Legislation surrounding cryptocurrency has taken center stage this year as members of US Congress try to grapple with this emerging technology. While some legislators recognize crypto’s potential, others view it with criticism. Yet, a topic within cryptocurrency that has gotten a lot of attention this year is stablecoins and because of this, it's likely that they will be one of the first areas of crypto that Congress will take action on in the coming year.

People in crypto often conflate legislation as a “restrictive” outcome when in fact it provides clear direction of what is acceptable within the law. For cryptocurrency to reach the trillions in TVL, the establishment of clear and broad-based rules are a rubicon that the industry needs to cross, it’s a matter how restrictive or how empowering that legislation will be to the industry as a whole.

Enter the Stablecoin TRUST Act

In fact, there is one piece of legislation that may be a home run for stablecoins and set the industry forward on sensible guidelines for all. Senator Pat Toomey in one of his last actions before retirement introduced the Stablecoin TRUST Act, which provides a regulatory framework for “payment stablecoins.” Commenting on his legislation, Toomey said that:

“I hope this framework lays the groundwork for my colleagues to pass legislation next year safeguarding customer funds without inhibiting innovation. I’ve put forward a regulatory model that won’t undermine competition by favoring entrenched incumbents—for example, by limiting payment stablecoin issuance to insured depository institutions. This bill will also ensure the Federal Reserve, which has displayed significant skepticism about stablecoins, won’t be in a position to stop this activity.”

As some of the clearest guidelines proposed by Congress to date, the bill defines what constitutes as payment stablecoins as well as the requirements for issuers and holders. The legislation explicitly treats stablecoins as money and regulates them as such, putting them under the eye of the Office of the Comptroller of Currency (OCC) which regulates banks and depository institutions and not the SEC or CFTC. This places them safely in the camp of not being securities for issuers while also outlining public disclosure requirements for them. For holders, the act guarantees privacy protections and exempts "new technologies like digital assets" from the Bank Secrecy Act, declaring that "private transactions not involving an intermediary or a financial institution do not need to be reported."

One of the most interesting parts of the bill is that it authorizes OCC to establish a new federal license specifically for payment stablecoin issuers. From this, payment stablecoin issuers will be allowed to attain Federal Reserve Master Accounts and their services. Toomey stated that his reasoning for including this is so entrenched incumbents don’t establish monopolies too early.

The Master Account aka “The Bank’s Bank Account”

For those unfamiliar, a Federal Reserve master account is an account that is established and maintained by a depository institution at a Federal Reserve Bank. Just as you may have a bank account at your local bank, banks themselves can have their own account at the Federal Reserve itself. A master account is used to facilitate the institution's participation in the Federal Reserve's payment and settlement services, including the clearing of checks, electronic payments, and other transactions. It is best to think of the Federal Reserve as the final ledger of settlement and all transactions between member banks are settled at the end of the day on their real-time gross settlement (RTGS) electronic payment system, Fedwire. Fedwire is operated by the Federal Reserve Banks that allows financial institutions to transfer funds and securities among themselves and with the government 24 hours a day, seven days a week and is fully audited and disclosed.

Like any bank, master account depositors earn interest on their deposits which is set directly by the Chair of The Federal Reserve. Those interest rate hearings we hear about every quarter? That’s what master account depositors are earning on their deposits. To have a master account at the Fed means you are earning dollars directly from the source, the Federal Reserve itself.

Stablecoins and The Master Account. A Match Soon To Be?

Now why does having a master account matter and what does it have to do with stablecoins? Well, having a master account gives you access to the safest yield in existence, the risk-free rate offered by the Fed. Stablecoins such as Tether and USDC already have treasuries on their balance sheets but having a master account is still uncharted territory. With the TRUST Act, it provides a clear pathway for fiat stablecoins to attain a Fed master account.

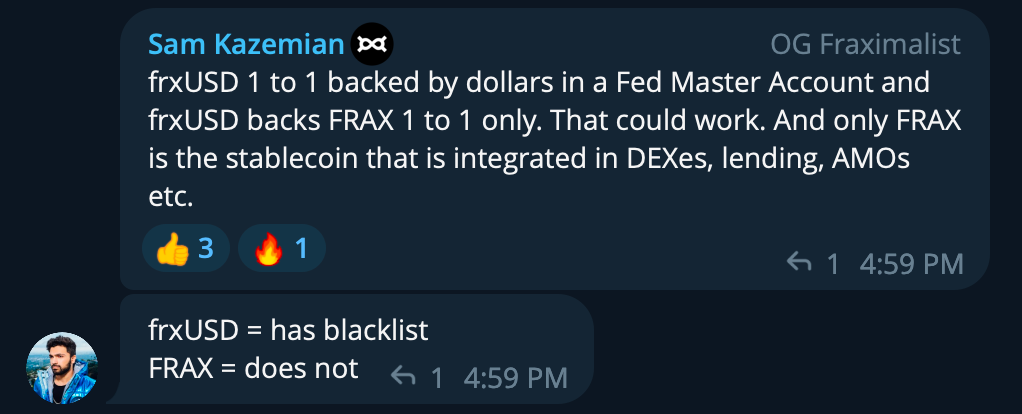

One of the pioneers in the stablecoin landscape who has expressed increased interest in master accounts is Frax Co-Founder Sam Kazemian. In fact last month, Sam Kaz came on Flywheel to share his thoughts on the subject which had been a topic of discussion in Frax’s telegram group at the time. His rationale is that in order for Frax to become the “central bank of DeFi”, it must emulate central banks of the real world such as the Federal Reserve. Sam views almost all types of RWAs as too risky and not in alignment with Frax’s goals as a protocol, and the only RWA worth pursuing is exposure to the risk-free rate of the Federal Reserve.

Yet it remains that Frax is a protocol that is governed by a DAO and Sam has declared in the past that the one commandment of Frax is that it exists 100% on-chain. In order for Frax to violate its on-chain roots, it must look towards other ways to access the yield. One route it can take is to partner with a bank that already has a master account or set up a special organization whose sole purpose is to issue a payment stablecoin that is under the TRUST Act’s guidelines. This entity could issue FrxUSD which is 1-1 backed by master account deposits (and rebases a la its yield) and abides by all standard regulations. FrxUSD can then back FRAX which is integrated into DeFi, greatly reducing the protocol’s reliance on USDC.

Conclusion

What Toomey’s legislation ultimately does is pave a pathway for stablecoins to be legitimized under law. If this legislation were to pass, I would expect there to be a stablecoin renaissance as clear guidelines will provide the framework necessary for both payment rails to be developed and for traditional institutions like banks to release their own stablecoins. Instead of GHO and crvUSD, we could very well see BofAUSD and citiUSD enter the fold. Questions still remain about crypto-native stablecoins, but since collateral can be transparently audited on-chain, it is much easier for people to scrutinize and make their own value judgments on the health of that collateral. As Frax pursues its dream of a master account, many might doubt how plausible it may be. But, if this legislation proves anything, it’s that stablecoins will continue to grow and anticipates new players (and not just traditional banks) to earn a piece of the pie.