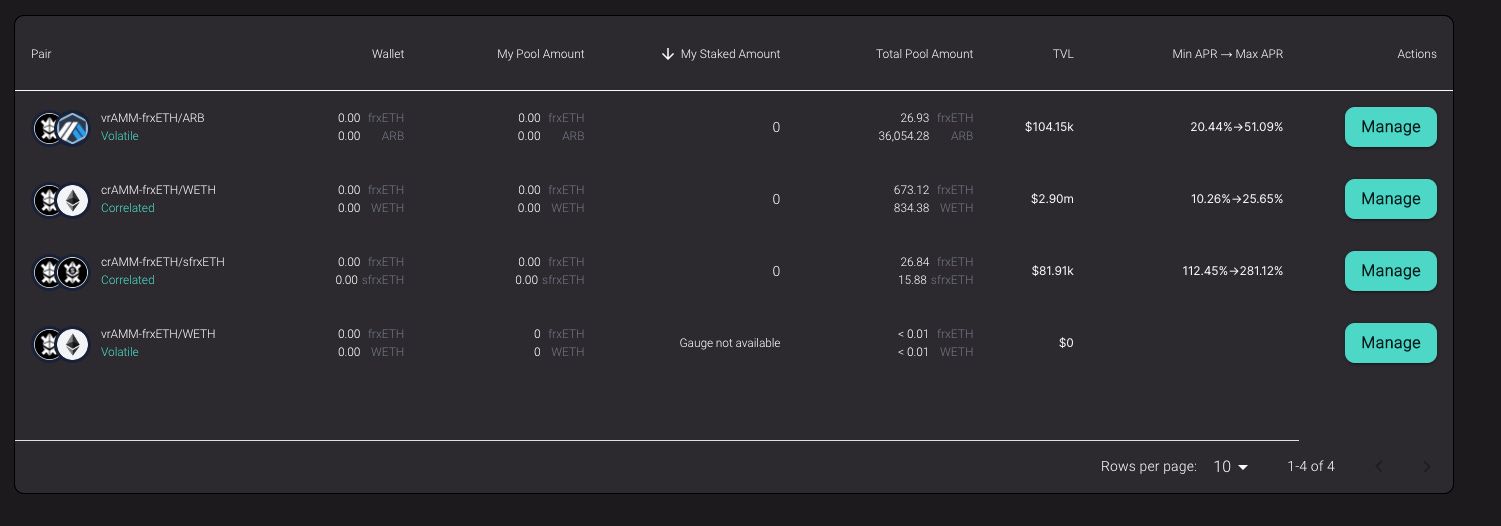

Ramses (Arbitrum)

Ramses is a Solidly fork on Arbitrum. It currently has three options for frxETH, the best being the frxETH/WETH LP with $2.9m in liquidity and a base 10.26% yield that can be boosted up to 25%

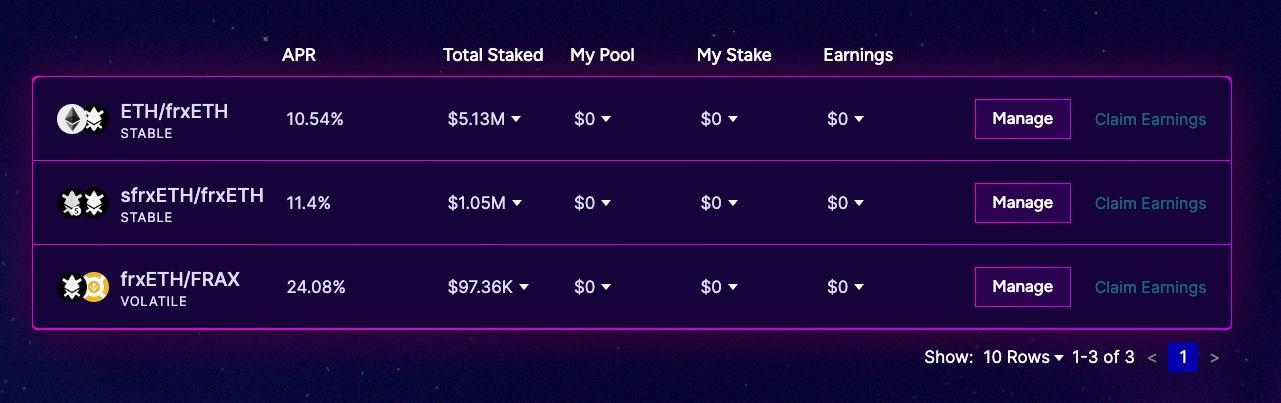

Thena (BNB Chain)

Thena is a Solidly fork on BNB that was launched a few months ago. It offers some great yields for ETH only exposure. Their ETH/frxETH LP has more than $5 million staked in it and still provides a 10.54% APR. Additionally their sfrxETH/frxETH pool yields 11.41%, but it also earns an extra yield 3% yield from sfrxETH. As the assets are on BSC, you are required to use Fraxferry to bridge over.

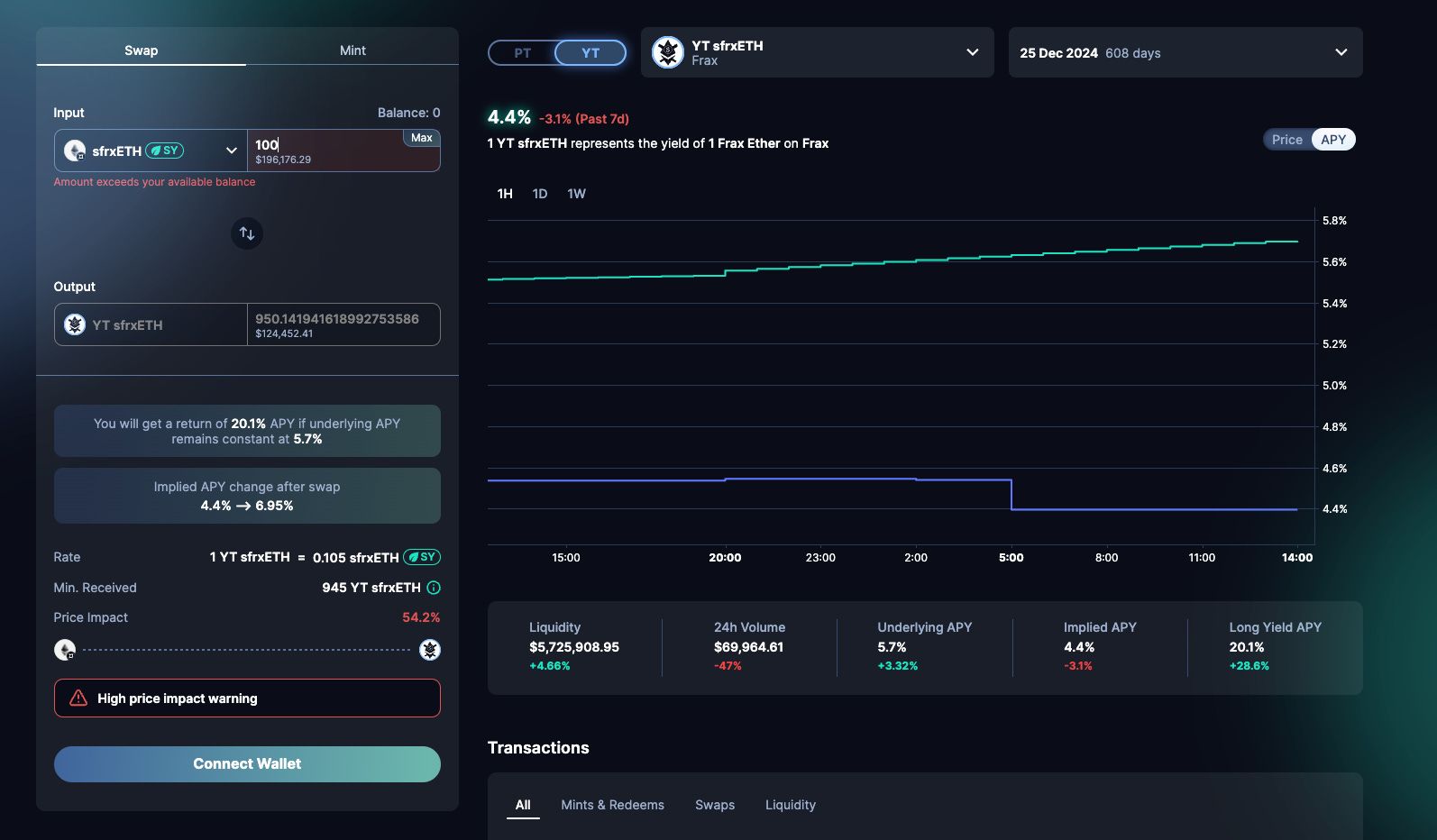

Pendle (ETH)

Pendle is the yield trading protocol where you can gain leverage yield exposure without liquidation risk. Pendell splits principal from yield and allows you to buy assets at a discount or get leverage on your yield.

Right now on Pendell, you can get a 5x leverage boost for your yield, and earn 20.1% APY. It is important to note that once you make this trade, your assets are locked for a long period of time, for example, in the picture above your assets would be locked for 608 days, until 25 December 2024.

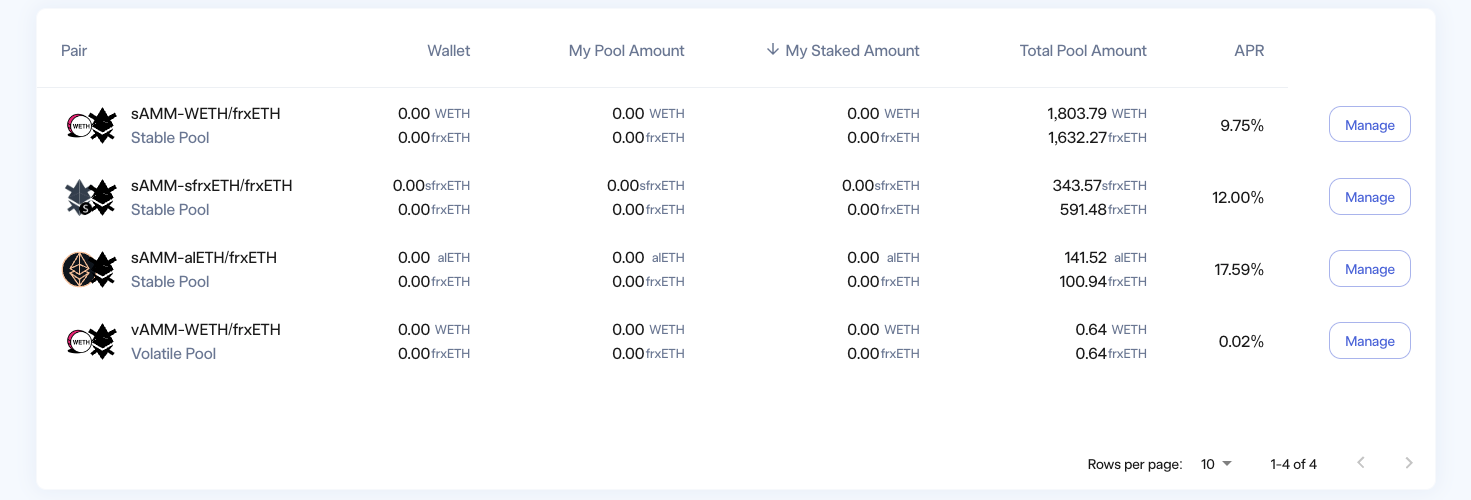

Velodrome (OP)

Velodrome is a Solidly fork on Optimism. It has four LP pools with frxETH exposure, however only 3 are earning significant yield. The alETH/frxETH pool is there any in the highest at 17.59%, followed by the sfrxETH/frxETH pool at 12%, and finally the WETH/frxETH pool at 9.75%. The total TVL for these pools is approximately 2mln.

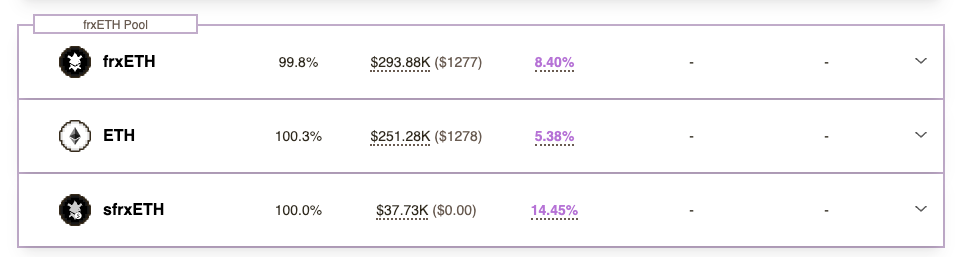

Wombat (ARB, BNB Chain)

Wombat is a DEX on BNB Chain and Arbitrum. They offer single sided deposits into their stable pools for frxETH and sfrxETH. The average APR earns is 8.4% and 14.45%, respectively on BNB Chain. On Arbitrum, the yields are 21.4% and 55.98%, however the total TVL is less than $350,000.

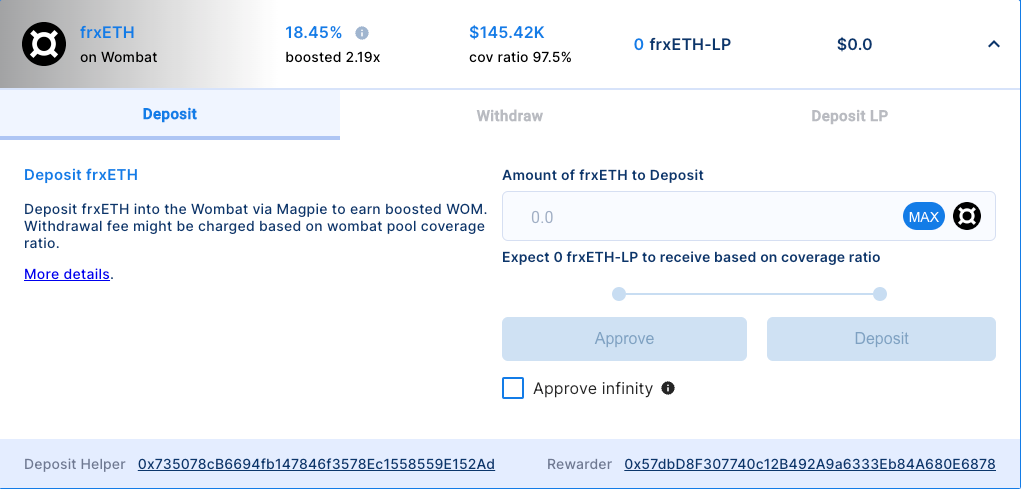

Magpie (ARB)

Magpie boosts yield with veTokenomics, and their frxETH offering on Arbitrum is earning 18.45%. It should be noted though that the TVL is quite low and could be significantly affected by higher deposit rates.

Thank you for reading Flywheel DeFi. This post is public so feel free to share it.

Not financial or tax advice. This article is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This post is not tax advice. Talk to your accountant. Do your own research.